Atalaya Risk Management Overview

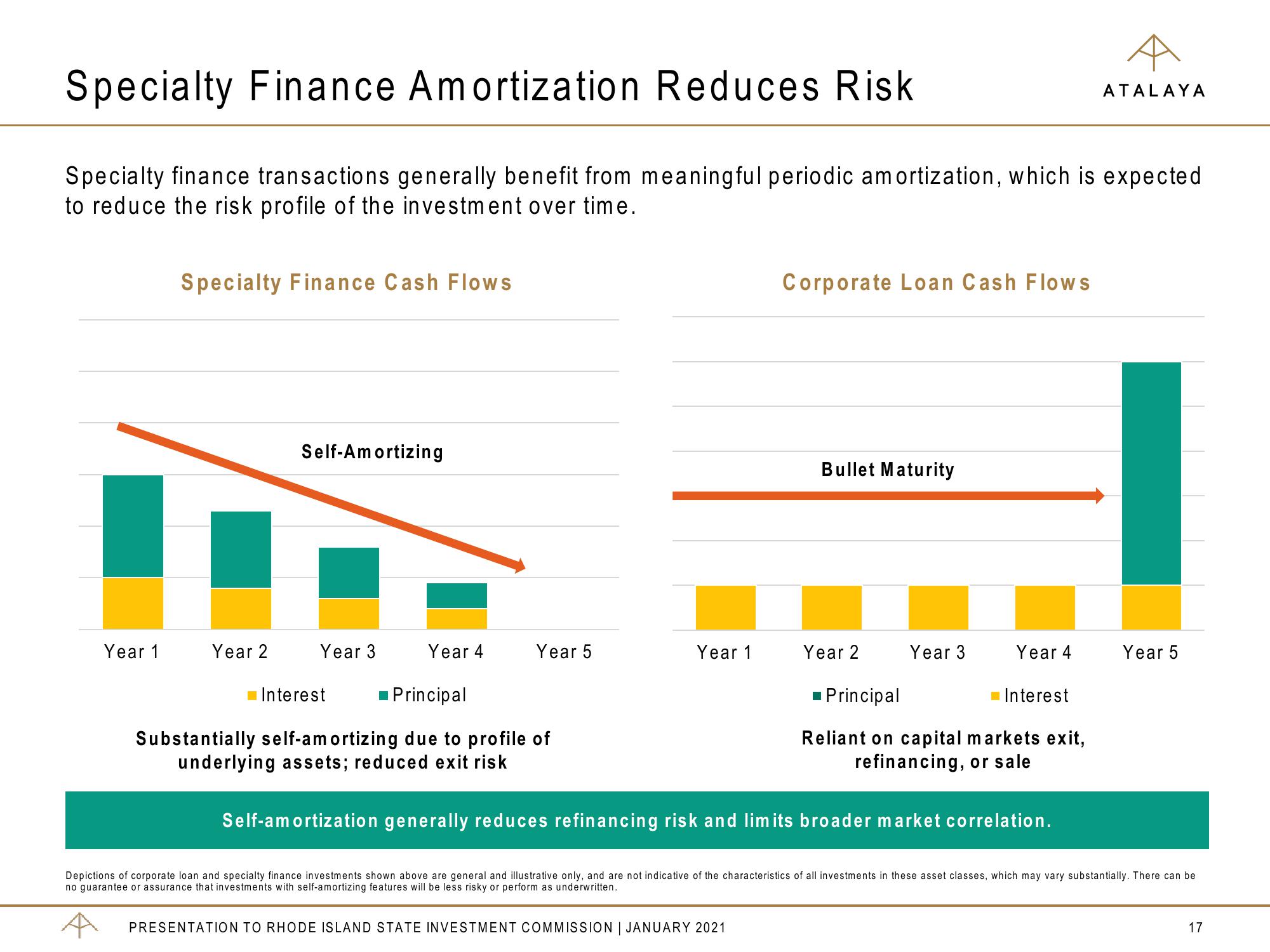

Specialty Finance Amortization Reduces Risk

Specialty finance transactions generally benefit from meaningful periodic amortization, which is expected

to reduce the risk profile of the investment over time.

Year 1

Specialty Finance Cash Flows

Year 2

Self-Amortizing

Year 3

Year 4

Year 5

Interest ■ Principal

Substantially self-amortizing due to profile of

underlying assets; reduced exit risk

Year 1

Corporate Loan Cash Flows

Bullet Maturity

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

Year 2

Year 3

Year 4

Principal

Reliant on capital markets exit,

refinancing, or sale

Interest

Self-amortization generally reduces refinancing risk and limits broader market correlation.

ATALAYA

Year 5

Depictions of corporate loan and specialty finance investments shown above are general and illustrative only, and are not indicative of the characteristics of all investments in these asset classes, which may vary substantially. There can be

no guarantee or assurance that investments with self-amortizing features will be less risky or perform as underwritten.

17View entire presentation