DraftKings Mergers and Acquisitions Presentation Deck

DRAFTKINGS P&L AND ADJUSTED EBITDA RECONCILIATION

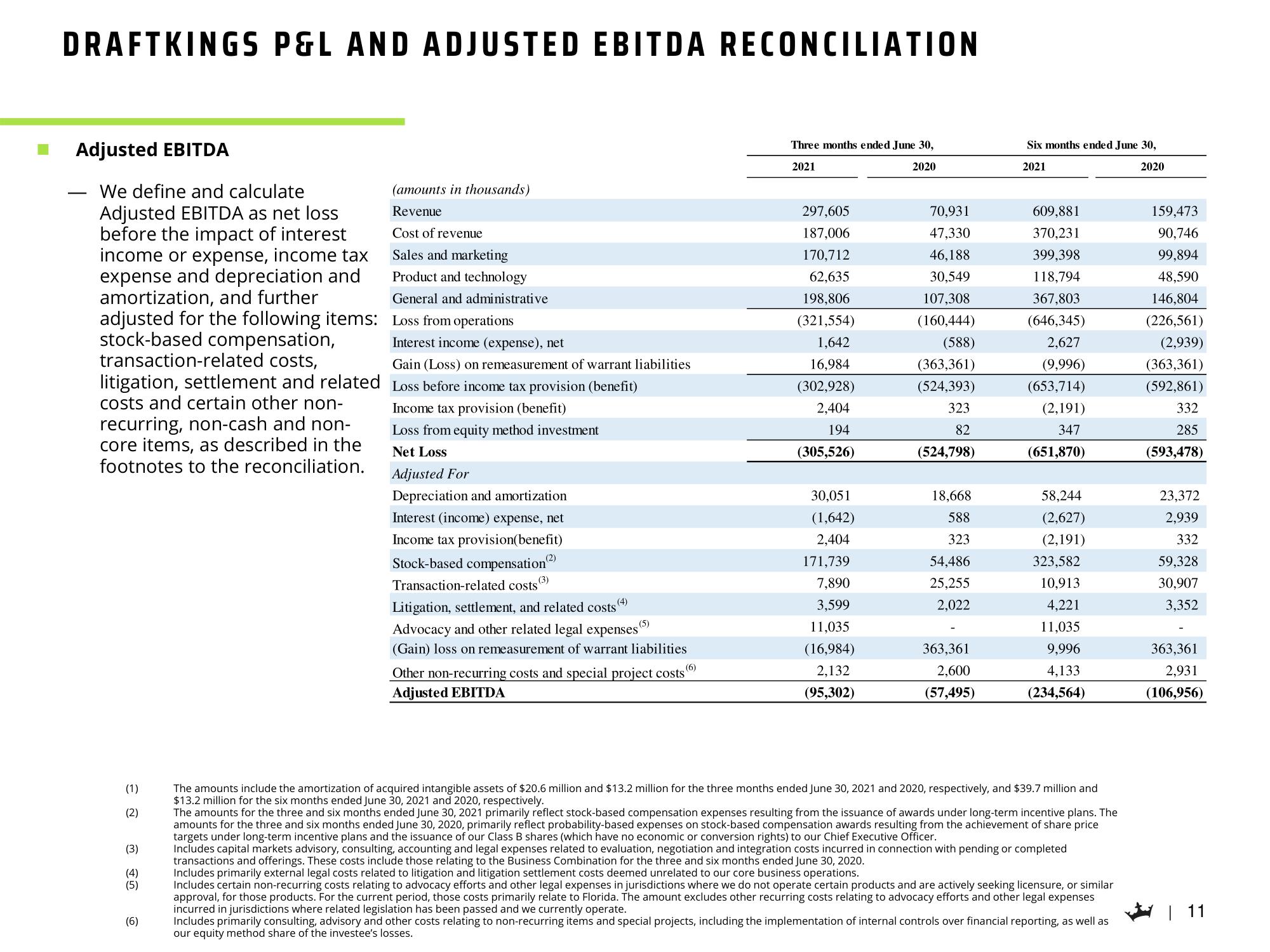

Adjusted EBITDA

We define and calculate

Adjusted EBITDA as net loss

before the impact of interest

income or expense, income tax

expense and depreciation and

amortization, and further

Cost of revenue

Sales and marketing

Product and technology

General and administrative

adjusted for the following items: Loss from operations

stock-based compensation,

transaction-related costs,

litigation, settlement and related

costs and certain other non-

recurring, non-cash and non-

core items, as described in the

footnotes to the reconciliation.

(1)

(2)

(3)

(4)

(5)

(6)

(amounts in thousands)

Revenue

Interest income (expense), net

Gain (Loss) on remeasurement of warrant liabilities

Loss before income tax provision (benefit)

Income tax provision (benefit)

Loss from equity method investment

Net Loss

Adjusted For

Depreciation and amortization

Interest (income) expense, net

Income tax provision(benefit)

Stock-based compensation)

Transaction-related costs"

(3)

(4)

Litigation, settlement, and related costs

Advocacy and other related legal expenses (5)

(Gain) loss on remeasurement of warrant liabilities

(6)

Other non-recurring costs and special project costs

Adjusted EBITDA

Three months ended June 30,

2021

2020

297,605

187,006

170,712

62,635

198,806

(321,554)

1,642

16,984

(302,928)

2,404

194

(305,526)

30,051

(1,642)

2,404

171,739

7,890

3,599

11,035

(16,984)

2,132

(95,302)

70,931

47,330

46,188

30,549

107,308

(160,444)

(588)

(363,361)

(524,393)

323

82

(524,798)

18,668

588

323

54,486

25,255

2,022

363,361

2,600

(57,495)

Six months ended June 30,

2021

2020

609,881

370,231

399,398

118,794

367,803

(646,345)

2,627

(9,996)

(653,714)

(2,191)

347

(651,870)

58,244

(2,627)

(2,191)

323,582

10,913

4,221

11,035

9,996

4,133

(234,564)

The amounts include the amortization of acquired intangible assets of $20.6 million and $13.2 million for the three months ended June 30, 2021 and 2020, respectively, and $39.7 million and

