Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

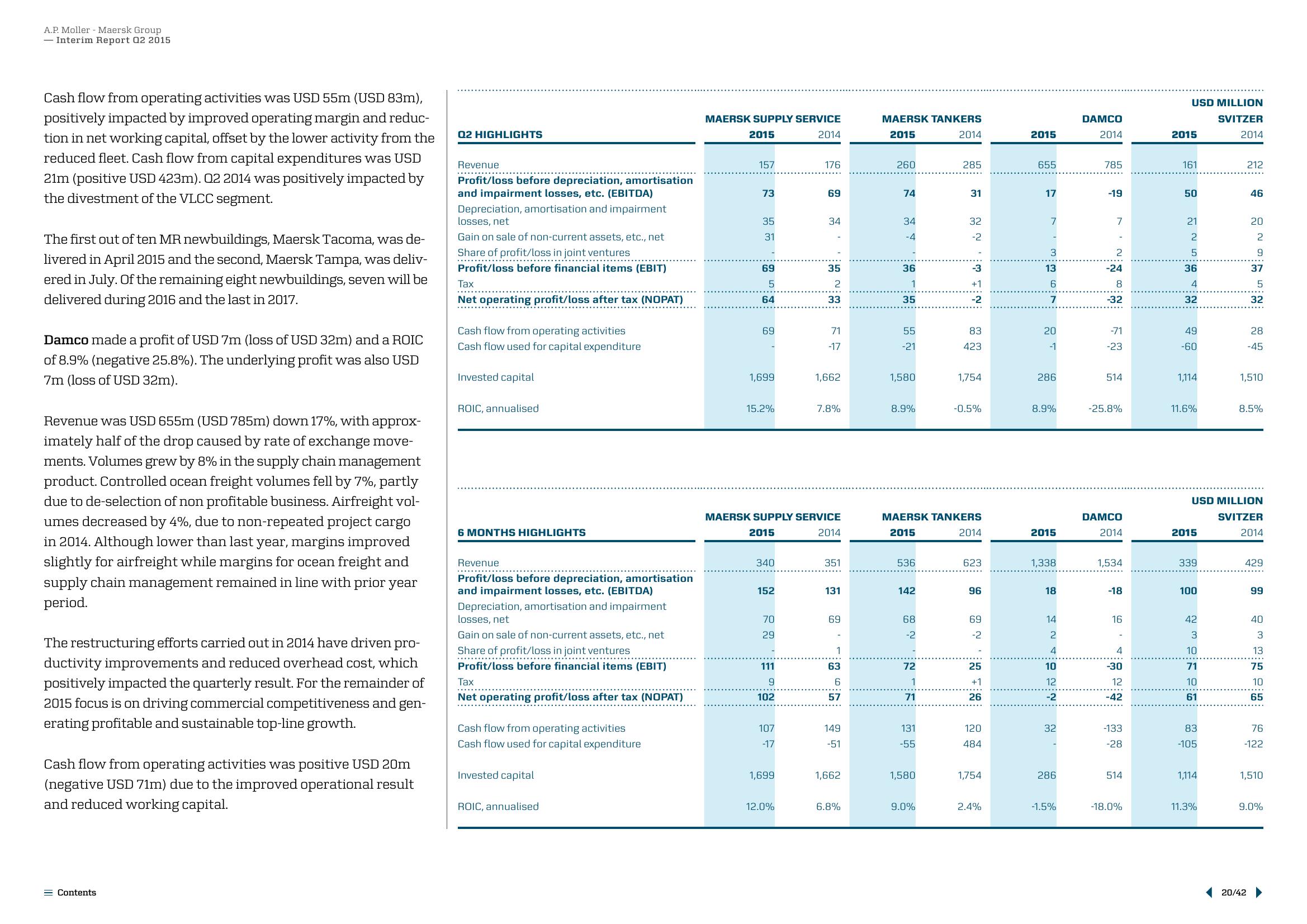

Cash flow from operating activities was USD 55m (USD 83m),

positively impacted by improved operating margin and reduc-

tion in net working capital, offset by the lower activity from the

reduced fleet. Cash flow from capital expenditures was USD

21m (positive USD 423m). 02 2014 was positively impacted by

the divestment of the VLCC segment.

The first out of ten MR newbuildings, Maersk Tacoma, was de-

livered in April 2015 and the second, Maersk Tampa, was deliv-

ered in July. Of the remaining eight newbuildings, seven will be

delivered during 2016 and the last in 2017.

Damco made a profit of USD 7m (loss of USD 32m) and a ROIC

of 8.9% (negative 25.8%). The underlying profit was also USD

7m (loss of USD 32m).

Revenue was USD 655m (USD 785m) down 17%, with approx-

imately half of the drop caused by rate of exchange move-

ments. Volumes grew by 8% in the supply chain management

product. Controlled ocean freight volumes fell by 7%, partly

due to de-selection of non profitable business. Airfreight vol-

umes decreased by 4%, due to non-repeated project cargo

in 2014. Although lower than last year, margins improved

slightly for airfreight while margins for ocean freight and

supply chain management remained in line with prior year

period.

The restructuring efforts carried out in 2014 have driven pro-

ductivity improvements and reduced overhead cost, which

positively impacted the quarterly result. For the remainder of

2015 focus is on driving commercial competitiveness and gen-

erating profitable and sustainable top-line growth.

Cash flow from operating activities was positive USD 20m

(negative USD 71m) due to the improved operational result

and reduced working capital.

Contents

Q2 HIGHLIGHTS

Revenue

Profit/loss before depreciation, amortisation

and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment

losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

.………………………...

Profit/loss before financial items (EBIT)

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Invested capital

ROIC, annualised

6 MONTHS HIGHLIGHTS

Revenue

.……….….....

Profit/loss before depreciation, amortisation

and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment

losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Profit/loss before financial items (EBIT)

*************

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Invested capital

ROIC, annualised

MAERSK SUPPLY SERVICE

2015

2014

157

73

35

31

69

5

64

69

1,699

15.2%

340

152

70

29

111

9

102

107

-17

1,699

176

MAERSK SUPPLY SERVICE

2015

2014

12.0%

69

34

35

2

33

71

-17

1,662

7.8%

351

131

69

1

63

6

57

149

-51

1,662

6.8%

MAERSK TANKERS

2015

2014

260

74

34

-4

36

1

35

55

-21

1,580

8.9%

536

142

68

-2

72

1

71

131

-55

1,580

285

MAERSK TANKERS

2015

2014

9.0%

31

32

-2

-2

83

423

1,754

-0.5%

623

96

69

-2

25

+1

26

120

484

1,754

2.4%

2015

655

17

7

3:36

13

7

20

-1

286

8.9%

2015

1,338

18

14

2

4

10

12

-2

32

286

-1.5%

DAMCO

2014

785

-19

7

2

-24

8

-32

-71

-23

514

-25.8%

DAMCO

2014

1,534

-18

16

4

-30

12

-42

-133

-28

514

-18.0%

USD MILLION

SVITZER

2014

2015

161

50

21

2

5

36

4

32

49

-60

1,114

11.6%

2015

339

100

42

3

10

71

10

61

83

-105

1,114

USD MILLION

SVITZER

2014

11.3%

212

46

229353

20

37

28

-45

1,510

8.5%

20/42

429

99

40

3

13

75

10

65

76

-122

1,510

9.0%View entire presentation