Confluent IPO Presentation Deck

Offering Summary

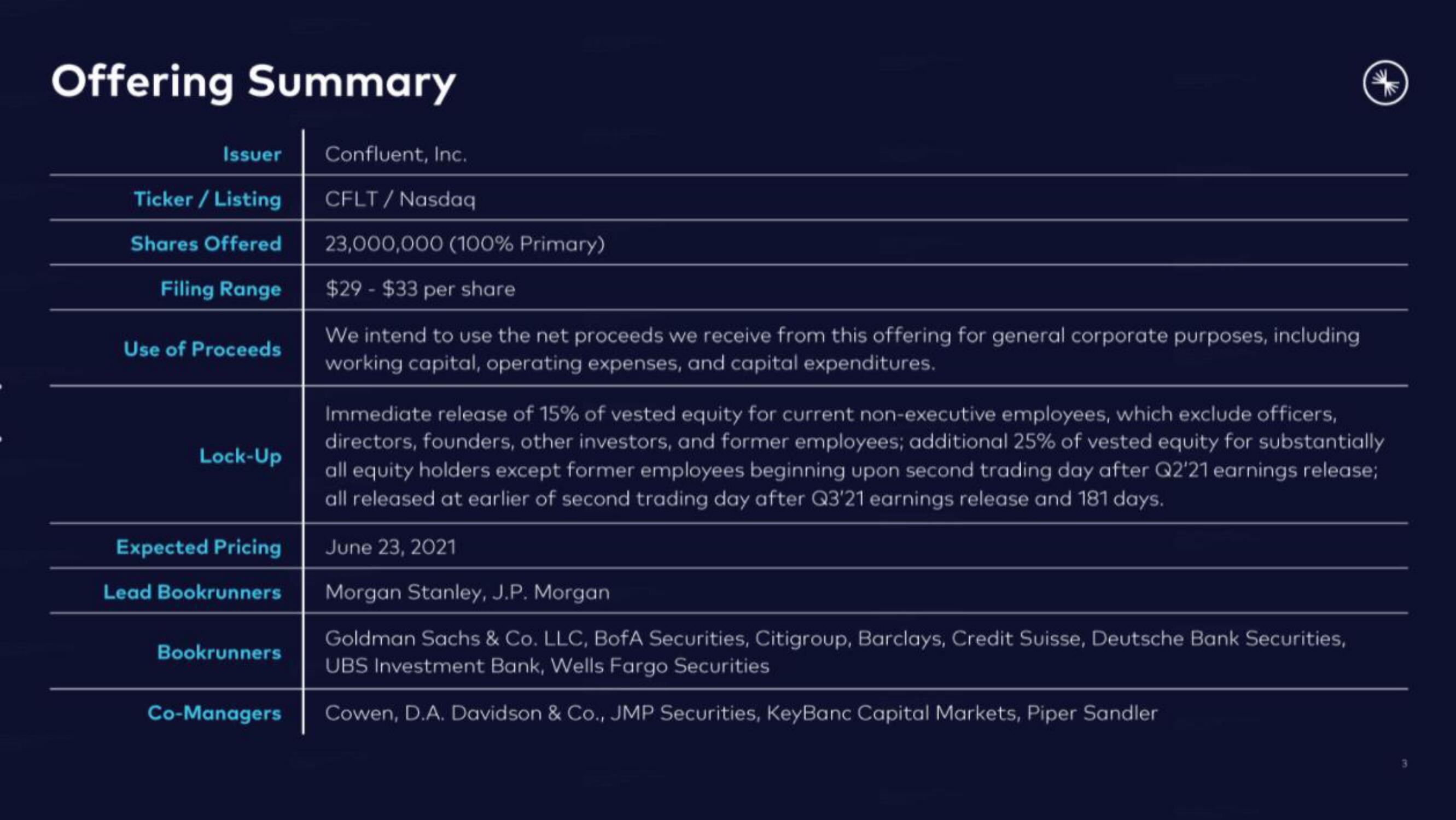

Issuer

Ticker / Listing

Shares Offered

Filing Range

Use of Proceeds

Lock-Up

Expected Pricing

Lead Bookrunners

Bookrunners

Co-Managers

Confluent, Inc.

CFLT/Nasdaq

23,000,000 (100% Primary)

$29- $33 per share

We intend to use the net proceeds we receive from this offering for general corporate purposes, including

working capital, operating expenses, and capital expenditures.

Immediate release of 15% of vested equity for current non-executive employees, which exclude officers,

directors, founders, other investors, and former employees; additional 25% of vested equity for substantially

all equity holders except former employees beginning upon second trading day after Q2'21 earnings release;

all released at earlier of second trading day after Q3'21 earnings release and 181 days.

June 23, 2021

Morgan Stanley, J.P. Morgan

Goldman Sachs & Co. LLC, BofA Securities, Citigroup, Barclays, Credit Suisse, Deutsche Bank Securities,

UBS Investment Bank, Wells Fargo Securities

Cowen, D.A. Davidson & Co., JMP Securities, KeyBanc Capital Markets, Piper SandlerView entire presentation