Summer 2023 Solar Industry Update

Low-Income Communities Bonus Newest Guidance

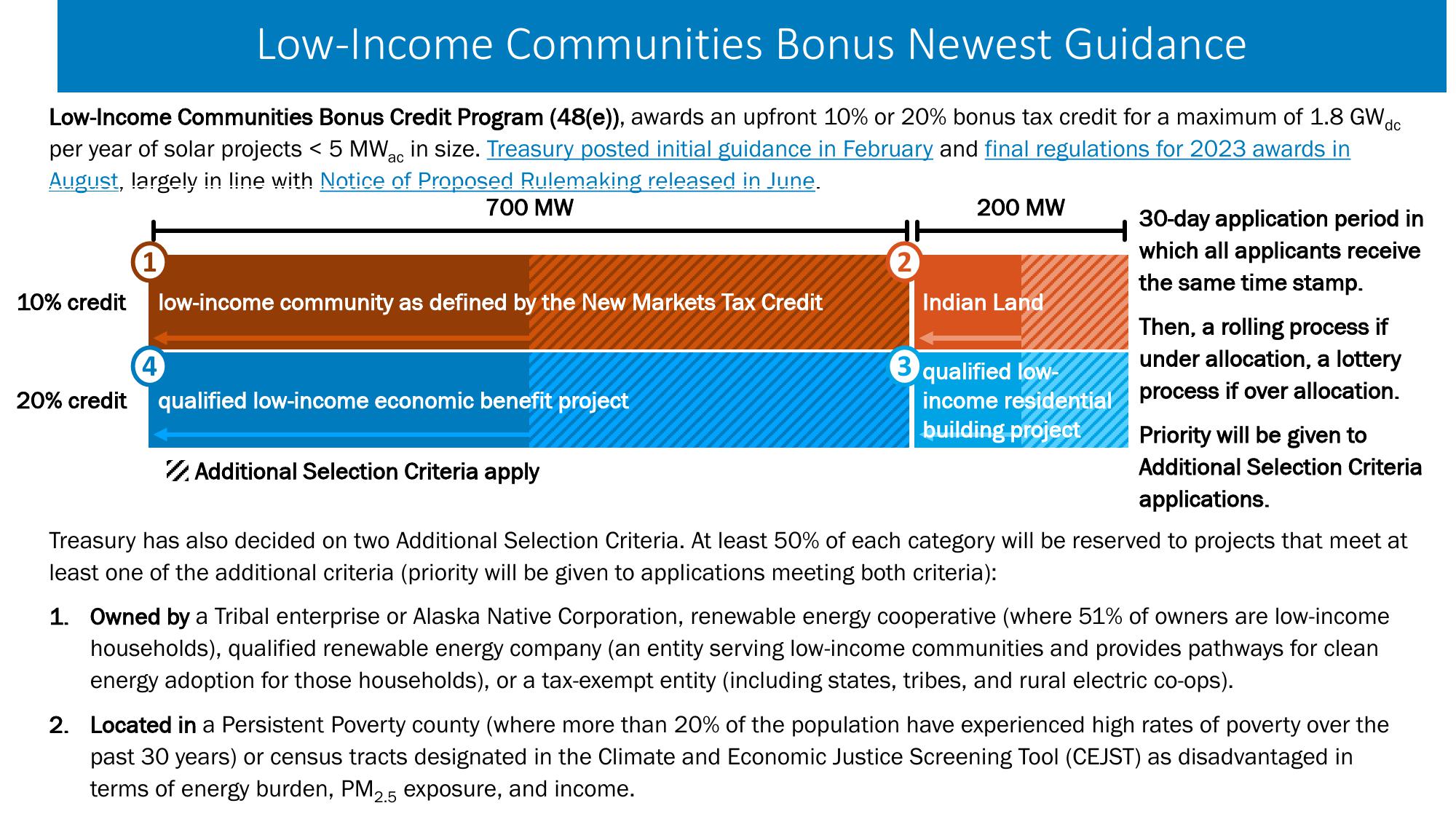

Low-Income Communities Bonus Credit Program (48(e)), awards an upfront 10% or 20% bonus tax credit for a maximum of 1.8 GWdc

per year of solar projects < 5 MW ac in size. Treasury posted initial guidance in February and final regulations for 2023 awards in

August, largely in line with Notice of Proposed Rulemaking released in June.

700 MW

200 MW

1

2

10% credit

low-income community as defined by the New Markets Tax Credit

Indian Land

4

20% credit

qualified low-income economic benefit project

3 qualified low-

income residential

building project

Additional Selection Criteria apply

30-day application period in

which all applicants receive

the same time stamp.

Then, a rolling process if

under allocation, a lottery

process if over allocation.

Priority will be given to

Additional Selection Criteria

applications.

Treasury has also decided on two Additional Selection Criteria. At least 50% of each category will be reserved to projects that meet at

least one of the additional criteria (priority will be given to applications meeting both criteria):

1. Owned by a Tribal enterprise or Alaska Native Corporation, renewable energy cooperative (where 51% of owners are low-income

households), qualified renewable energy company (an entity serving low-income communities and provides pathways for clean

energy adoption for those households), or a tax-exempt entity (including states, tribes, and rural electric co-ops).

2. Located in a Persistent Poverty county (where more than 20% of the population have experienced high rates of poverty over the

past 30 years) or census tracts designated in the Climate and Economic Justice Screening Tool (CEJST) as disadvantaged in

terms of energy burden, PM2.5 exposure, and income.View entire presentation