Kinnevik Results Presentation Deck

LIQUIDATION PREFERENCES CAN CAUSE SOME IMMOBILITY IN OUR FAIR VALUES,

IN PARTICULAR IN INVESTMENTS WHERE WE HAVE ONLY INVESTED IN ONE ROUND

■

■

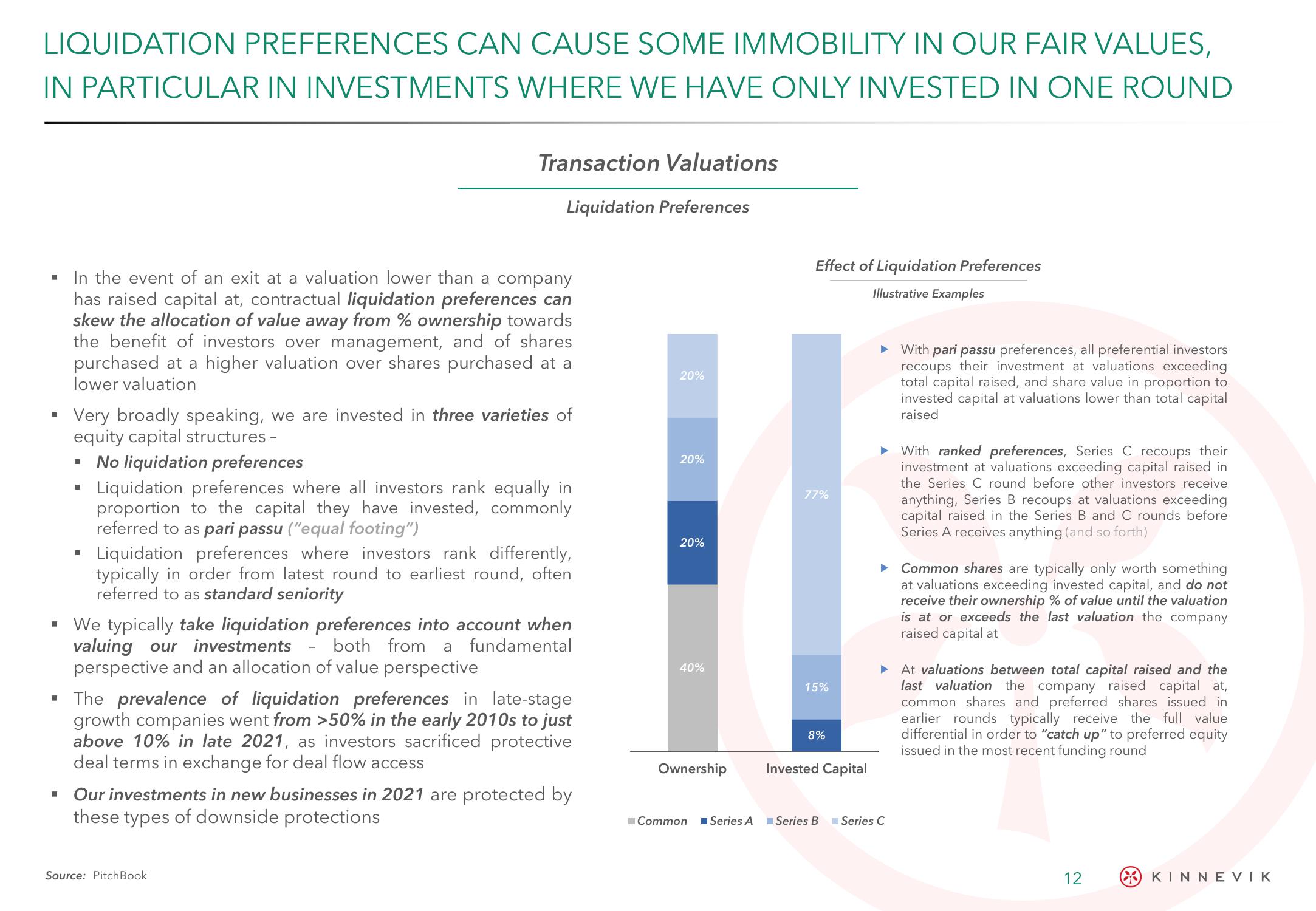

In the event of an exit at a valuation lower than a company

has raised capital at, contractual liquidation preferences can

skew the allocation of value away from % ownership towards

the benefit of investors over management, and of shares

purchased at a higher valuation over shares purchased at a

lower valuation

■

Very broadly speaking, we are invested in three varieties of

equity capital structures -

No liquidation preferences

■

Transaction Valuations

I

Liquidation Preferences

Liquidation preferences where all investors rank equally in

proportion to the capital they have invested, commonly

referred to as pari passu ("equal footing")

Liquidation preferences where investors rank differently,

typically in order from latest round to earliest round, often

referred to as standard seniority

▪ We typically take liquidation preferences into account when

valuing our investments both from a fundamental

perspective and an allocation of value perspective

▪ The prevalence of liquidation preferences in late-stage

growth companies went from >50% in the early 2010s to just

above 10% in late 2021, as investors sacrificed protective

deal terms in exchange for deal flow access

Source: Pitch Book

Our investments in new businesses in 2021 are protected by

these types of downside protections

20%

20%

20%

40%

Ownership

Common ■Series A

Effect of Liquidation Preferences

Illustrative Examples

77%

15%

8%

Invested Capital

With pari passu preferences, all preferential investors

recoups their investment at valuations exceeding

total capital raised, and share value in proportion to

invested capital at valuations lower than total capital

raised

► With ranked preferences, Series C recoups their

investment at valuations exceeding capital raised in

the Series C round before other investors receive

anything, Series B recoups at valuations exceeding

capital raised in the Series B and C rounds before

Series A receives anything (and so forth)

► Common shares are typically only worth something

at valuations exceeding invested capital, and do not

receive their ownership % of value until the valuation

is at or exceeds the last valuation the company

raised capital at

► At valuations between total capital raised and the

last valuation the company raised capital at,

common shares and preferred shares issued in

earlier rounds typically receive the full value

differential in order to "catch up" to preferred equity

issued in the most recent funding round

Series B Series C

12

KINNEVIKView entire presentation