HHR Mergers and Acquisitions Presentation Deck

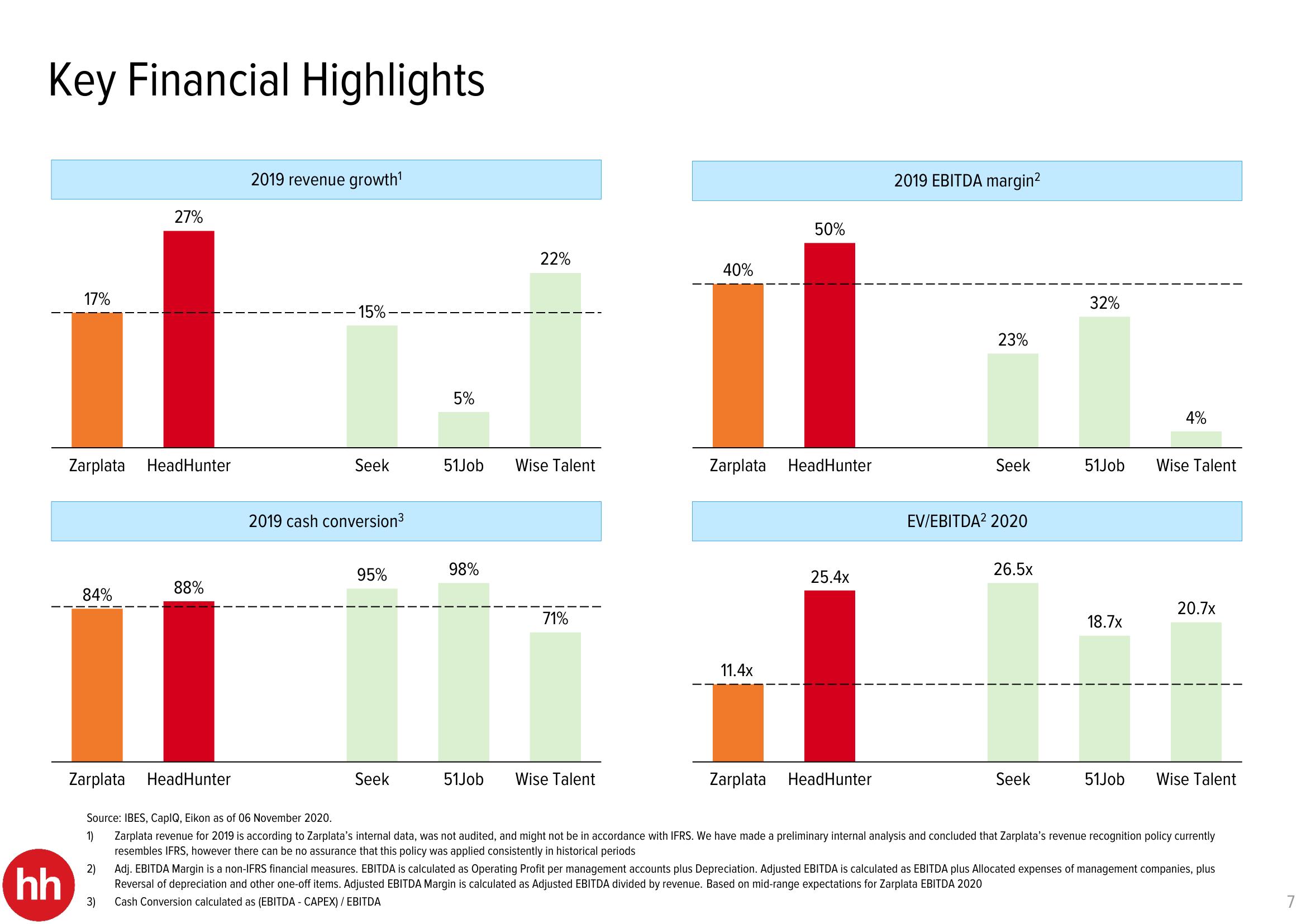

Key Financial Highlights

hh

17%

Zarplata

84%

2)

27%

3)

HeadHunter

88%

2019 revenue growth¹

-15%-

Seek

2019 cash conversion³

95%

5%

Seek

22%

51Job Wise Talent

98%

71%

40%

51Job Wise Talent

Zarplata HeadHunter

11.4x

50%

Zarplata

25.4x

2019 EBITDA margin²

HeadHunter

23%

Seek

EV/EBITDA² 2020

26.5x

Zarplata HeadHunter

Source: IBES, CapIQ, Eikon as of 06 November 2020.

Zarplata revenue for 2019 is according to Zarplata's internal data, was not audited, and might not be in accordance with IFRS. We have made a preliminary internal analysis and concluded that Zarplata's revenue recognition policy currently

resembles IFRS, however there can be no assurance that this policy was applied consistently in historical periods

1)

32%

Seek

51Job Wise Talent

18.7x

4%

51Job

20.7x

Wise Talent

Adj. EBITDA Margin is a non-IFRS financial measures. EBITDA is calculated as Operating Profit per management accounts plus Depreciation. Adjusted EBITDA is calculated as EBITDA plus Allocated expenses of management companies, plus

Reversal of depreciation and other one-off items. Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by revenue. Based on mid-range expectations for Zarplata EBITDA 2020

Cash Conversion calculated as (EBITDA - CAPEX) / EBITDA

7View entire presentation