SmileDirectClub Investor Presentation Deck

●

●

Q4 2021 Results.

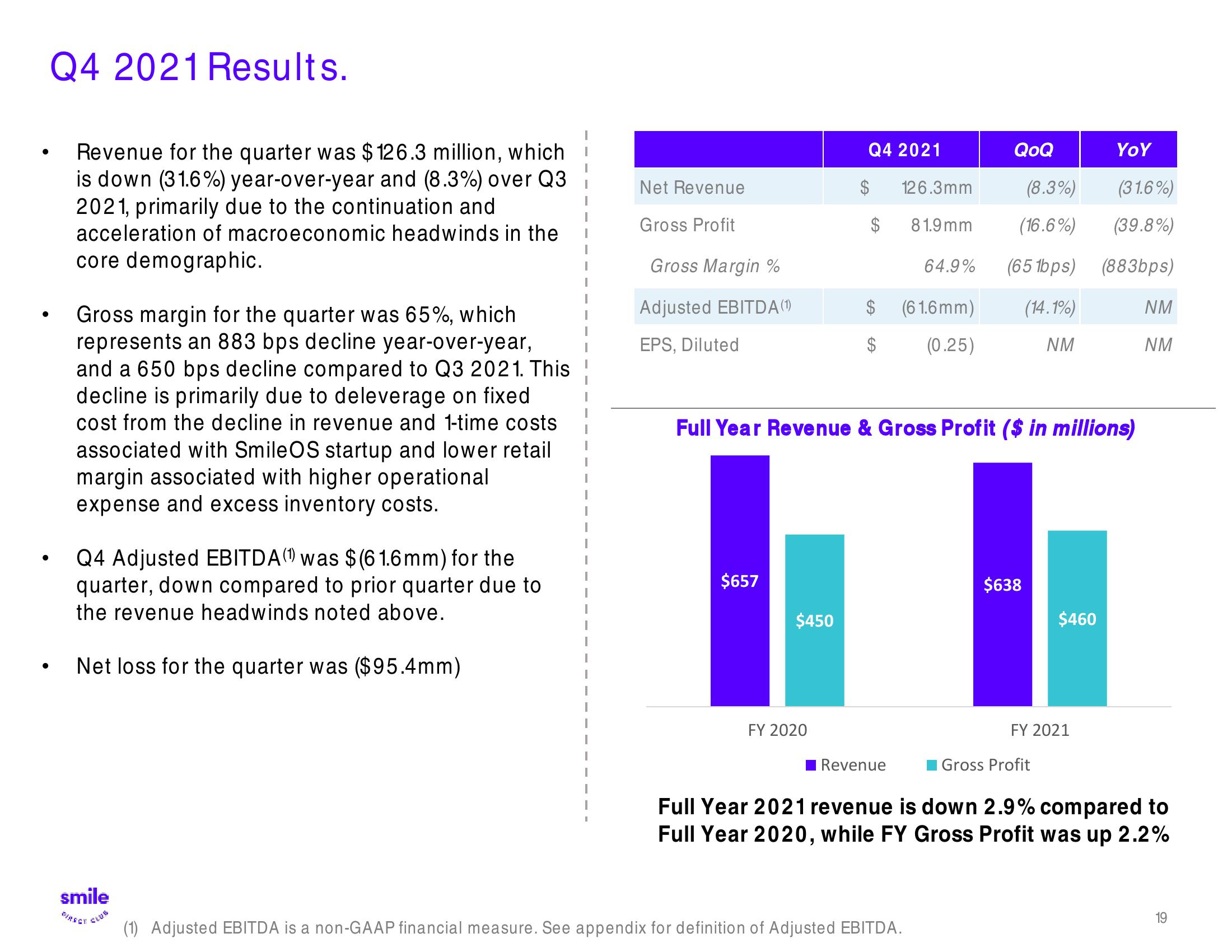

Revenue for the quarter was $126.3 million, which

is down (31.6%) year-over-year and (8.3%) over Q3

2021, primarily due to the continuation and

acceleration of macroeconomic headwinds in the

core demographic.

Gross margin for the quarter was 65%, which

represents an 883 bps decline year-over-year,

and a 650 bps decline compared to Q3 2021. This

decline is primarily due to deleverage on fixed

cost from the decline in revenue and 1-time costs

associated with Smile OS startup and lower retail

margin associated with higher operational

expense and excess inventory costs.

Q4 Adjusted EBITDA (1) was $(61.6mm) for the

quarter, down compared to prior quarter due to

the revenue headwinds noted above.

Net loss for the quarter was ($95.4mm)

smile

CLUB

Net Revenue

Gross Profit

Gross Margin %

Adjusted EBITDA (1)

EPS, Diluted

$657

$450

Q4 2021

FY 2020

$

126.3mm

$ 81.9mm

64.9%

SA

$

(61.6mm)

(0.25)

Full Year Revenue & Gross Profit ($ in millions)

Revenue

QoQ

(8.3%)

(16.6%)

(65 1bps)

(14.1%)

NM

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA.

$638

$460

YOY

(31.6%)

(39.8%)

(883bps)

FY 2021

NM

NM

Gross Profit

Full Year 2021 revenue is down 2.9% compared to

Full Year 2020, while FY Gross Profit was up 2.2%

19View entire presentation