jetBlue Mergers and Acquisitions Presentation Deck

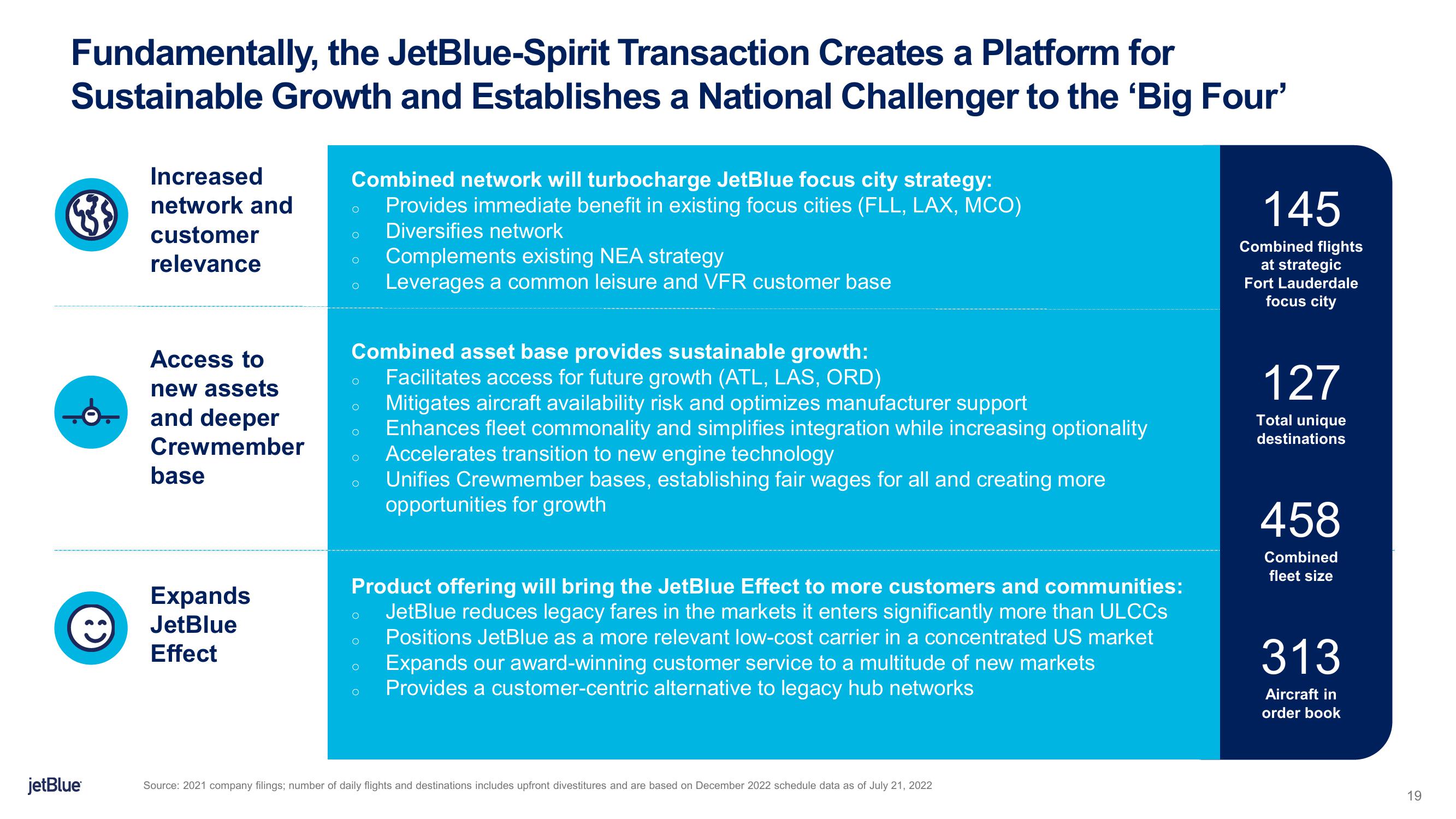

Fundamentally, the JetBlue-Spirit Transaction Creates a Platform for

Sustainable Growth and Establishes a National Challenger to the 'Big Four'

(3

jetBlue

Increased

network and

customer

relevance

Access to

new assets

and deeper

Crewmember

base

Expands

JetBlue

Effect

Combined network will turbocharge JetBlue focus city strategy:

Provides immediate benefit in existing focus cities (FLL, LAX, MCO)

Diversifies network

Combined asset base provides sustainable growth:

Facilitates access for future growth (ATL, LAS, ORD)

O

O

O

Complements existing NEA strategy

Leverages a common leisure and VFR customer base

Product offering will bring the JetBlue Effect to more customers and communities:

JetBlue reduces legacy fares in the markets it enters significantly more than ULCCS

Positions JetBlue as a more relevant low-cost carrier in a concentrated US market

O

O

Mitigates aircraft availability risk and optimizes manufacturer support

Enhances fleet commonality and simplifies integration while increasing optionality

Accelerates transition to new engine technology

Unifies Crewmember bases, establishing fair wages for all and creating more

opportunities for growth

Expands our award-winning customer service to a multitude of new markets

Provides a customer-centric alternative to legacy hub networks

Source: 2021 company filings; number of daily flights and destinations includes upfront divestitures and are based on December 2022 schedule data as of July 21, 2022

145

Combined flights

at strategic

Fort Lauderdale

focus city

127

Total unique

destinations

458

Combined

fleet size

313

Aircraft in

order book

19View entire presentation