Granite Ridge Investor Presentation Deck

●

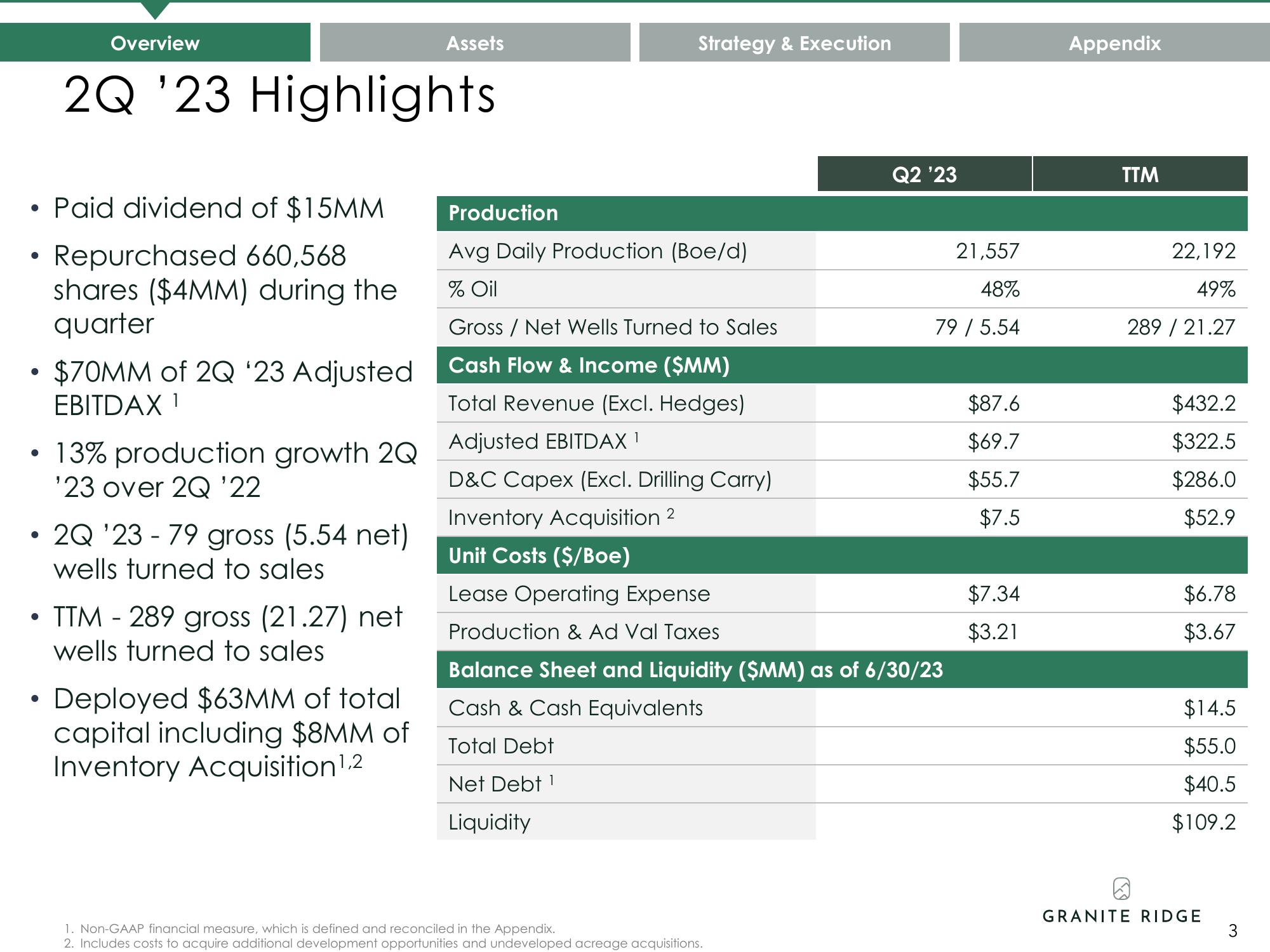

• Paid dividend of $15MM

Repurchased 660,568

shares ($4MM) during the

quarter

●

●

●

Overview

●

2Q '23 Highlights

$70MM of 2Q '23 Adjusted

EBITDAX 1

2Q '23 - 79 gross (5.54 net)

wells turned to sales

Assets

TTM - 289 gross (21.27) net

wells turned to sales

13% production growth 2Q Adjusted EBITDAX

'23 over 2Q '22

Deployed $63MM of total

capital including $8MM of

Inventory Acquisition 1¹.2

Strategy & Execution

Production

Avg Daily Production (Boe/d)

% Oil

Gross / Net Wells Turned to Sales

Cash Flow & Income ($MM)

Total Revenue (Excl. Hedges)

¹

Q2 '23

1. Non-GAAP financial measure, which is defined and reconciled in the Appendix.

2. Includes costs to acquire additional development opportunities and undeveloped acreage acquisitions.

21,557

48%

79 / 5.54

D&C Capex (Excl. Drilling Carry)

2

Inventory Acquisition

Unit Costs ($/Boe)

Lease Operating Expense

Production & Ad Val Taxes

Balance Sheet and Liquidity ($MM) as of 6/30/23

Cash & Cash Equivalents

Total Debt

Net Debt ¹

Liquidity

$87.6

$69.7

$55.7

$7.5

$7.34

$3.21

Appendix

TTM

22,192

49%

289 / 21.27

$432.2

$322.5

$286.0

$52.9

$6.78

$3.67

$14.5

$55.0

$40.5

$109.2

GRANITE RIDGE

3View entire presentation