$13.2 million for the six months ended June 30, 2021 and 2020, respectively.

The amounts for the three and six months ended June 30, 2021 primarily reflect stock-based compensation expenses resulting from the issuance of awards under long-term incentive plans. The

amounts for the three and six months ended June 30, 2020, primarily reflect probability-based expenses on stock-based compensation awards resulting from the achievement of share price

targets under long-term incentive plans and the issuance of our Class B shares (which have no economic or conversion rights) to our Chief Executive Officer.

Includes capital markets advisory, consulting, accounting and legal expenses related to evaluation, negotiation and integration costs incurred in connection with pending or completed

transactions and offerings. These costs include those relating to the Business Combination for the three and six months ended June 30, 2020.

Includes primarily external legal costs related to litigation and litigation settlement costs deemed unrelated to our core business operations.

Includes certain non-recurring costs relating to advocacy efforts and other legal expenses in jurisdictions where we do not operate certain products and are actively seeking licensure, or similar

approval, for those products. For the current period, those costs primarily relate to Florida. The amount excludes other recurring costs relating to advocacy efforts and other legal expenses

incurred in jurisdictions where related legislation has been passed and we currently operate.

Includes primarily consulting, advisory and other costs relating to non-recurring items and special projects, including the implementation of internal controls over financial reporting, as well as

our equity method share of the investee's losses.

159,473

90,746

99,894

48,590

146,804

(226,561)

(2,939)

(363,361)

(592,861)

332

285

(593,478)

23,372

2,939

332

59,328

30,907

3,352

363,361

2,931

(106,956)View entire presentation