Aeva SPAC Presentation Deck

Pro Forma Equity Ownership

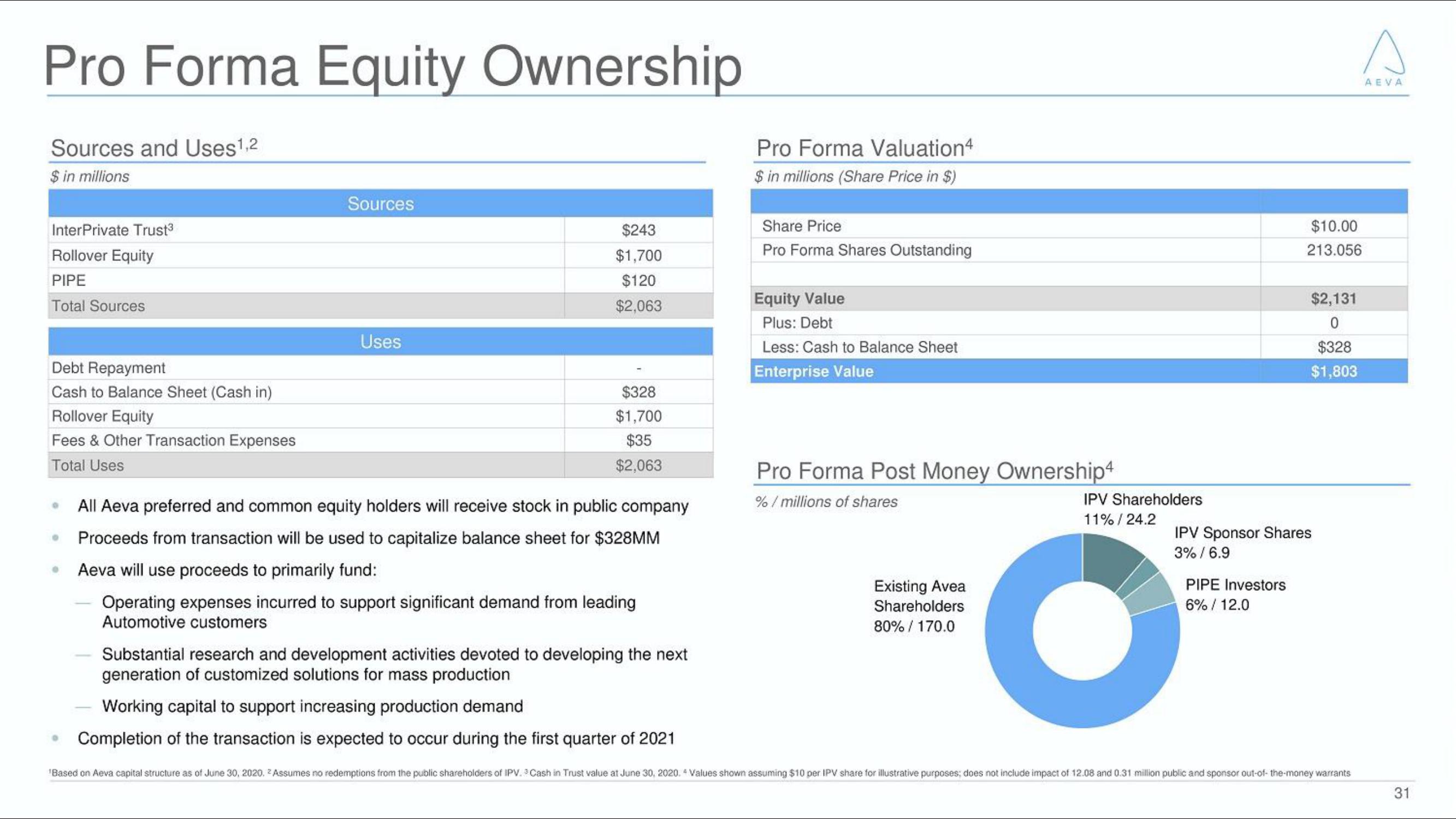

Sources and Uses¹,2

$ in millions

InterPrivate Trust³

Rollover Equity

PIPE

Total Sources

Debt Repayment

Cash to Balance Sheet (Cash in)

Rollover Equity

Fees & Other Transaction Expenses

Total Uses

O

●

Sources

Uses

$243

$1,700

$120

$2,063

$328

$1,700

$35

$2,063

All Aeva preferred and common equity holders will receive stock in public company

Proceeds from transaction will be used to capitalize balance sheet for $328MM

Aeva will use proceeds to primarily fund:

Operating expenses incurred to support significant demand from leading

Automotive customers

Substantial research and development activities devoted to developing the next

generation of customized solutions for mass production

Working capital to support increasing production demand

Completion of the transaction is expected to occur during the first quarter of 2021

Pro Forma Valuation4

$ in millions (Share Price in $)

Share Price

Pro Forma Shares Outstanding

Equity Value

Plus: Debt

Less: Cash to Balance Sheet

Enterprise Value

Pro Forma Post Money Ownership4

%/millions of shares

Existing Avea

Shareholders

80% / 170.0

IPV Shareholders

11%/ 24.2

$10.00

213.056

PIPE Investors

6% / 12.0

$2,131

0

$328

$1,803

IPV Sponsor Shares

3% / 6.9

'Based on Aeva capital structure as of June 30, 2020. Assumes no redemptions from the public shareholders of IPV. 3 Cash in Trust value at June 30, 2020. 4 Values shown assuming $10 per IPV share for illustrative purposes; does not include impact of 12.08 and 0.31 million public and sponsor out-of-the-money warrants

AEVA

31View entire presentation