Netstreit IPO Presentation Deck

2 Portfolio Overview

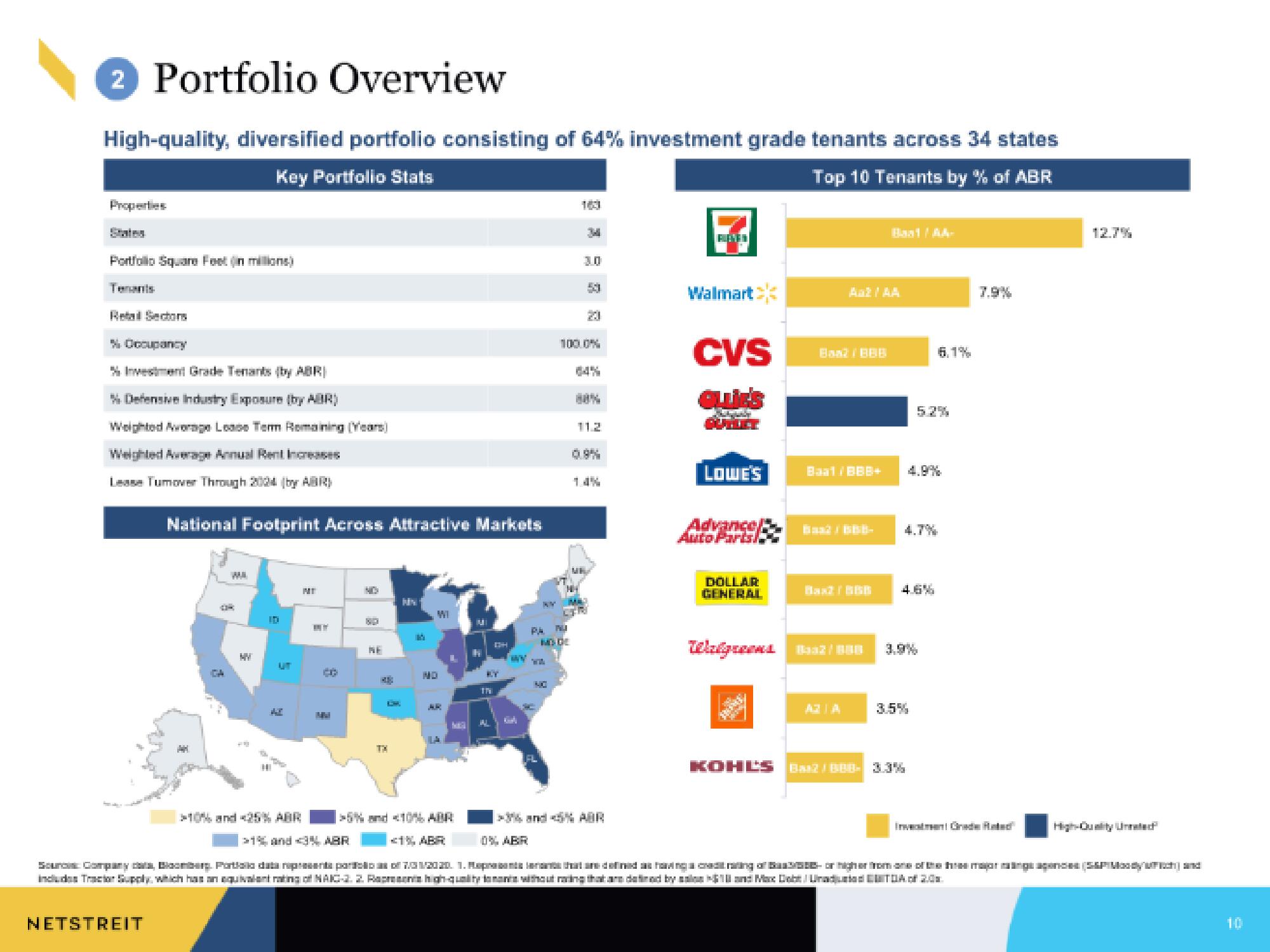

High-quality, diversified portfolio consisting of 64% investment grade tenants across 34 states

Key Portfolio Stats

Top 10 Tenants by % of ABR

Properties

Portfolio Square Feet(in millions)

Tenants

Retail Sectors

% Occupancy

% Investment Grade Tenants (by ABR)

% Defensive Industry Exposure (by ABR)

Weighted Average Lease Tem Remaining (Years)

Weighted Average Annual Rent Increases

Lease Tumover Through 2004 (by ABR)

National Footprint Across Attractive Markets

NETSTREIT

DA

MV

ID

UT

AX

10

MI

Co

NE

48

TX

11

WI

NO

UT

BY

Th

13H

AL

MO

30

PA PU

MODE

100.0%

20

ME

CTR

11.2

FEMEN

Walmart

CVS

LOWE'S

Auto Parts

DOLLAR

GENERAL

Bax?! BBB

Baal/BBB+

Walgreens Baaz / 800

AZIA

4.9%

4.7%

4.6%

KOHLS BZ/BBB- 3.3%

3.5%

7.9%

> and <5% ABR

0% ABR

>5% and <10% ARR

>15 and 3% ABR

<1% ABR

Souros Company, Bloomberg. Portia data representa parti7.01/2020. 1. Poplence that are defined as having a xed rating of Bag303- or higher from one of the three majanganse (S&P Moddychand

Includes Tractor Supply, which has an equivalent rating of NAIG-2. 2. Repreenhigh-quality and without racing that are defined by

and Maxx Debt Urduiad CTO of 2.0

12.7%

Investment Grade Rated

High Quality Unrated

10View entire presentation