Cannae SPAC Presentation Deck

4

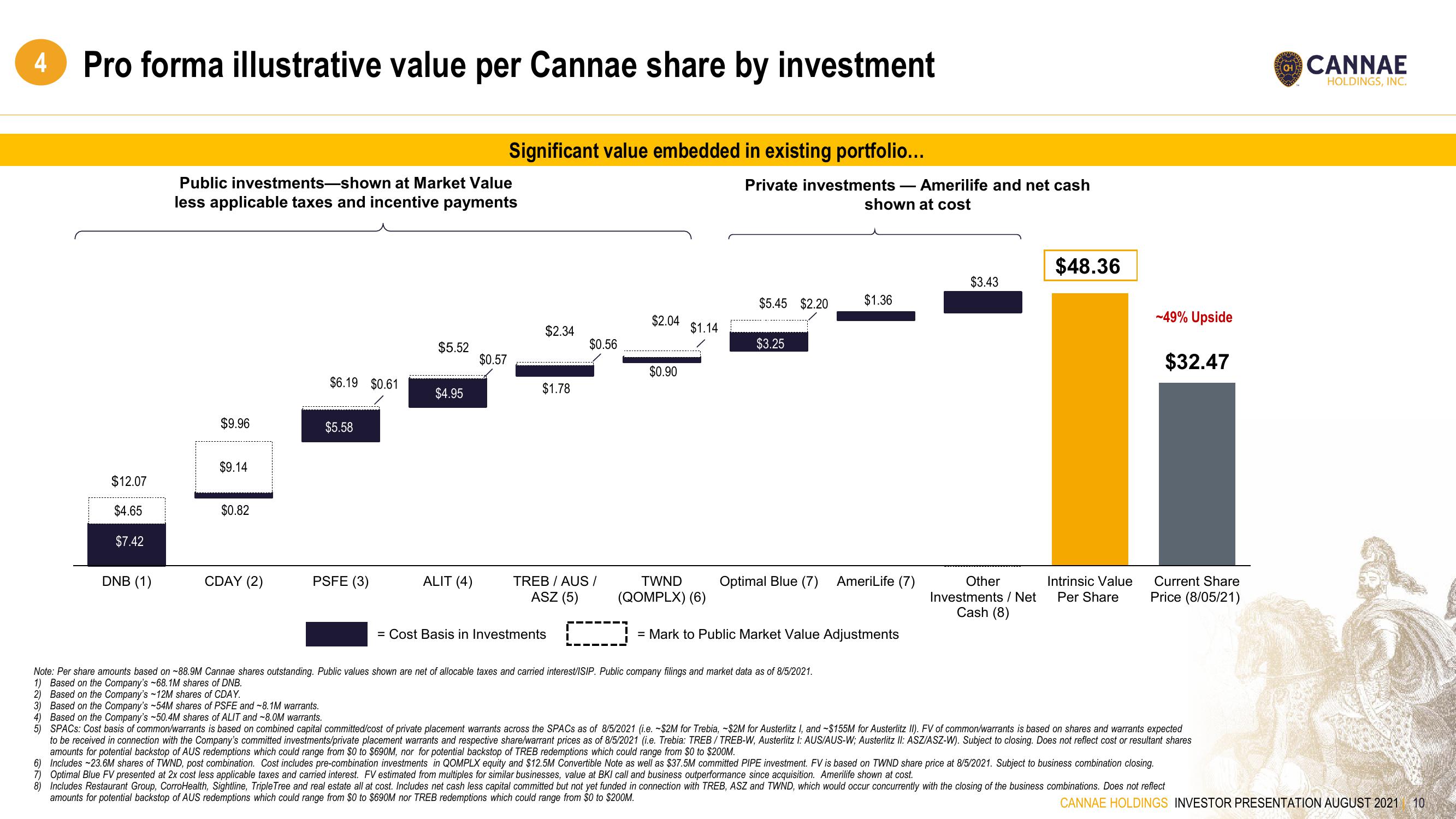

Pro forma illustrative value per Cannae share by investment

$12.07

$4.65

$7.42

DNB (1)

Public investments-shown at Market Value

less applicable taxes and incentive payments

$9.96

$9.14

$0.82

CDAY (2)

$6.19 $0.61

$5.58

PSFE (3)

$5.52

$4.95

Significant value embedded in existing portfolio...

$0.57

ALIT (4)

$2.34

$1.78

$0.56

TREB/AUS /

ASZ (5)

= Cost Basis in Investments {

$2.04

$0.90

$1.14

Private investments - Amerilife and net cash

shown at cost

$5.45 $2.20

$3.25

Optimal Blue (7)

$1.36

TWND

(QOMPLX) (6)

= Mark to Public Market Value Adjustments

AmeriLife (7)

$3.43

Other

Investments / Net

Cash (8)

$48.36

Intrinsic Value

Per Share

-49% Upside

$32.47

Current Share

Price (8/05/21)

Note: Per share amounts based on ~88.9M Cannae shares outstanding. Public values shown are net of allocable taxes and carried interest/ISIP. Public company filings and market data as of 8/5/2021.

1) Based on the Company's ~68.1M shares of DNB.

2) Based on the Company's ~12M shares of CDAY.

3) Based on the Company's -54M shares of PSFE and ~8.1M warrants.

4) Based on the Company's ~50.4M shares of ALIT and ~8.0M warrants.

5) SPACS: Cost basis of common/warrants is based on combined capital committed/cost of private placement warrants across the SPACs as of 8/5/2021 (i.e. -$2M for Trebia, -$2M for Austerlitz I, and -$155M for Austerlitz II). FV of common/warrants is based on shares and warrants expected

to be received in connection with the Company's committed investments/private placement warrants and respective share/warrant prices as of 8/5/2021 (i.e. Trebia: TREB/TREB-W, Austerlitz I: AUS/AUS-W; Austerlitz II: ASZ/ASZ-W). Subject to closing. Does not reflect cost or resultant shares

amounts for potential backstop of AUS redemptions which could range from $0 to $690M, nor for potential backstop of TREB redemptions which could range from $0 to $200M.

6) Includes -23.6M shares of TWND, post combination. Cost includes pre-combination investments in QOMPLX equity and $12.5M Convertible Note as well as $37.5M committed PIPE investment. FV is based on TWND share price at 8/5/2021. Subject to business combination closing.

7) Optimal Blue FV presented at 2x cost less applicable taxes and carried interest. FV estimated from multiples for similar businesses, value at BKI call and business outperformance since acquisition. Amerilife shown at cost.

8) Includes Restaurant Group, CorroHealth, Sightline, Triple Tree and real estate all at cost. Includes net cash less capital committed but not yet funded in connection with TREB, ASZ and TWND, which would occur concurrently with the closing of the business combinations. Does not reflect

amounts for potential backstop of AUS redemptions which could range from $0 to $690M nor TREB redemptions which could range from $0 to $200M.

CH

CANNAE

HOLDINGS, INC.

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 10View entire presentation