KKR Real Estate Finance Trust Results Presentation Deck

KREF Portfolio by the Numbers

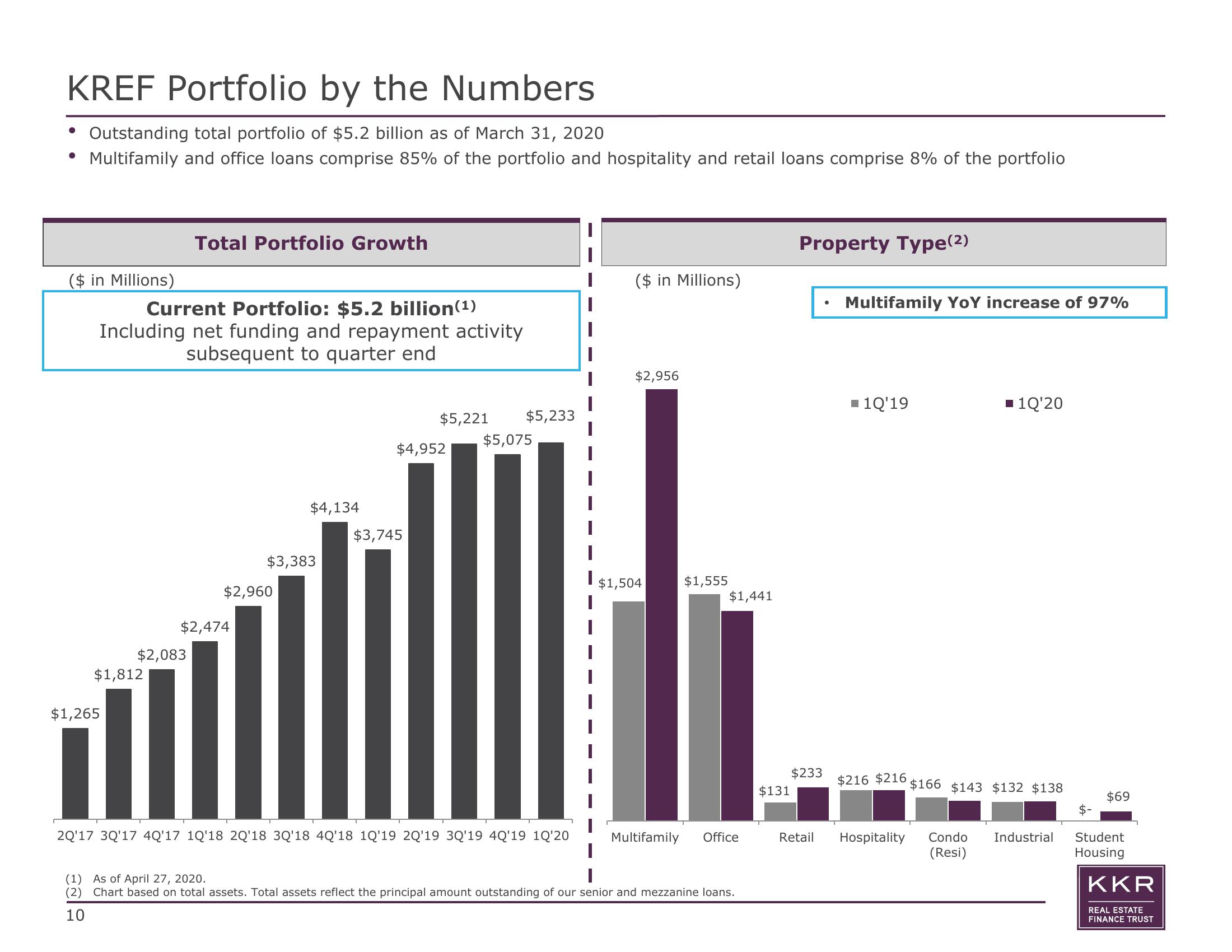

Outstanding total portfolio of $5.2 billion as of March 31, 2020

• Multifamily and office loans comprise 85% of the portfolio and hospitality and retail loans comprise 8% of the portfolio

($ in Millions)

Current Portfolio: $5.2 billion (¹)

Including net funding and repayment activity

subsequent to quarter end

$1,812

$1,265

Total Portfolio Growth

$2,083

$2,474

$2,960

$4,134

$3,383

$5,221 $5,233

$4,952

$3,745

$5,075

2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20

($ in Millions)

$2,956

$1,504

$1,555

$1,441

Multifamily Office

(1) As of April 27, 2020.

(2) Chart based on total assets. Total assets reflect the principal amount outstanding of our senior and mezzanine loans.

10

$131

Property Type(²)

$233

Multifamily YoY increase of 97%

■ 1Q'19

$216 $216

Retail Hospitality

■ 1Q'20

$166 $143 $132 $138

Condo Industrial

(Resi)

$69

Student

Housing

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation