Flutter SPAC Presentation Deck

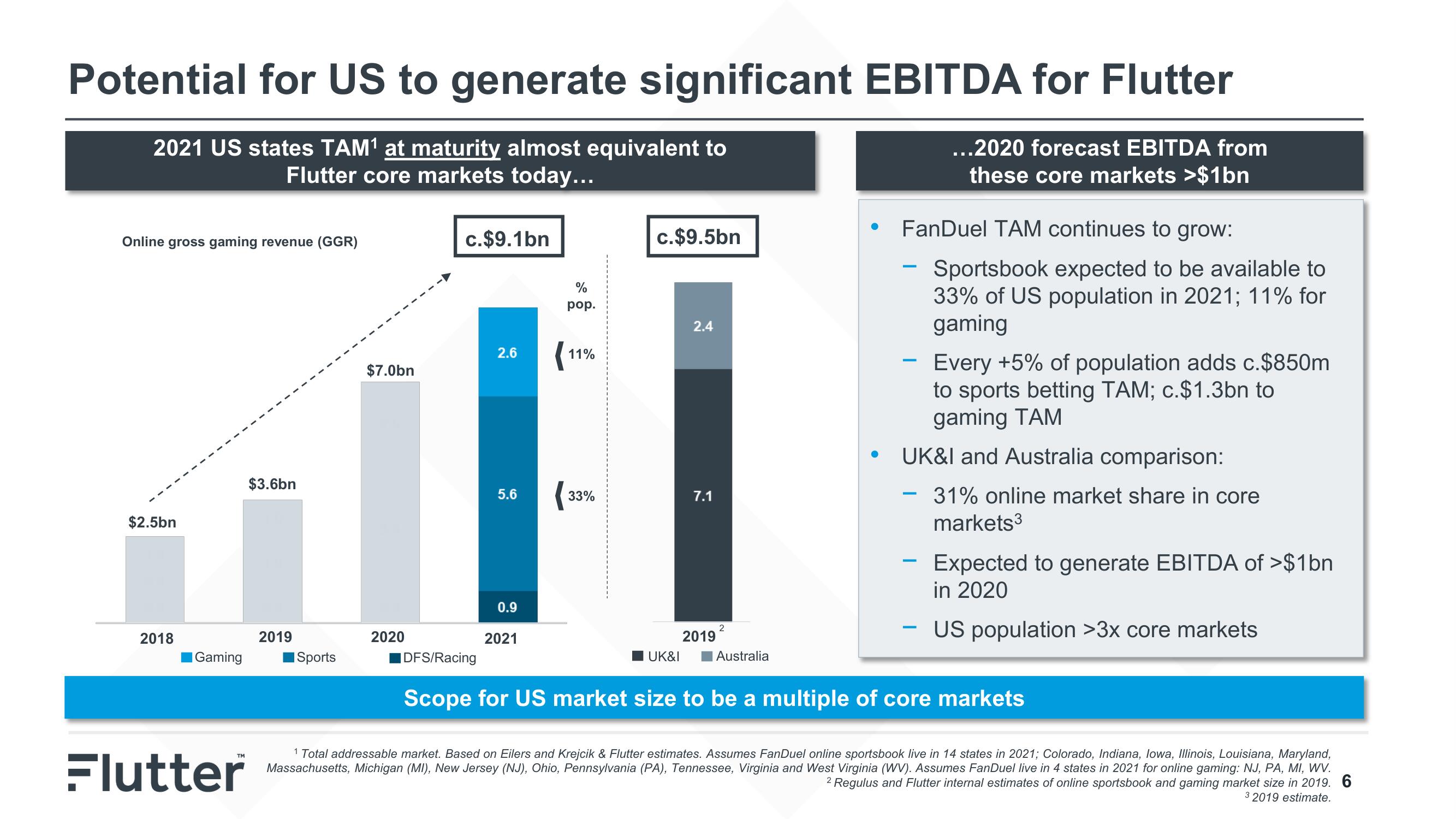

Potential for US to generate significant EBITDA for Flutter

2021 US states TAM¹ at maturity almost equivalent to

...2020 forecast EBITDA from

these core markets >$1bn

Flutter core markets today...

Online gross gaming revenue (GGR)

$2.5bn

2018

Gaming

Flutter

$3.6bn

2019

Sports

$7.0bn

2020

c.$9.1bn

IDFS/Racing

2.6

5.6

0.9

2021

%

pop.

(11⁹

33%

c.$9.5bn

UK&I

2.4

7.1

2019

2

Australia

FanDuel TAM continues to grow:

Sportsbook expected to be available to

33% of US population in 2021; 11% for

gaming

Every +5% of population adds c.$850m

to sports betting TAM; c.$1.3bn to

gaming TAM

UK&I and Australia comparison:

31% online market share in core

markets3

—

Expected to generate EBITDA of >$1bn

in 2020

- US population >3x core markets

-

Scope for US market size to be a multiple of core markets

1 Total addressable market. Based on Eilers and Krejcik & Flutter estimates. Assumes FanDuel online sportsbook live in 14 states in 2021; Colorado, Indiana, Iowa, Illinois, Louisiana, Maryland,

Massachusetts, Michigan (MI), New Jersey (NJ), Ohio, Pennsylvania (PA), Tennessee, Virginia and West Virginia (WV). Assumes FanDuel live in 4 states in 2021 for online gaming: NJ, PA, MI, WV.

2 Regulus and Flutter internal estimates of online sportsbook and gaming market size in 2019. 6

3 2019 estimate.View entire presentation