Bank of America Investment Banking Pitch Book

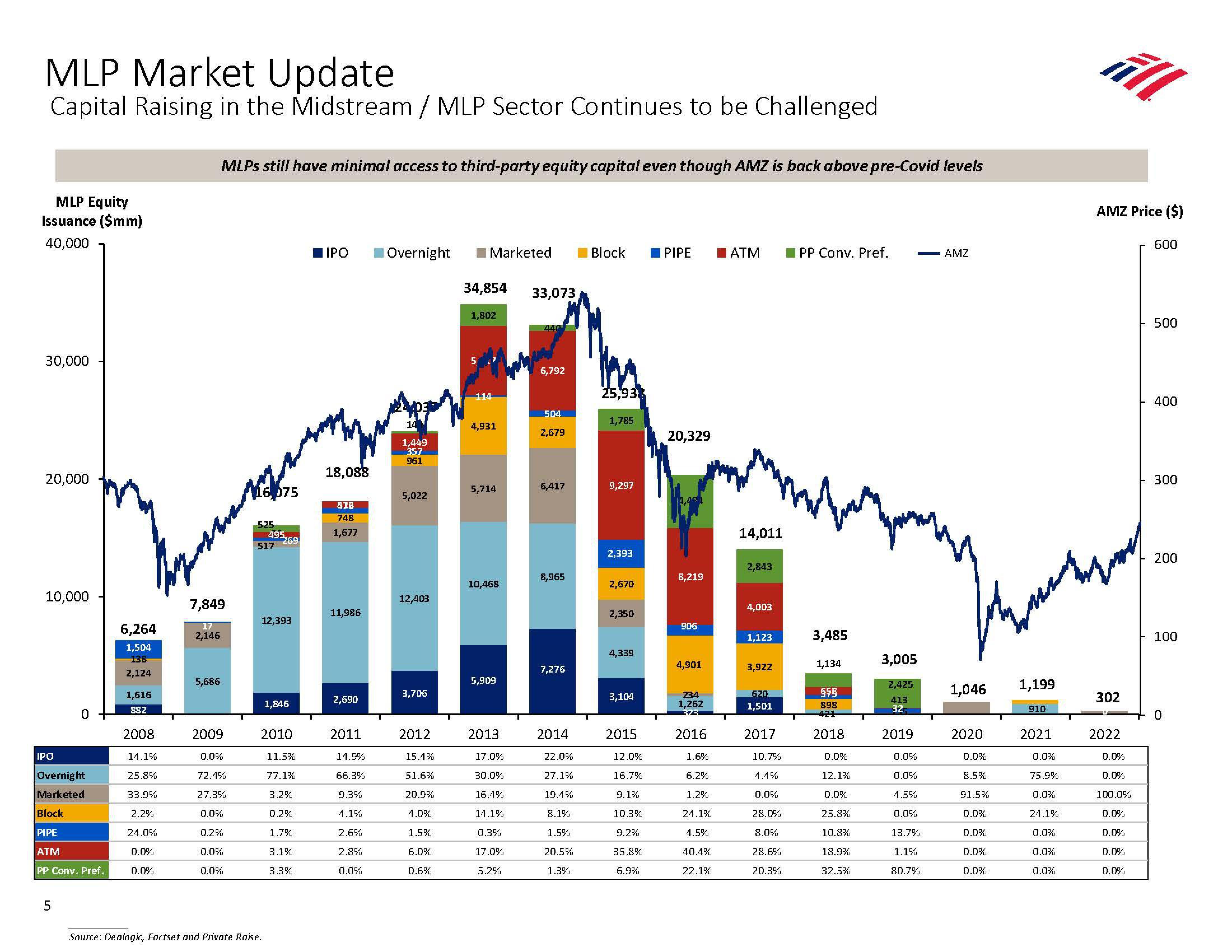

MLP Market Update

Capital Raising in the Midstream / MLP Sector Continues to be Challenged

MLP Equity

Issuance ($mm)

40,000

30,000

20,000

10,000

IPO

0

Overnight

Marketed

Block

PIPE

ATM

PP Conv. Pref.

5

6,264

1,504

138

2,124

1,616

882

2008

14.1%

25.8%

33.9%

2.2%

24.0%

0.0%

0.0%

MLPs still have minimal access to third-party equity capital even though AMZ is back above pre-Covid levels

7,849

17

2,146

5,686

2009

0.0%

72.4%

27.3%

0.0%

0.2%

0.0%

0.0%

16, 075

525

495

517

269

12,393

Source: Dealogic, Factset and Private Raise.

1,846

2010

11.5%

77.1%

3.2%

0.2%

1.7%

3.1%

3.3%

IPO

18,088

418

748

1,677

11,986

2,690

2011

14.9%

66.3%

9.3%

4.1%

2.6%

2.8%

0.0%

Overnight

1,449

357

961

5,022

12,403

3,706

2012

15.4%

51.6%

20.9%

4.0%

1.5%

6.0%

0.6%

Marketed

34,854 33,073

1,802

114

4,931

5,714

10,468

5,909

2013

17.0%

30.0%

16.4%

14.1%

0.3%

17.0%

5.2%

440

6,792

504

2,679

6,417

8,965

7,276

2014

22.0%

27.1%

19.4%

8.1%

1.5%

20.5%

1.3%

Block

25,938

1,785

9,297

2,393

2,670

2,350

4,339

3,104

2015

12.0%

16.7%

9.1%

10.3%

9.2%

35.8%

6.9%

PIPE

20,329

8,219

906

4,901

234

1,262

323

2016

1.6%

6.2%

1.2%

24.1%

4.5%

40.4%

22.1%

ATM

14,011

2,843

4,003

1,123

3,922

620

1,501

2017

10.7%

4.4%

0.0%

28.0%

8.0%

28.6%

20.3%

PP Conv. Pref. - AMZ

3,485

1,134

658

898

421

2018

0.0%

12.1%

0.0%

25.8%

10.8%

18.9%

32.5%

3,005

2,425

413

32

2019

0.0%

0.0%

4.5%

0.0%

13.7%

1.1%

80.7%

Marnateg

1,046

2020

0.0%

8.5%

91.5%

0.0%

0.0%

0.0%

0.0%

1,199

910

2021

AMZ Price ($)

0.0%

75.9%

0.0%

24.1%

0.0%

0.0%

0.0%

302

2022

0.0%

0.0%

100.0%

0.0%

0.0%

0.0%

0.0%

600

500

400

300

200

100View entire presentation