Vertical Aerospace SPAC Presentation Deck

OVERVIEW OF TRANSACTION

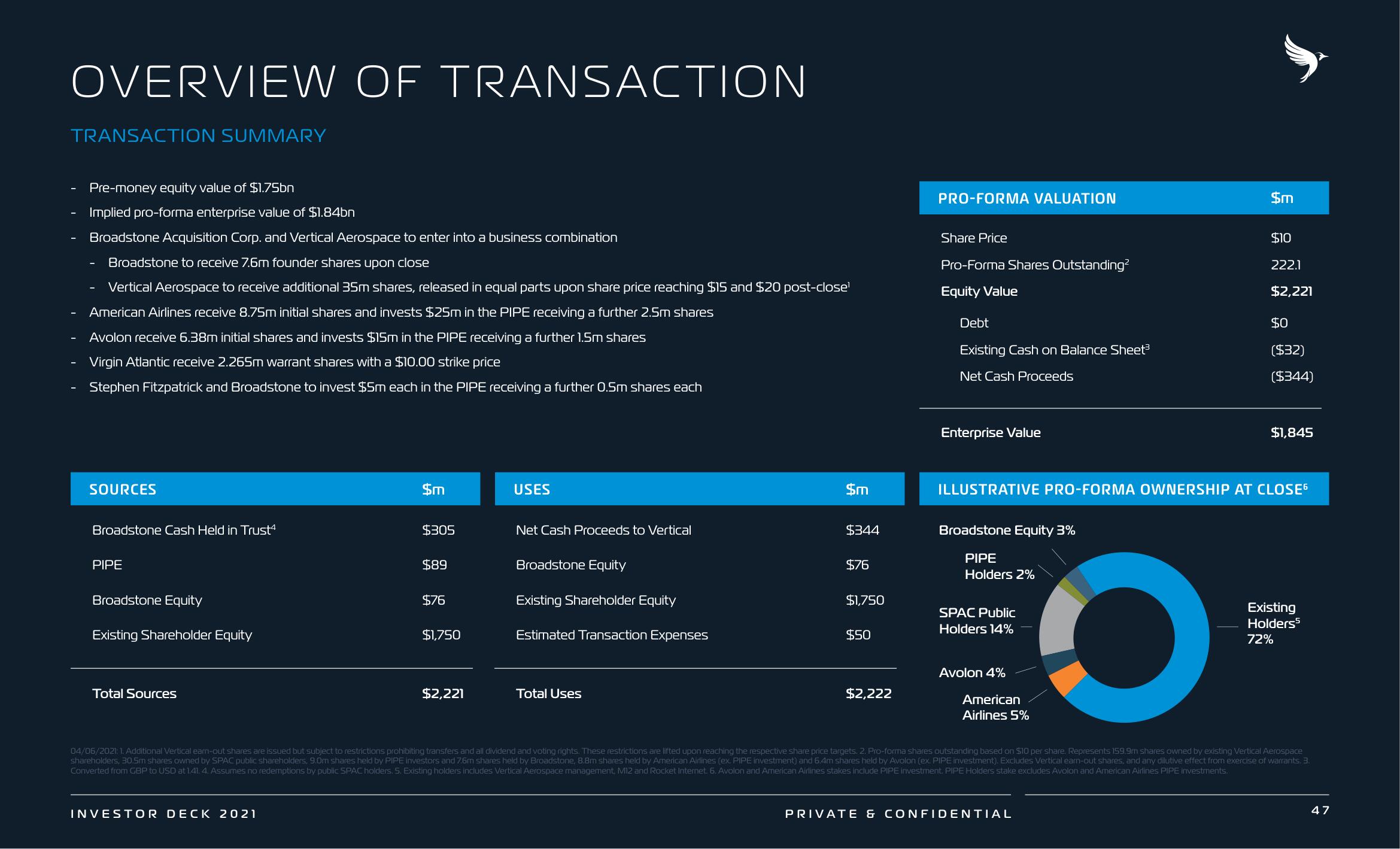

TRANSACTION SUMMARY

-

Pre-money equity value of $1.75bn

Implied pro-forma enterprise value of $1.84bn

Broadstone Acquisition Corp. and Vertical Aerospace to enter into a business combination

Broadstone to receive 7.6m founder shares upon close

Vertical Aerospace to receive additional 35m shares, released in equal parts upon share price reaching $15 and $20 post-close¹

American Airlines receive 8.75m initial shares and invests $25m in the PIPE receiving a further 2.5m shares

Avolon receive 6.38m initial shares and invests $15m in the PIPE receiving a further 1.5m shares

Virgin Atlantic receive 2.265m warrant shares with a $10.00 strike price

Stephen Fitzpatrick and Broadstone to invest $5m each in the PIPE receiving a further 0.5m shares each

-

SOURCES

Broadstone Cash Held in Trust4

PIPE

Broadstone Equity

Existing Shareholder Equity

Total Sources

$m

INVESTOR DECK 2021

$305

$89

$76

$1,750

USES

$2,221

Net Cash Proceeds to Vertical

Broadstone Equity

Existing Shareholder Equity

Estimated Transaction Expenses

$m

Total Uses

$344

O

04/06/2021: 1. Additional Vertical earn-out shares are issued but subject to restrictions prohibiting transfers and all dividend and voting rights. These restrictions are lifted upon reaching the respective share price targets. 2. Pro-forma shares outstanding based on $10 per share. Represents 159.9m shares owned by existing Vertical Aerospace

shareholders, 30.5m shares owned by SPAC public shareholders, 9.0m shares held by PIPE investors and 7.6m shares held by Broadstone, 8.8m shares held by American Airlines (ex. PIPE investment) and 6.4m shares held by Avalon (ex. PIPE Investment). Excludes Vertical earn-out shares, and any dilutive effect from exercise of warrants. 3.

Converted from GBP to USD at 1.41. 4. Assumes no redemptions by public SPAC holders. 5. Existing holders includes Vertical Aerospace management, M12 and Rocket Internet. 6. Avolon and American Airlines stakes include PIPE investment. PIPE Holders stake excludes Avolon and American Airlines PIPE investments.

$76

$1,750

$50

PRO-FORMA VALUATION

$2,222

Share Price

Pro-Forma Shares Outstanding²

Equity Value

Debt

Existing Cash on Balance Sheet³

Net Cash Proceeds

Enterprise Value

Broadstone Equity 3%

PIPE

Holders 2%

SPAC Public

Holders 14%

ILLUSTRATIVE PRO-FORMA OWNERSHIP AT CLOSE

Avolon 4%

$m

American

Airlines 5%

$10

222.1

$2,221

PRIVATE & CONFIDENTIAL

$0

($32)

($344)

$1,845

Existing

Holders5

72%

47View entire presentation