Dave Investor Day Presentation Deck

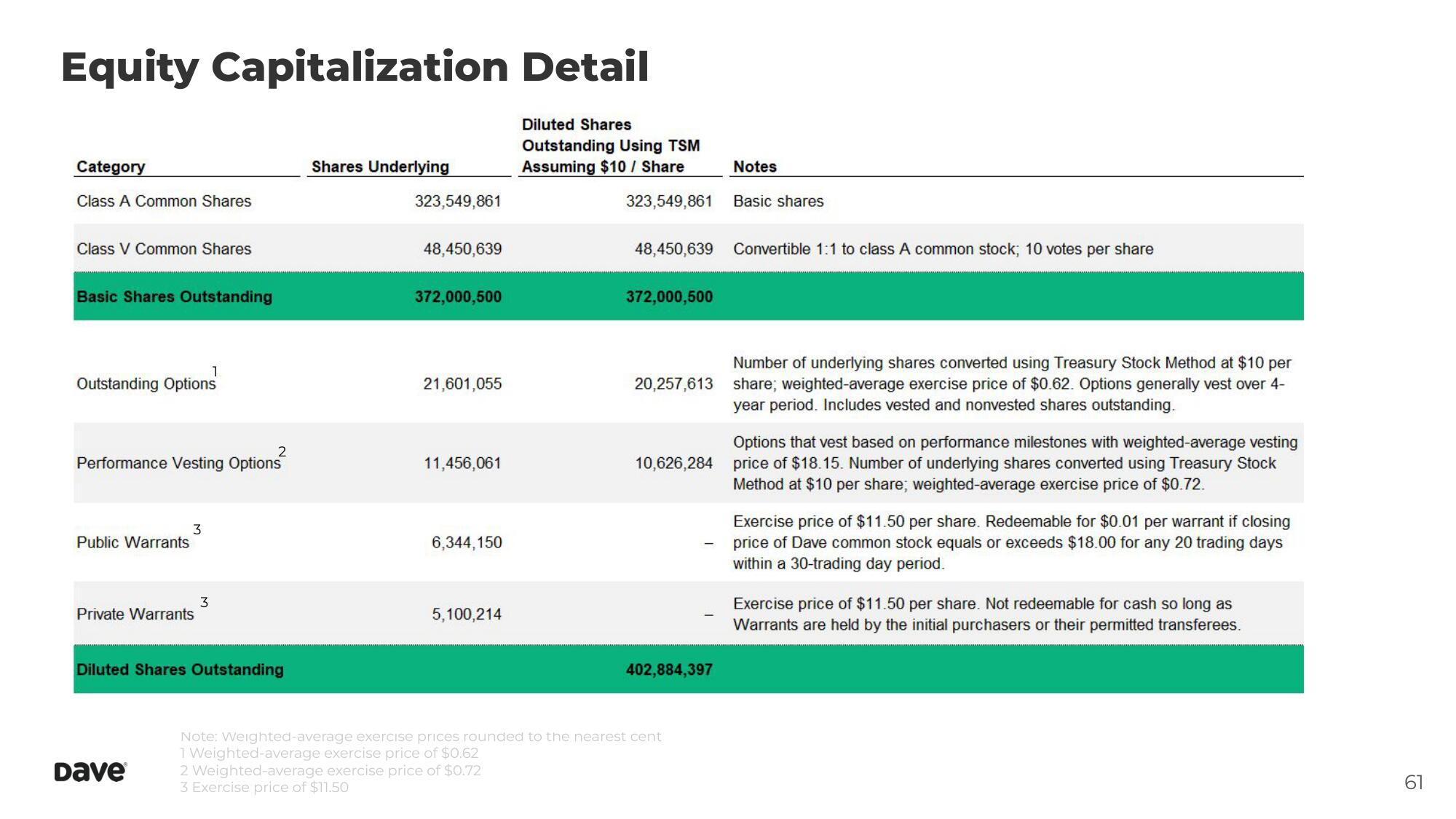

Equity Capitalization Detail

Diluted Shares

Outstanding Using TSM

Assuming $10 / Share

323,549,861

Category

Class A Common Shares

Class V Common Shares

Basic Shares Outstanding

Outstanding Options

2

Performance Vesting Options

Public Warrants

3

Private Warrants

Dave®

3

Diluted Shares Outstanding

Shares Underlying

323,549,861

48,450,639

372,000,500

21,601,055

11,456,061

6,344,150

5,100,214

372,000,500

48,450,639 Convertible 1:1 to class A common stock; 10 votes per share

Notes

Basic shares

Number of underlying shares converted using Treasury Stock Method at $10 per

20,257,613 share; weighted-average exercise price of $0.62. Options generally vest over 4-

year period. Includes vested and nonvested shares outstanding.

402,884,397

Options that vest based on performance milestones with weighted-average vesting

10,626,284 price of $18.15. Number of underlying shares converted using Treasury Stock

Method at $10 per share; weighted-average exercise price of $0.72.

Note: Weighted-average exercise prices rounded to the nearest cent

1 Weighted-average exercise price of $0.62

2 Weighted-average exercise price of $0.72

3 Exercise price of $11.50

Exercise price of $11.50 per share. Redeemable for $0.01 per warrant if closing

price of Dave common stock equals or exceeds $18.00 for any 20 trading days

within a 30-trading day period.

Exercise price of $11.50 per share. Not redeemable for cash so long as

Warrants are held by the initial purchasers or their permitted transferees.

61View entire presentation