Oatly Results Presentation Deck

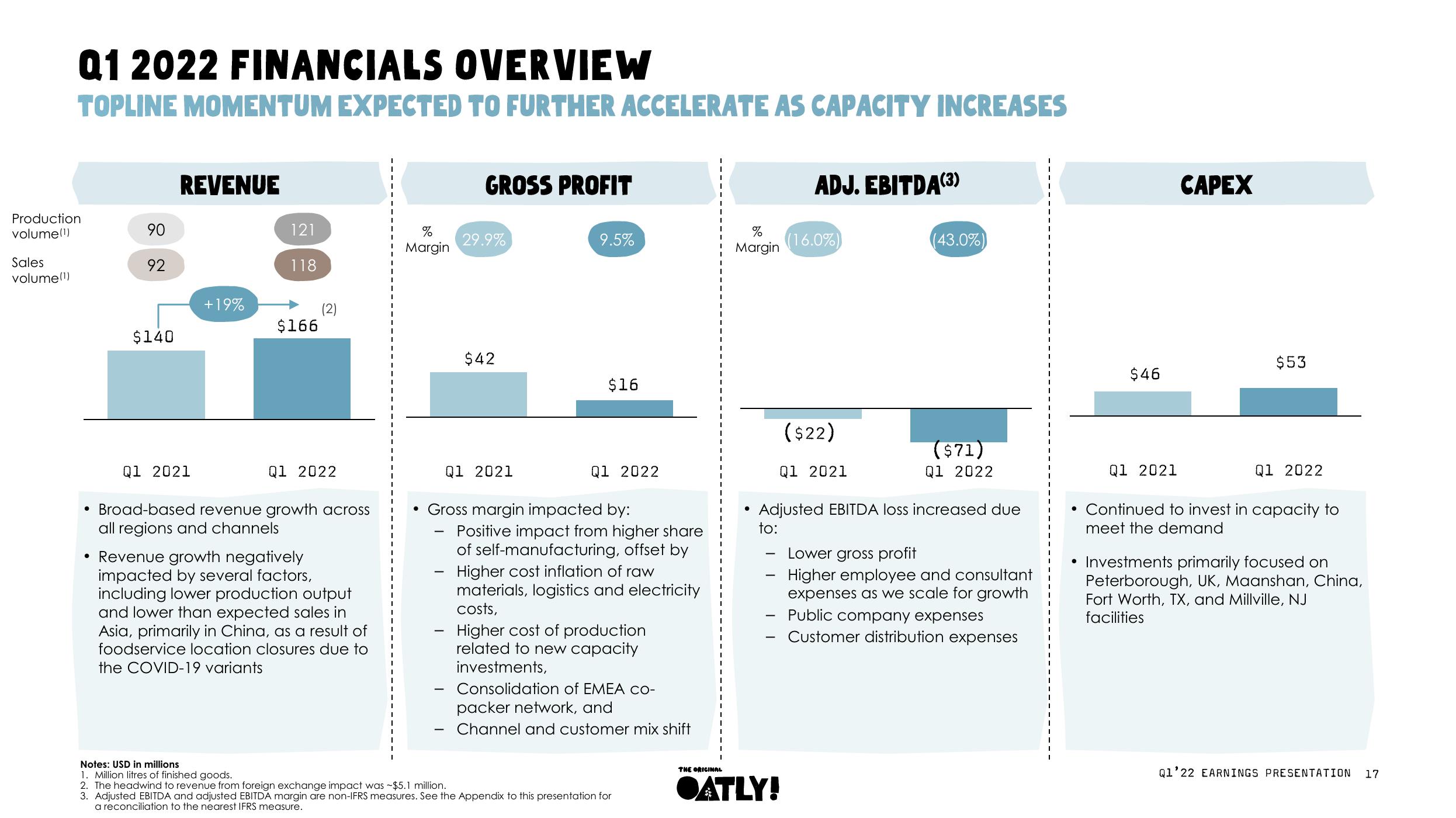

Q1 2022 FINANCIALS OVERVIEW

TOPLINE MOMENTUM EXPECTED TO FURTHER ACCELERATE AS CAPACITY INCREASES

Production

volume(¹)

Sales

volume(1)

●

●

90

92

$140

REVENUE

Q1 2021

+19%

121

118

$166

Q1 2022

Broad-based revenue growth across

all regions and channels

Revenue growth negatively

impacted by several factors,

including lower production output

and lower than expected sales in

Asia, primarily in China, as a result of

foodservice location closures due to

the COVID-19 variants

%

Margin

●

-

-

GROSS PROFIT

-

29.9%

$42

Q1 2021

9.5%

Gross margin impacted by:

$16

Q1 2022

Positive impact from higher share

of self-manufacturing, offset by

Higher cost inflation of raw

materials, logistics and electricity

costs,

Higher cost of production

related to new capacity

investments,

Consolidation of EMEA co-

packer network, and

Channel and customer mix shift

Notes: USD in millions

1. Million litres of finished goods.

2. The headwind to revenue from foreign exchange impact was -$5.1 million.

3. Adjusted EBITDA and adjusted EBITDA margin are non-IFRS measures. See the Appendix to this presentation for

a reconciliation to the nearest IFRS measure.

THE ORIGINAL

%

Margin

●

-

-

ADJ. EBITDA(3)

(16.0%)

●ATLY!

($22)

Q1 2021

Adjusted EBITDA loss increased due

to:

(43.0%)

($71)

Q1 2022

Lower gross profit

Higher employee and consultant

expenses as we scale for growth

Public company expenses

Customer distribution expenses

$46

Q1 2021

CAPEX

$53

Q1 2022

• Continued to invest in capacity to

meet the demand

• Investments primarily focused on

Peterborough, UK, Maanshan, China,

Fort Worth, TX, and Millville, NJ

facilities

Q1'22 EARNINGS PRESENTATION

17View entire presentation