Lyft Results Presentation Deck

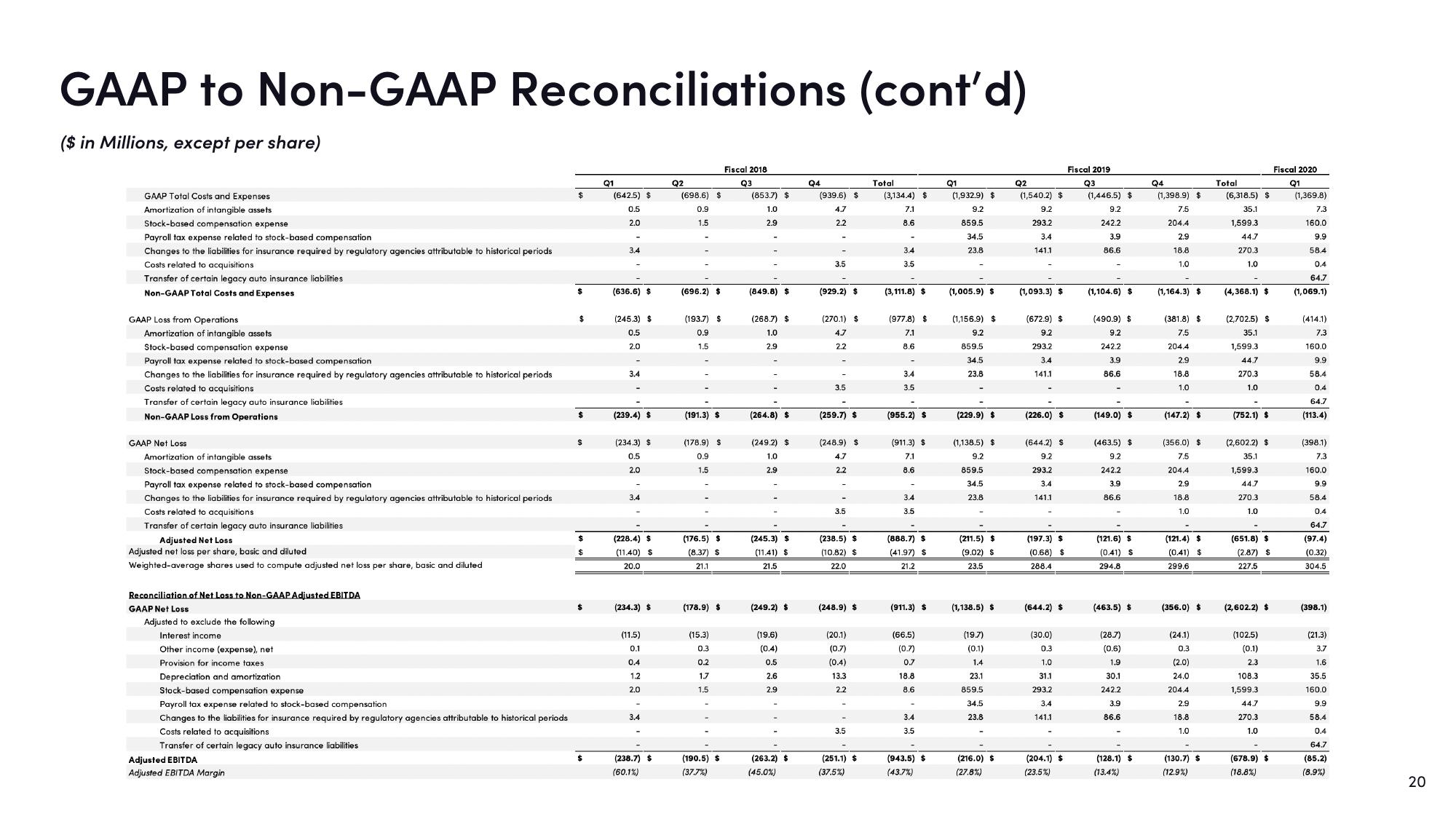

GAAP to Non-GAAP Reconciliations (cont'd)

($ in Millions, except per share)

GAAP Total Costs and Expenses

Amortization of intangible assets

Stock-based compensation expense.

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by regulatory agencies attributable to historical periods

Costs related to acquisitions.

Transfer of certain legacy auto insurance liabilities

Non-GAAP Total Costs and Expenses

GAAP Loss from Operations

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by regulatory agencies attributable to historical periods

Costs related to acquisitions

Transfer of certain legacy auto insurance liabilities

Non-GAAP Loss from Operations

GAAP Not Loss

Amortization of intangible assets

Stock-based compensation expense.

