Ares US Real Estate Opportunity Fund III, L.P Market and Portfolio Update

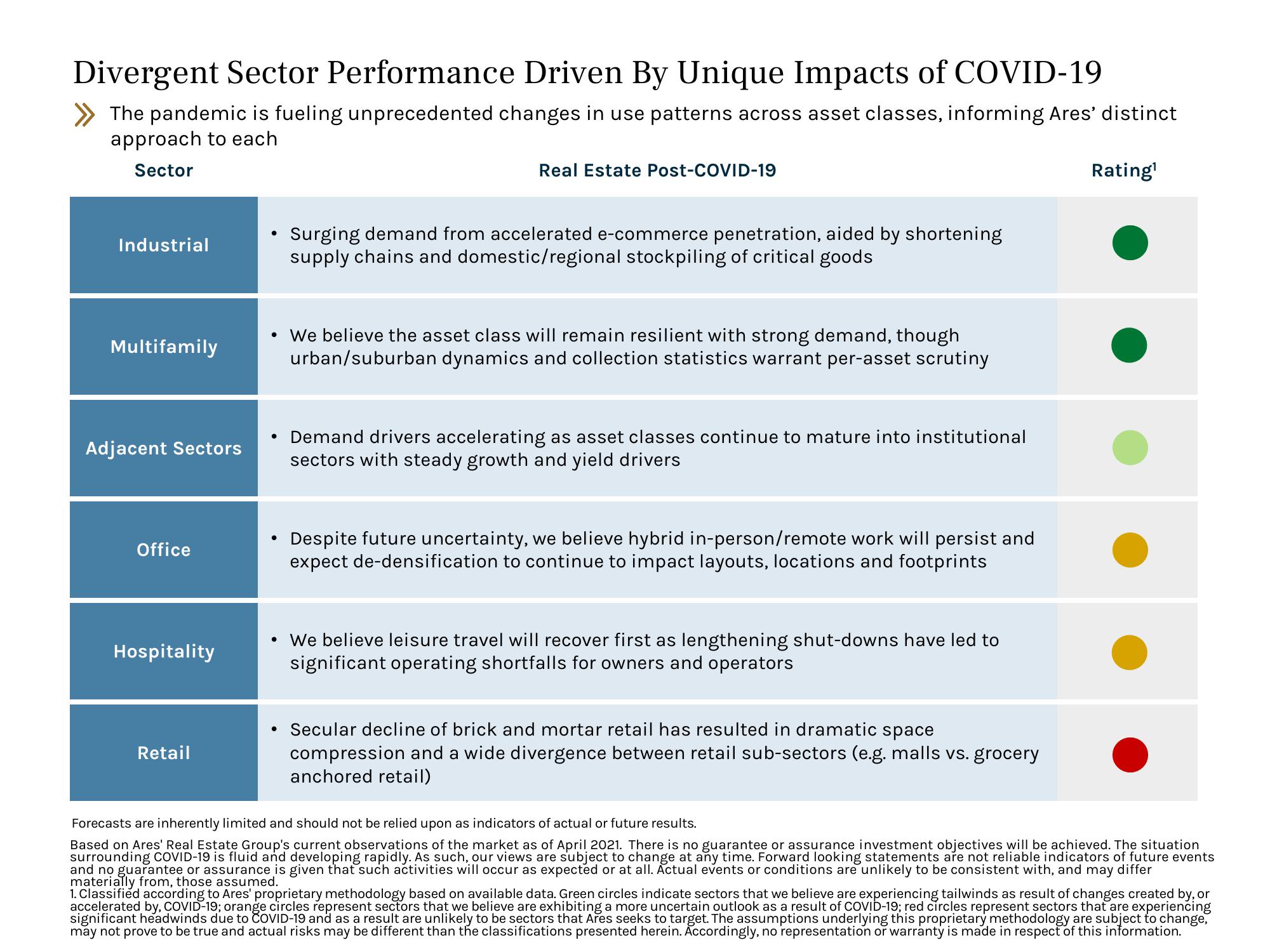

Divergent Sector Performance Driven By Unique Impacts of COVID-19

»The pandemic is fueling unprecedented changes in use patterns across asset classes, informing Ares' distinct

approach to each

Sector

Industrial

Multifamily

Adjacent Sectors

Office

Hospitality

Retail

●

●

Real Estate Post-COVID-19

• We believe the asset class will remain resilient with strong demand, though

urban/suburban dynamics and collection statistics warrant per-asset scrutiny

●

Surging demand from accelerated e-commerce penetration, aided by shortening

supply chains and domestic/regional stockpiling of critical goods

Demand drivers accelerating as asset classes continue to mature into institutional

sectors with steady growth and yield drivers

Despite future uncertainty, we believe hybrid in-person/remote work will persist and

expect de-densification to continue to impact layouts, locations and footprints

We believe leisure travel will recover first as lengthening shut-downs have led to

significant operating shortfalls for owners and operators

Secular decline of brick and mortar retail has resulted in dramatic space

compression and a wide divergence between retail sub-sectors (e.g. malls vs. grocery

anchored retail)

Rating¹

Forecasts are inherently limited and should not be relied upon as indicators of actual or future results.

Based on Ares' Real Estate Group's current observations of the market as of April 2021. There is no guarantee or assurance investment objectives will be achieved. The situation

surrounding COVID-19 is fluid and developing rapidly. As such, our views are subject to change at any time. Forward looking statements are not reliable indicators of future events

and no guarantee or assurance is given that such activities will occur as expected or at all. Actual events or conditions are unlikely to be consistent with, and may differ

materially from, those assumed.

1. Classified according to Ares' proprietary methodology based on available data. Green circles indicate sectors that we believe are experiencing tailwinds as result of changes created by, or

accelerated by, COVID-19; orange circles represent sectors that we believe are exhibiting a more uncertain outlook as a result of COVID-19; red circles represent sectors that are experiencing

significant headwinds due to COVID-19 and as a result are unlikely to be sectors that Ařes seeks to target. The assumptions underlying this proprietary methodology are subject to change,

may not prove to be true and actual risks may be different than the classifications presented herein. Accordingly, no representation or warranty is made in respect of this information.View entire presentation