Kinnevik Results Presentation Deck

OUR VALUATION FRAMEWORK RENDERS QUARTER-ON-QUARTER

CHANGES IN SEVERAL OF OUR INVESTMENTS' ASSESSED FAIR VALUES

I

■

■

Valuations

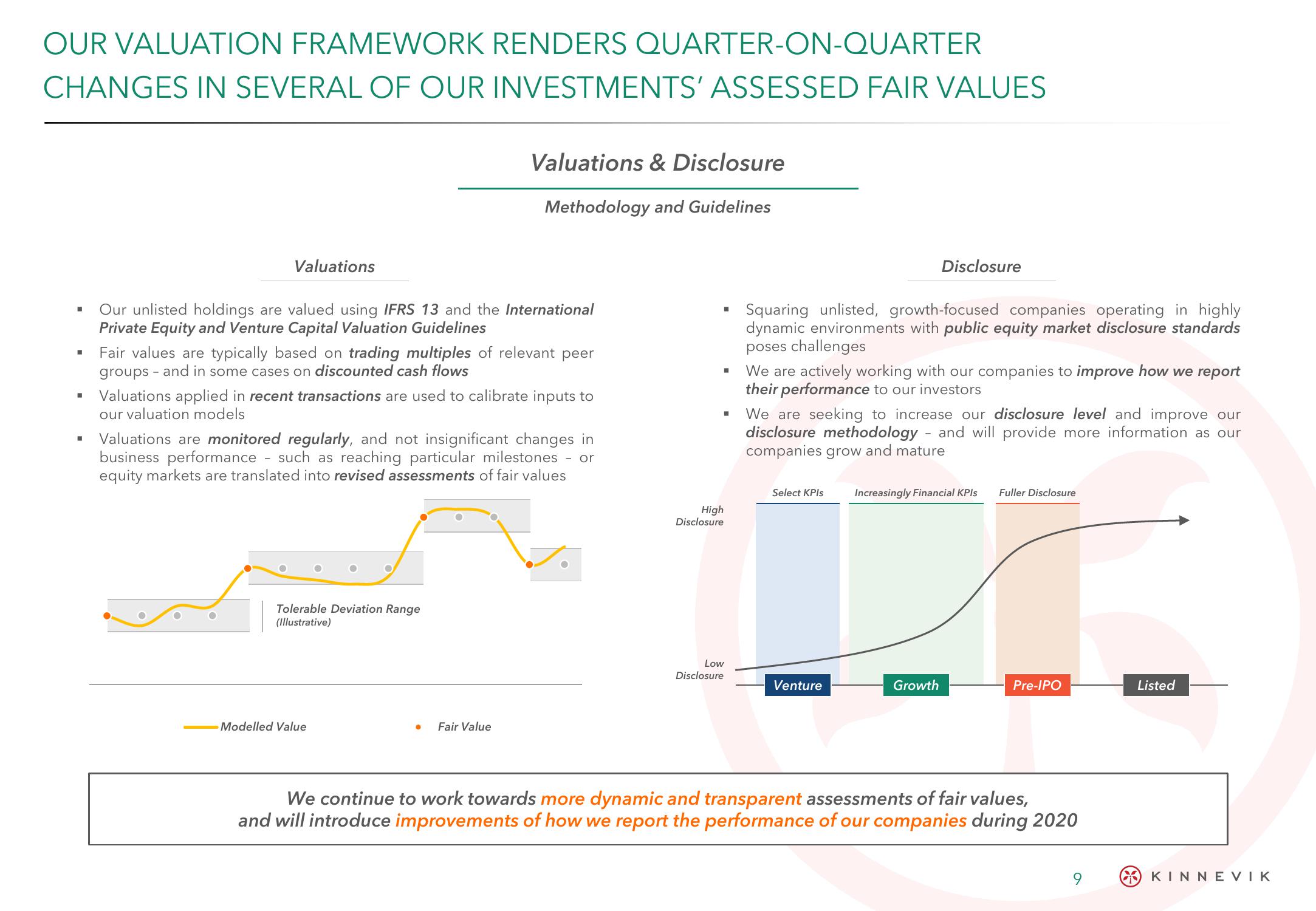

Our unlisted holdings are valued using IFRS 13 and the International

Private Equity and Venture Capital Valuation Guidelines

Fair values are typically based on trading multiples of relevant peer

groups and in some cases on discounted cash flows

Valuations & Disclosure

Methodology and Guidelines

Valuations applied in recent transactions are used to calibrate inputs to

our valuation models

Valuations are monitored regularly, and not insignificant changes in

business performance - such as reaching particular milestones - or

equity markets are translated into revised assessments of fair values

Tolerable Deviation Range

(Illustrative)

Modelled Value

Fair Value

I

■

High

Disclosure

Low

Disclosure

Squaring unlisted, growth-focused companies operating in highly

dynamic environments with public equity market disclosure standards

poses challenges

We are actively working with our companies to improve how we report

their performance to our investors

Disclosure

We are seeking to increase our disclosure level and improve our

disclosure methodology and will provide more information as our

companies grow and mature

Select KPIs

Venture

Increasingly Financial KPIs

Growth

Fuller Disclosure

Pre-IPO

We continue to work towards more dynamic and transparent assessments of fair values,

and will introduce improvements of how we report the performance of our companies during 2020

9

Listed

KINNEVIKView entire presentation