Ares US Real Estate Opportunity Fund III

Retailer Bankruptcies Per Annum

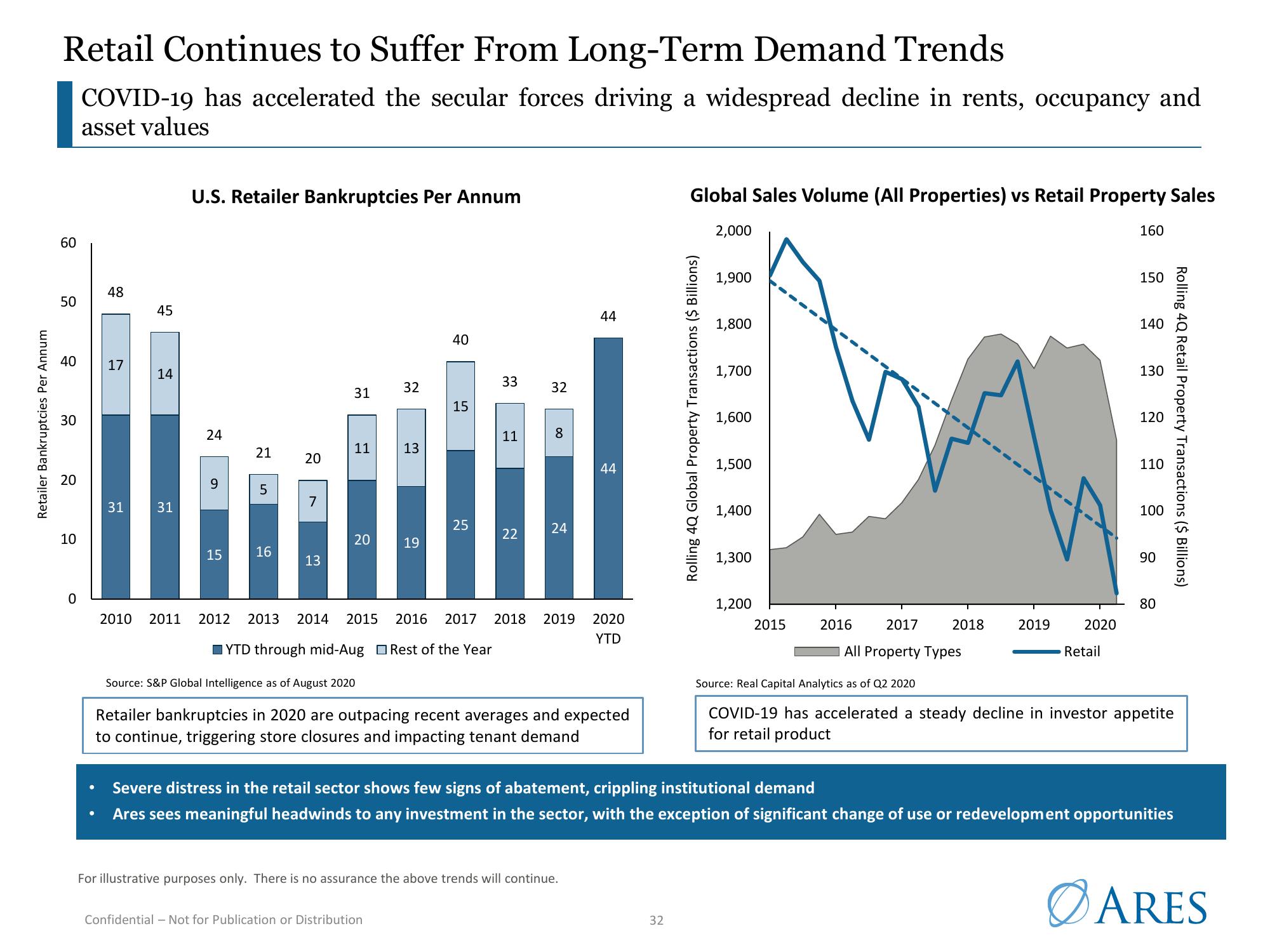

Retail Continues to Suffer From Long-Term Demand Trends

COVID-19 has accelerated the secular forces driving a widespread decline in rents, occupancy and

asset values

60

50

40

30

20

10

0

48

17

31

45

14

31

2010 2011

U.S. Retailer Bankruptcies Per Annum

24

9

15

21

5

16

20

7

13

31

11

20

32

13

w

19

Confidential - Not for Publication or Distribution

40

15

25

33

11

22

32

8

24

44

2012 2013 2014 2015 2016 2017 2018 2019 2020

YTD

YTD through mid-Aug Rest of the Year

44

Source: S&P Global Intelligence as of August 2020

Retailer bankruptcies in 2020 are outpacing recent averages and expected

to continue, triggering store closures and impacting tenant demand

For illustrative purposes only. There is no assurance the above trends will continue.

Global Sales Volume (All Properties) vs Retail Property Sales

32

Billions)

Rolling 4Q Global Property Transactions

2,000

1,900

1,800

1,700

1,600

1,500

1,400

1,300

1,200

2015

2017

All Property Types

2016

2018

2019

2020

Retail

160

150

140

130

120

110

100

90

80

Severe distress in the retail sector shows few signs of abatement, crippling institutional demand

Ares sees meaningful headwinds to any investment in the sector, with the exception of significant change of use or redevelopment opportunities

ARES

Rolling 4Q Retail Property Transactions ($ Billions)

Source: Real Capital Analytics as of Q2 2020

COVID-19 has accelerated a steady decline in investor appetite

for retail productView entire presentation