Ginkgo Results Presentation Deck

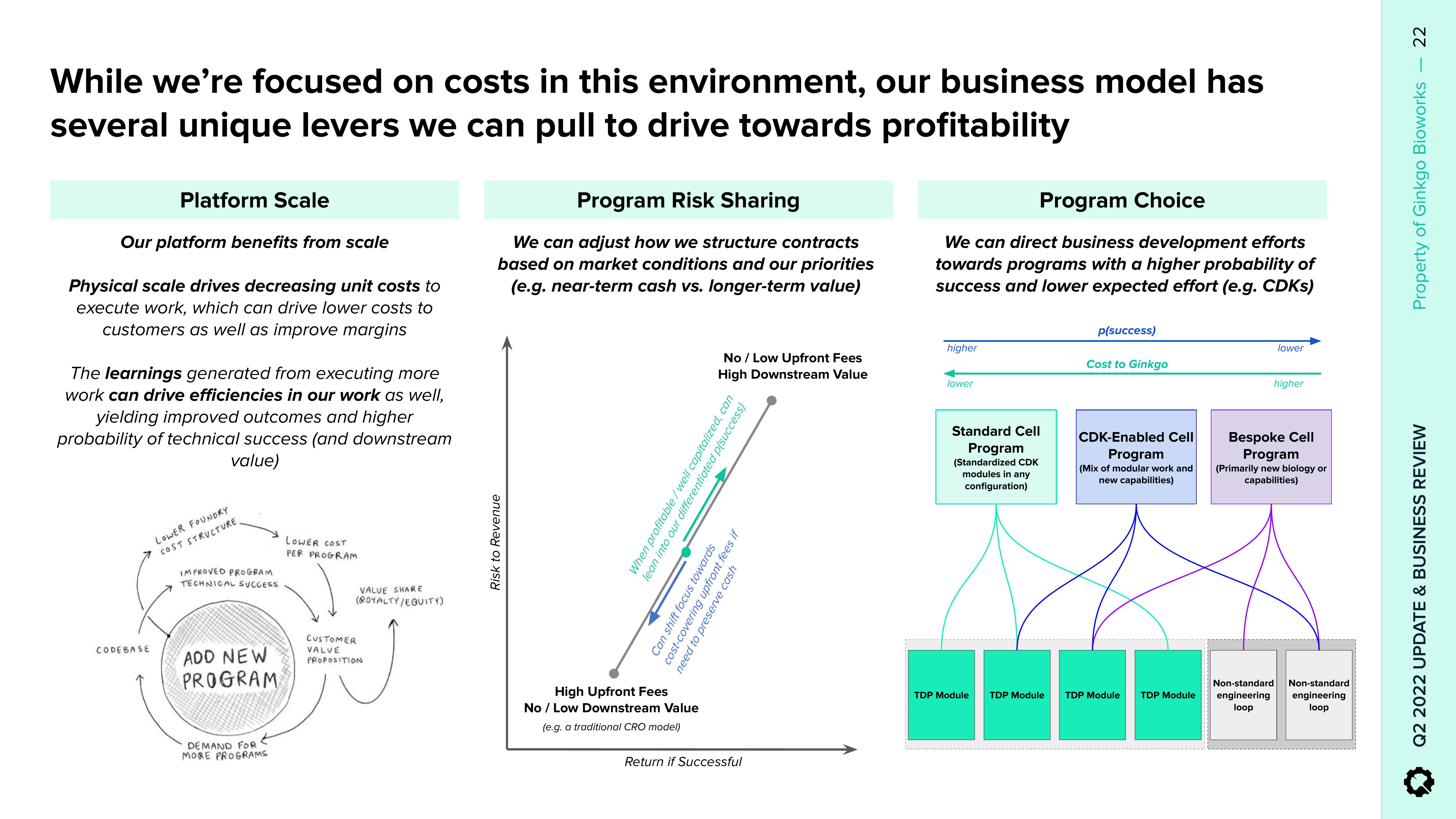

While we're focused on costs in this environment, our business model has

several unique levers we can pull to drive towards profitability

Platform Scale

Our platform benefits from scale

Physical scale drives decreasing unit costs to

execute work, which can drive lower costs to

customers as well as improve margins

The learnings generated from executing more

work can drive efficiencies in our work as well,

yielding improved outcomes and higher

probability of technical success (and downstream

value)

CODEBASE

LOWER FOUNDRY

COST STRUCTURE,

IMPROVED PROGRAM

TECHNICAL SUCCESS

ADD NEW

PROGRAM

DEMAND FOR

MORE PROGRAMS

LOWER COST

PER PROGRAM

VALUE SHARE

(ROYALTY/EQUITY)

CUSTOMER

VALVE

PROPOSITION

Program Risk Sharing

We can adjust how we structure contracts

based on market conditions and our priorities

(e.g. near-term cash vs. longer-term value)

Risk to Revenue

High Upfront Fees

No / Low Downstream Value

(e.g. a traditional CRO model)

No / Low Upfront Fees

High Downstream Value

When profitable / well capitalized, can

lean into our differentiated p(success)

Can shift focus towards

need to preserve cash

cost-covering upfront fees if

Return if Successful

Program Choice

We can direct business development efforts

towards programs with a higher probability of

success and lower expected effort (e.g. CDKS)

higher

lower

Standard Cell

Program

(Standardized CDK

modules in any

configuration)

TDP Module

TDP Module

p(success)

Cost to Ginkgo

CDK-Enabled Cell

Program

(Mix of modular work and

new capabilities)

TDP Module

TDP Module

lower

higher

Bespoke Cell

Program

(Primarily new biology or

capabilities)

Non-standard

engineering

loop

Non-standard

engineering

loop

22

Property of Ginkgo Bioworks

Q2 2022 UPDATE & BUSINESS REVIEWView entire presentation