Bank of America Investment Banking Pitch Book

Go-Shop Considerations

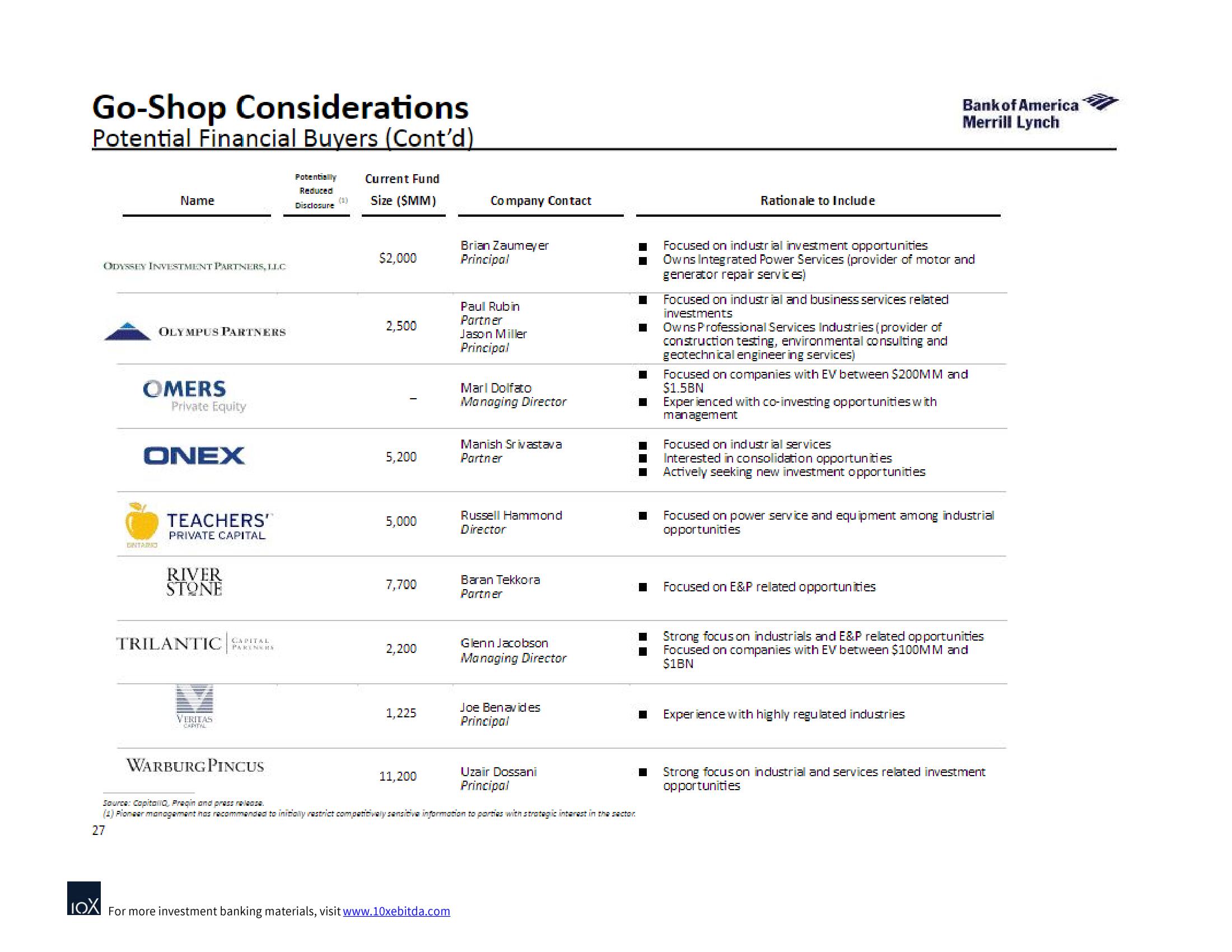

Potential Financial Buyers (Cont'd)

Name

ODYSSEY INVESTMENT PARTNERS, LLC

OLYMPUS PARTNERS

OMERS

ENTARIO

Private Equity

ONEX

TEACHERS"

PRIVATE CAPITAL

RIVER

STONE

TRILANTIC CAPITAL

PARTNERS

VERITAS

CAPITAL

WARBURG PINCUS

Potentially

Reduced

Disclosure

Current Fund

Size (SMM)

$2,000

2,500

5,200

5,000

7,700

2,200

1,225

11,200

Company Contact

IOX For more investment banking materials, visit www.10xebitda.com

Brian Zaumeyer

Principal

Paul Rubin

Partner

Jason Miller

Principal

Marl Dolfato

Managing Director

Manish Srivastava

Partner

Russell Hammond

Director

Baran Tekkora

Partner

Glenn Jacobson

Managing Director

Joe Benavides

Principal

Uzair Dossani

Principal

Source: Capitallo, Pragin and press release.

(1) Ploneer management has recommended to initially restrict competitivaly sensitive information to parties with strategic interest in the sector

27

2

---

1

Rationale to Include

Focused on industrial investment opportunities

Owns Integrated Po

generator repair services)

Services (provider of motor and

Focused on industrial and business services related

investments

Owns Professional Services Industries (provider of

construction testing, environmental consulting and

geotechnical engineering services)

Focused on companies with EV between $200MM and

$1.5BN

Experienced with co-investing opportunities with

management

Focused on industrial services

Interested in consolidation opportunities

Actively seeking new investment opportunities

Bank of America

Merrill Lynch

Focused on power service and equipment among industrial

opportunities

Focused on E&P related opportunities

Strong focus on industrials and E&P related opportunities

Focused on companies with EV between $100MM and

$1BN

Experience with highly regulated industries

Strong focus on industrial and services related investment

opportunitiesView entire presentation