First Citizens BancShares Results Presentation Deck

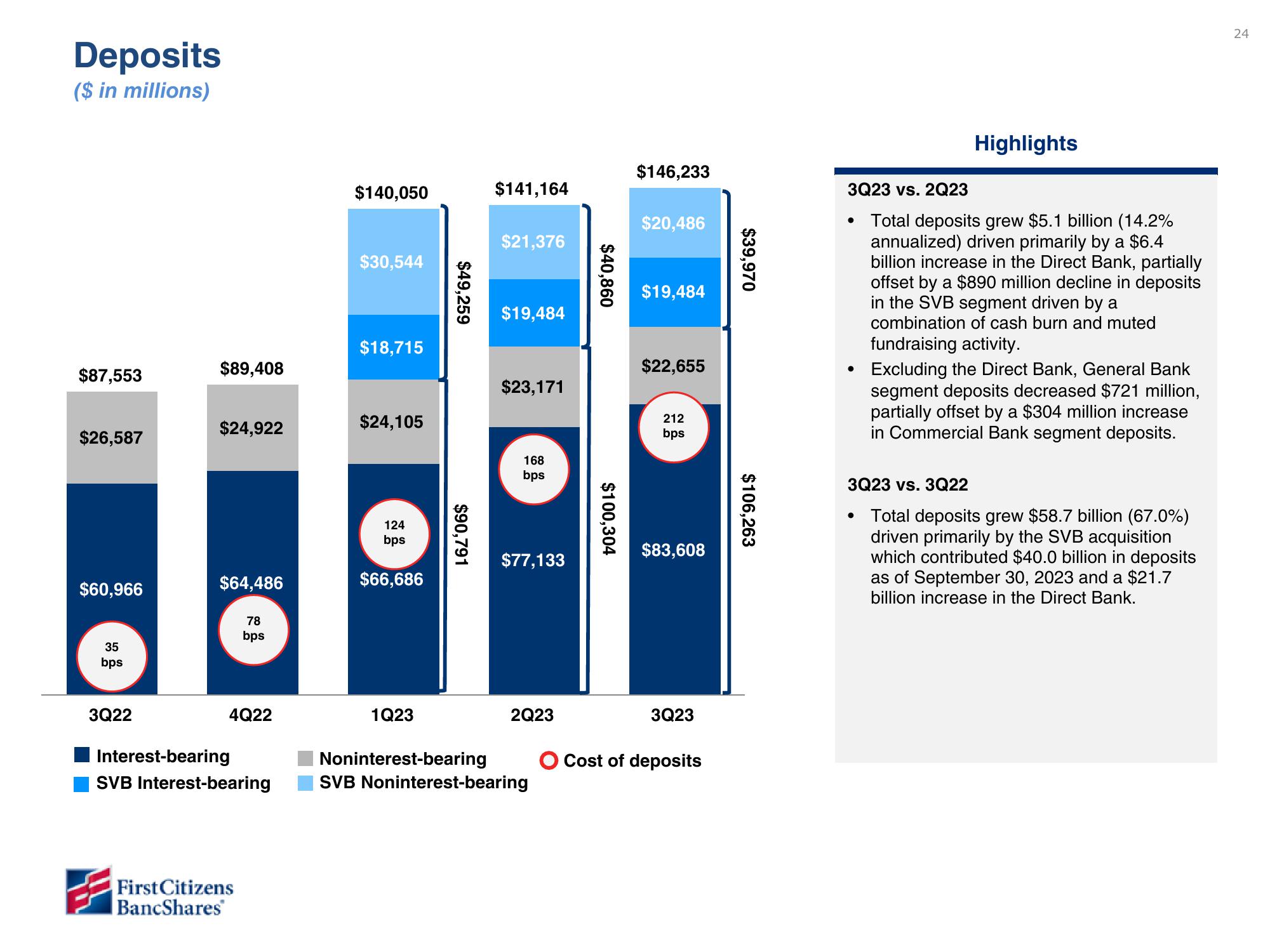

Deposits

($ in millions)

$87,553

$26,587

$60,966

35

bps

3Q22

$89,408

$24,922

$64,486

78

bps

4Q22

Interest-bearing

SVB Interest-bearing

First Citizens

BancShares

$140,050

$30,544

$18,715

$24,105

124

bps

$66,686

1Q23

$49,259

$90,791

Noninterest-bearing

$141,164

$21,376

$19,484

$23,171

168

bps

$77,133

2Q23

SVB Noninterest-bearing

$40,860

$100,304

$146,233

$20,486

$19,484

$22,655

212

bps

$83,608

3Q23

Cost of deposits

$39,970

$106,263

Highlights

3Q23 vs. 2Q23

Total deposits grew $5.1 billion (14.2%

annualized) driven primarily by a $6.4

billion increase in the Direct Bank, partially

offset by a $890 million decline in deposits

in the SVB segment driven by a

combination of cash burn and muted

fundraising activity.

●

Excluding the Direct Bank, General Bank

segment deposits decreased $721 million,

partially offset by a $304 million increase

in Commercial Bank segment deposits.

3Q23 vs. 3Q22

Total deposits grew $58.7 billion (67.0%)

driven primarily by the SVB acquisition

which contributed $40.0 billion in deposits

as of September 30, 2023 and a $21.7

billion increase in the Direct Bank.

24View entire presentation