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by regulatory agencies attributable to historical periods

Costs related to acquisitions

Transfer of certain legacy auto insurance liabilities

Adjusted Net Loss

Adjusted net loss per share, basic and diluted

Weighted-average shares used to compute adjusted net loss per share, basic and diluted

Reconciliation of Net Loss to Non-GAAP Adjusted EBITDA

GAAP Net Loss

Adjusted to exclude the following

Interest income

Other income (expense), net

Provision for income taxes

Depreciation and amortization

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by regulatory agencies attributable to historical periods

Costs related to acquisitions

Transfer of certain legacy auto insurance liabilities

Adjusted EBITDA

Adjusted EBITDA Margin

$

$

$

$

$

$

$

$

Q1

(642.5) $

0.5

2.0

3.4

(636.6) $

(245.3) $

0.5

2.0

3.4

(239.4) $

(234.3) $

0.5

2.0

3.4

(228.4) $

(11.40) S

20.0

(234.3) $

(11.5)

0.1

0.4

1.2

2.0

3.4

(238.7) $

(60.1%)

Q2

(698.6) $

0.9

1.5

(696.2) $

(193.7) $

0.9

1.5

(191.3) S

(178.9) $

0.9

1.5

(176.5) $

(8.37) S

21.1

(178.9) $

(15.3)

0.3

0.2

1.7

1.5

(190.5) $

(37.7%)

Fiscal 2018

Q3

(853.7) $

1.0

2.9

(849.8) $

(268.7) $

1.0

2.9

(264.8) $

(249.2) $

1.0

2.9

(245.3) $

(11.41) S

21.5

(249.2) $

(19.6)

(0.4)

0.5

2.6

2.9

(263.2) $

(45.0%)

Q4

(939.6) $

4.7

2.2

3.5

(929.2) $

(270.1) S

4.7

2.2

3.5

-

(259.7) $

(248.9) $

4.7

3.5

(238.5) $

(10.82) $

22.0

(248.9) $

(20.1)

(0.7)

(0.4)

13.3

2.2

-

3.5

(251.1) $

(37.5%)

Total

(3,134.4) $

7.1

8.6

3.4

3.5

(3,111.8) $

(977.8) $

7.1

8.6

3.4

3.5

-

(955.2) $

(911.3) $

7.1

8.6

3.4

3.5

-

(888.7) $

(41.97) S

21.2

(911.3) S

(66.5)

(0.7)

0.7

18.8

8.6

3.4

3.5

(943.5) $

(43.7%)

Q1

(1,932.9) $

9.2

859.5

34.5

23.8

(1,005.9) $

(1,156.9) $

9.2

859.5

34.5

23.8

-

(229.9) $

(1,138.5) $

9.2

859.5

34.5

23.8

(211.5) $

(9.02) S

23.5

(1,138.5) $

(19.7)

(0.1)

1.4

23.1

859.5

34.5

23.8

(216.0) $

(27.8%)

Q2

(1,540.2) $

9.2

293.2

3.4

141.1

(1,093.3) $

(672.9) $

9.2

293.2

3.4

141.1

(226.0) $

(644.2) $

9.2

293.2

3.4

141.1

-

(197.3) $

(0.68) $

288.4

(644.2) $

(30.0)

0.3

1.0

31.1

293.2

3.4

141.1

(204.1) S

(23.5%)

Fiscal 2019

Q3

(1,446.5) $

9.2

242.2

3.9

86.6

(1,104.6) $

(490.9) $

9.2

242.2

3.9

86.6

(149.0) $

(463.5) $

9.2

242.2

3.9

86.6

(121.6) $

(0.41) S

294.8

(463.5) $

(28.7)

(0.6)

1.9

30.1

242.2

3.9

86.6

-

(128.1) S

(13.4%)

Q4

(1,398.9) $

7.5

204.4

2.9

18.8

1.0

(1,164.3) $

(381.8) $

7.5

204.4

2.9

18.8

1.0

(147.2) S

(356.0) $

7.5

204.4

2.9

18.8

1.0

(121.4) $

(0.41) $

299.6

(356.0) $

(24.1)

0.3

(2.0)

24.0

204.4

2.9

18.8

1.0

(130.7) S

(12.9%)

Total

(6,318.5) $

35.1

1,599.3

44.7

270.3

1.0

(4,368.1) $

(2,702.5) $

35.1

1,599.3

44.7

270.3

1.0

-

(752.1) $

(2,602.2) $

35.1

1,599.3

44.7

270.3

1.0

-

(651.8) $

(2.87) $

227.5

(2,602.2) $

(102.5)

(0.1)

2.3

108.3

1,599.3

44.7

270.3

1.0

(678.9) $

(18.8%)

Fiscal 2020

Q1

(1,369.8)

7.3

160.0

9.9

58.4

0.4

64.7

(1,069.1)

(414.1)

7.3

160.0

9.9

58.4

0.4

64.7

(113.4)

(398.1)

7.3

160.0

9.9

58.4

0.4

64.7

(97.4)

(0.32)

304.5

(398.1)

(21.3)

3.7

1.6

35.5

160.0

9.9

58.4

0.4

64,7

(85.2)

(8.9%)

20View entire presentation