Alternus Energy SPAC Presentation Deck

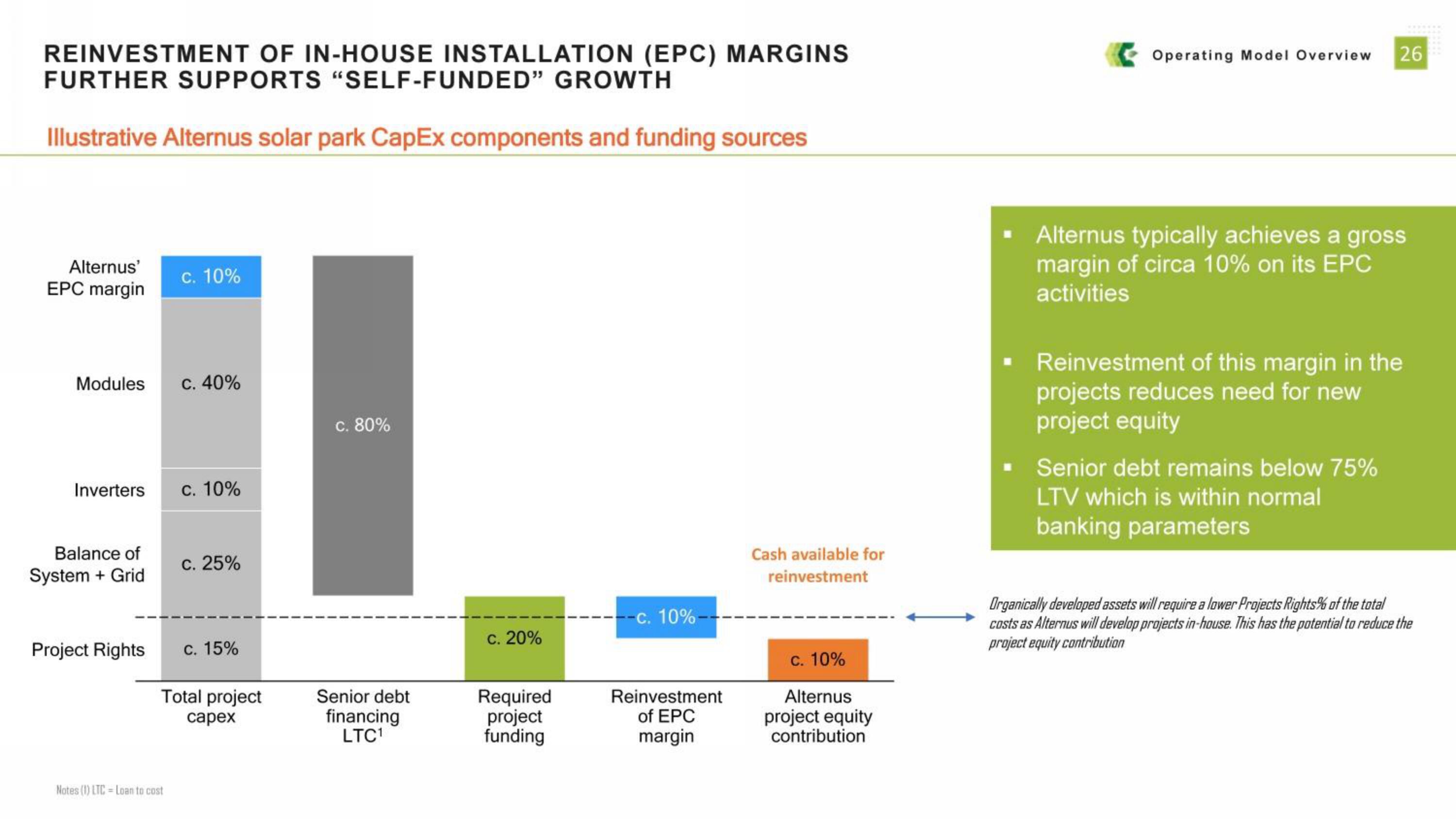

REINVESTMENT OF IN-HOUSE INSTALLATION (EPC) MARGINS

FURTHER SUPPORTS "SELF-FUNDED" GROWTH

Illustrative Alternus solar park CapEx components and funding sources

Alternus'

EPC margin

Modules

Inverters

Balance of

System + Grid

Project Rights

c. 10%

Notes (1) LTC - Loan to cost

c. 40%

c. 10%

c. 25%

c. 15%

Total project

capex

c. 80%

Senior debt

financing

LTC¹

c. 20%

Required

project

funding

-c. 10%

Reinvestment

of EPC

margin

Cash available for

reinvestment

c. 10%

Alternus

project equity

contribution

Operating Model Overview 26

Alternus typically achieves a gross

margin of circa 10% on its EPC

activities

▪ Reinvestment of this margin in the

projects reduces need for new

project equity

Senior debt remains below 75%

LTV which is within normal

banking parameters

Organically developed assets will require a lower Projects Rights% of the total

costs as Alternus will develop projects in-house. This has the potential to reduce the

project equity contributionView entire presentation