Evolv SPAC Presentation Deck

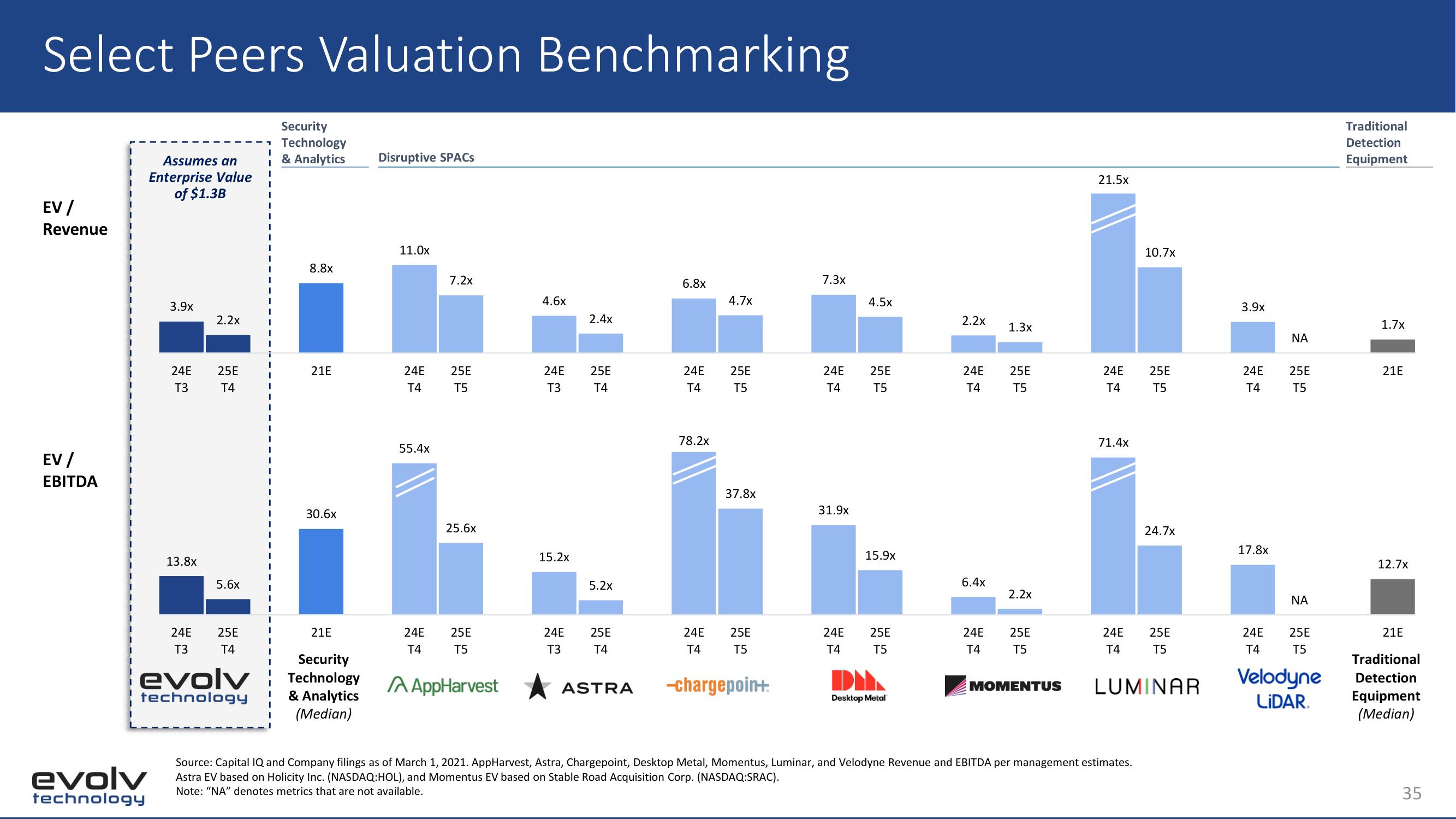

Select Peers Valuation Benchmarking

EV/

Revenue

EV /

EBITDA

Assumes an

Enterprise Value

of $1.3B

evolv

technology

3.9x

24E

T3

13.8x

24E

T3

2.2x

25E

T4

5.6x

25E

T4

evolv

technology

I

I

I

I

I

I

1

I

I

I

1

I

I

I

i

I

1

I

1

I

I

1

I

I

T

I

1

1

I

1

I

1

I

I

I

I

T

I

I

I

1

Security

Technology

& Analytics

8.8x

21E

30.6x

21E

Security

Technology

& Analytics

(Median)

Disruptive SPACS

11.0x

7.2x

24E 25E

T4

T5

55.4x

25.6x

24E 25E

T4

T5

A AppHarvest

4.6x

24E

T3

15.2x

24E

T3

2.4x

25E

T4

5.2x

25E

T4

ASTRA

6.8x

24E

T4

78.2x

24E

T4

4.7x

25E

T5

37.8x

25E

T5

-chargepoin+

7.3x

24E

T4

31.9x

24E

T4

4.5x

25E

T5

15.9x

25E

T5

DI

Desktop Metal

2.2x

24E 25E

T4

T5

6.4x

1.3x

24E

T4

2.2x

25E

T5

MOMENTUS

21.5x

24E

T4

71.4x

24E

T4

10.7:

Source: Capital IQ and Company filings as of March 1, 2021. AppHarvest, Astra, Chargepoint, Desktop Metal, Momentus, Luminar, and Velodyne Revenue and EBITDA per management estimates.

Astra EV based on Holicity Inc. (NASDAQ:HOL), and Momentus EV based on Stable Road Acquisition Corp. (NASDAQ:SRAC).

Note: "NA" denotes metrics that are not available.

25E

T5

25E

T5

LUMINAR

24.7x

3.9x

24E 25E

T4

T5

17.8x

ΝΑ

24E

T4

ΝΑ

25E

T5

Velodyne

LIDAR.

Traditional

Detection

Equipment

1.7x

21E

12.7x

21E

Traditional

Detection

Equipment

(Median)

35View entire presentation