J.P.Morgan Results Presentation Deck

Consumer & Community Banking¹

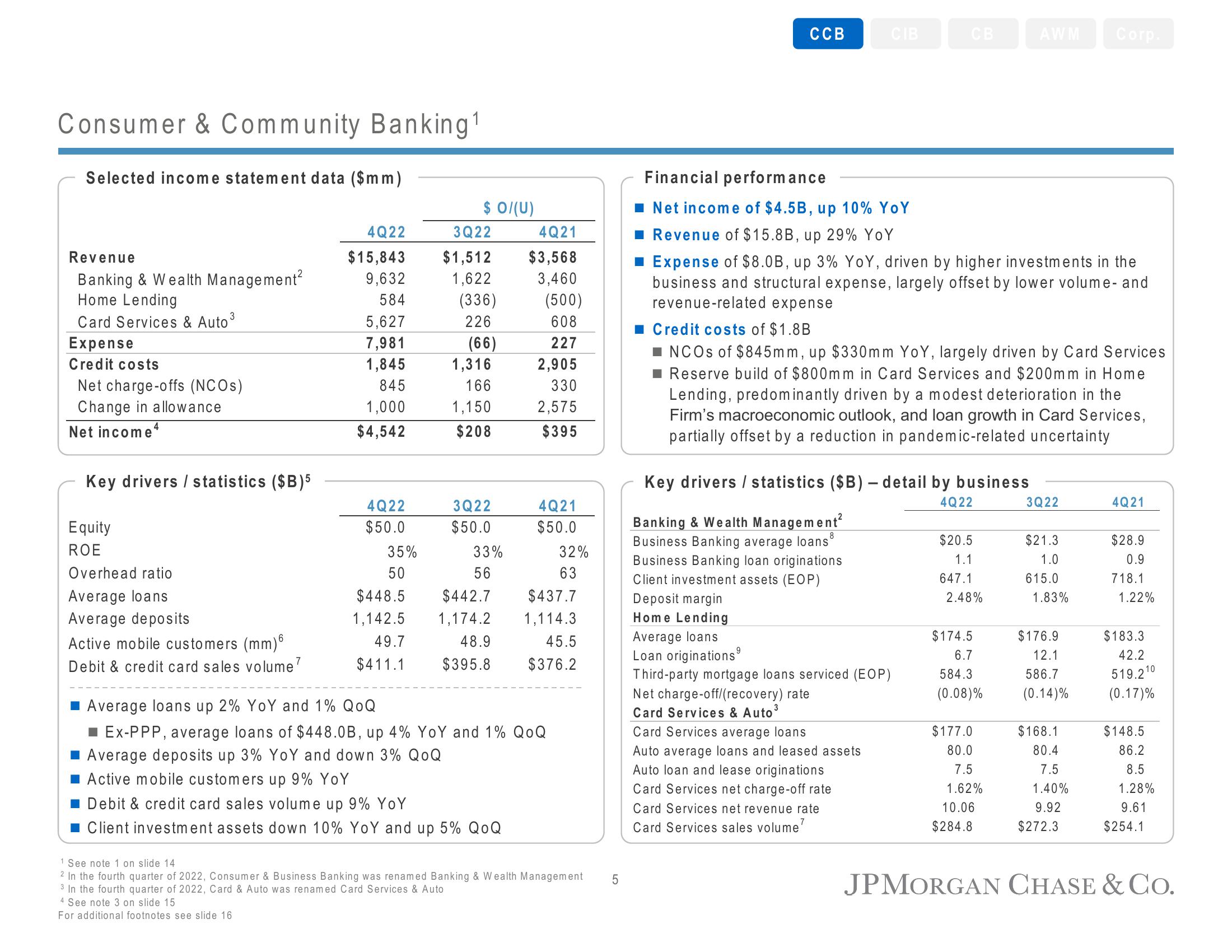

Selected income statement data ($mm)

Revenue

Banking & Wealth Management²

Home Lending

Card Services & Auto³

Expense

Credit costs

Net charge-offs (NCOs)

Change in allowance

Net income 4

Key drivers / statistics ($B)5

Equity

ROE

Overhead ratio

Average loans

Average deposits

Active mobile customers (mm)6

Debit & credit card sales volume

4Q22

$15,843

9,632

584

5,627

7,981

1,845

845

1,000

$4,542

4Q22

$50.0

35%

50

$448.5

1,142.5

49.7

$411.1

$ 0/(U)

3Q22

$1,512

1,622

(336)

226

(66)

1,316

166

1,150

$208

3Q22

$50.0

33%

56

4Q21

$3,568

3,460

(500)

608

227

2,905

330

2,575

$395

4Q21

$50.0

32%

63

$442.7 $437.7

1,174.2 1,114.3

45.5

48.9

$395.8 $376.2

Average loans up 2% YoY and 1% QOQ

■ Ex-PPP, average loans of $448.0B, up 4% YoY and 1% QOQ

Average deposits up 3% YoY and down 3% QOQ

Active mobile customers up 9% YoY

Debit & credit card sales volume up 9% YoY

■ Client investment assets down 10% YoY and up 5% QOQ

1 See note 1 on slide 14

2 In the fourth quarter of 2022, Consumer & Business Banking was renamed Banking & Wealth Management

3 In the fourth quarter of 2022, Card & Auto was renamed Card Services & Auto

4 See note 3 on slide 15

For additional footnotes see slide 16.

5

CCB

CIB

CB

Financial performance

Net income of $4.5B, up 10% YoY

■ Revenue of $15.8B, up 29% YoY

■ Expense of $8.0B, up 3% YoY, driven by higher investments in the

business and structural expense, largely offset by lower volume - and

revenue-related expense

Banking & Wealth Management²

Business Banking average loans

Business Banking loan originations

Client investment assets (EOP)

Deposit margin

Home Lending

Average loans

Loan originations⁹

■ Credit costs of $1.8B

■NCOs of $845mm, up $330mm YoY, largely driven by Card Services

■ Reserve build of $800mm in Card Services and $200mm in Home

Lending, predominantly driven by a modest deterioration in the

Firm's macroeconomic outlook, and loan growth in Card Services,

partially offset by a reduction in pandemic-related uncertainty

Key drivers / statistics ($B) - detail by business

4Q22

Third-party mortgage loans serviced (EOP)

Net charge-off/(recovery) rate

Card Services & Auto³

Card Services average loans

Auto average loans and leased assets

Auto loan and lease originations

Card Services net charge-off rate

Card Services net revenue rate

Card Services sales volume¹

$20.5

1.1

647.1

2.48%

$174.5

6.7

584.3

(0.08)%

AWM Corp.

$177.0

80.0

7.5

1.62%

10.06

$284.8

3Q22

$21.3

1.0

615.0

1.83%

$176.9

12.1

586.7

(0.14)%

$168.1

80.4

7.5

1.40%

9.92

$272.3

4Q21

$28.9

0.9

718.1

1.22%

$183.3

42.2

519.210

(0.17)%

$148.5

86.2

8.5

1.28%

9.61

$254.1

JPMORGAN CHASE & Co.View entire presentation