Credit Suisse Investor Event Presentation Deck

I

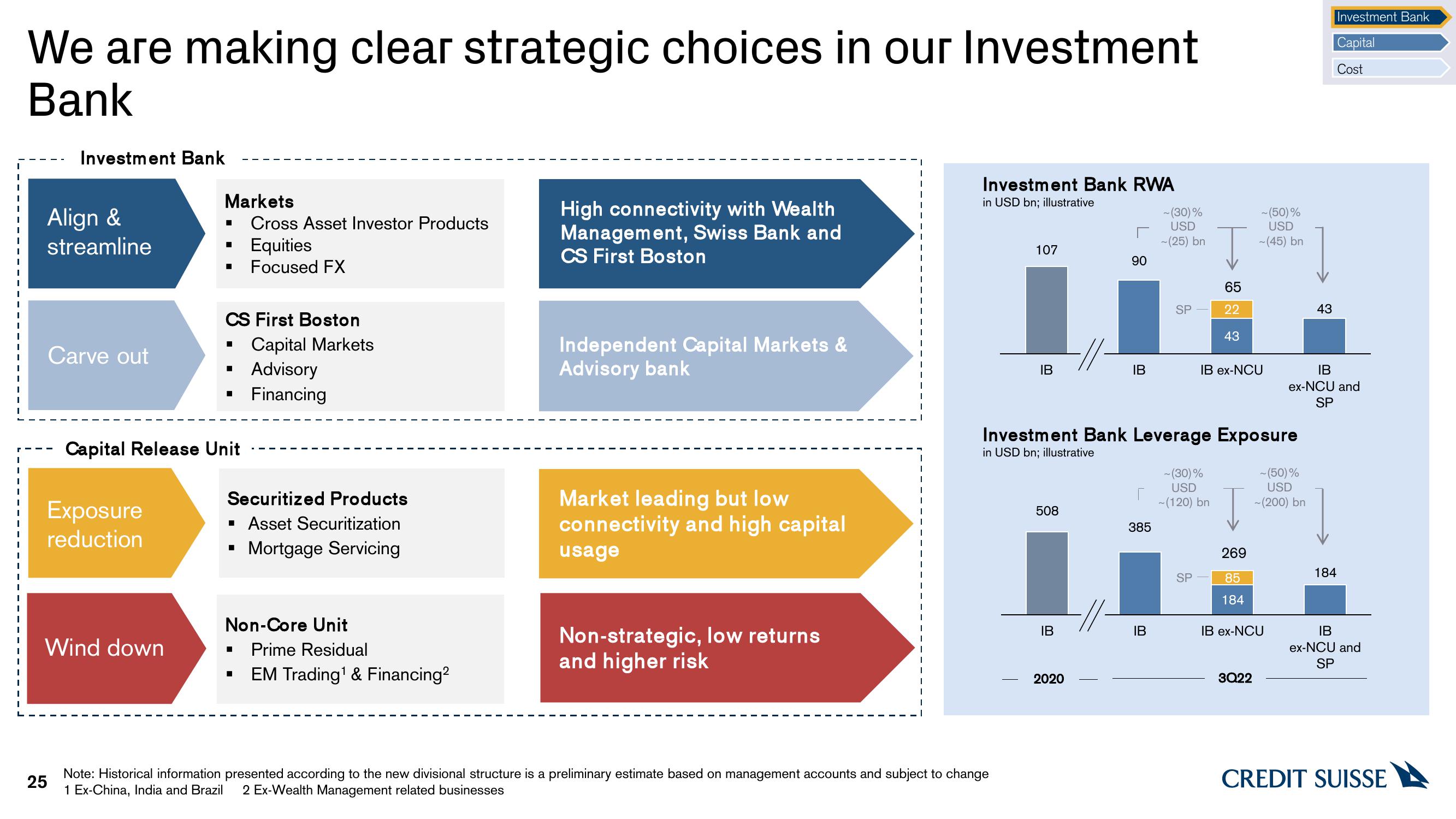

We are making clear strategic choices in our Investment

Bank

Investment Bank

Align &

streamline

Carve out

Exposure

reduction

Markets

Wind down

■

■

■ Focused FX

CS First Boston

■

Capital Release Unit

■

Cross Asset Investor Products

Equities

Capital Markets

Advisory

Financing

Securitized Products

▪ Asset Securitization

Mortgage Servicing

■

Non-Core Unit

Prime Residual

EM Trading¹ & Financing²

High connectivity with Wealth

Management, Swiss Bank and

CS First Boston

Independent Capital Markets &

Advisory bank

Market leading but low

connectivity and high capital

usage

Non-strategic, low returns

and higher risk

Investment Bank RWA

in USD bn; illustrative

107

25

Note: Historical information presented according to the new divisional structure is a preliminary estimate based on management accounts and subject to change

1 Ex-China, India and Brazil 2 Ex-Wealth Management related businesses

IB

508

IB

90

2020

IB

385

~(30)%

USD

~(25) bn

Investment Bank Leverage Exposure

in USD bn; illustrative

IB

SP

65

22

43

- (30)%

USD

~(120) bn

SP

IB ex-NCU

~(50)%

USD

~(45) bn

269

85

184

3Q22

IB ex-NCU

- (50)%

USD

~(200) bn

43

IB

ex-NCU and

SP

Investment Bank

Capital

Cost

184

IB

ex-NCU and

SP

CREDIT SUISSEView entire presentation