HHR Investor Presentation Deck

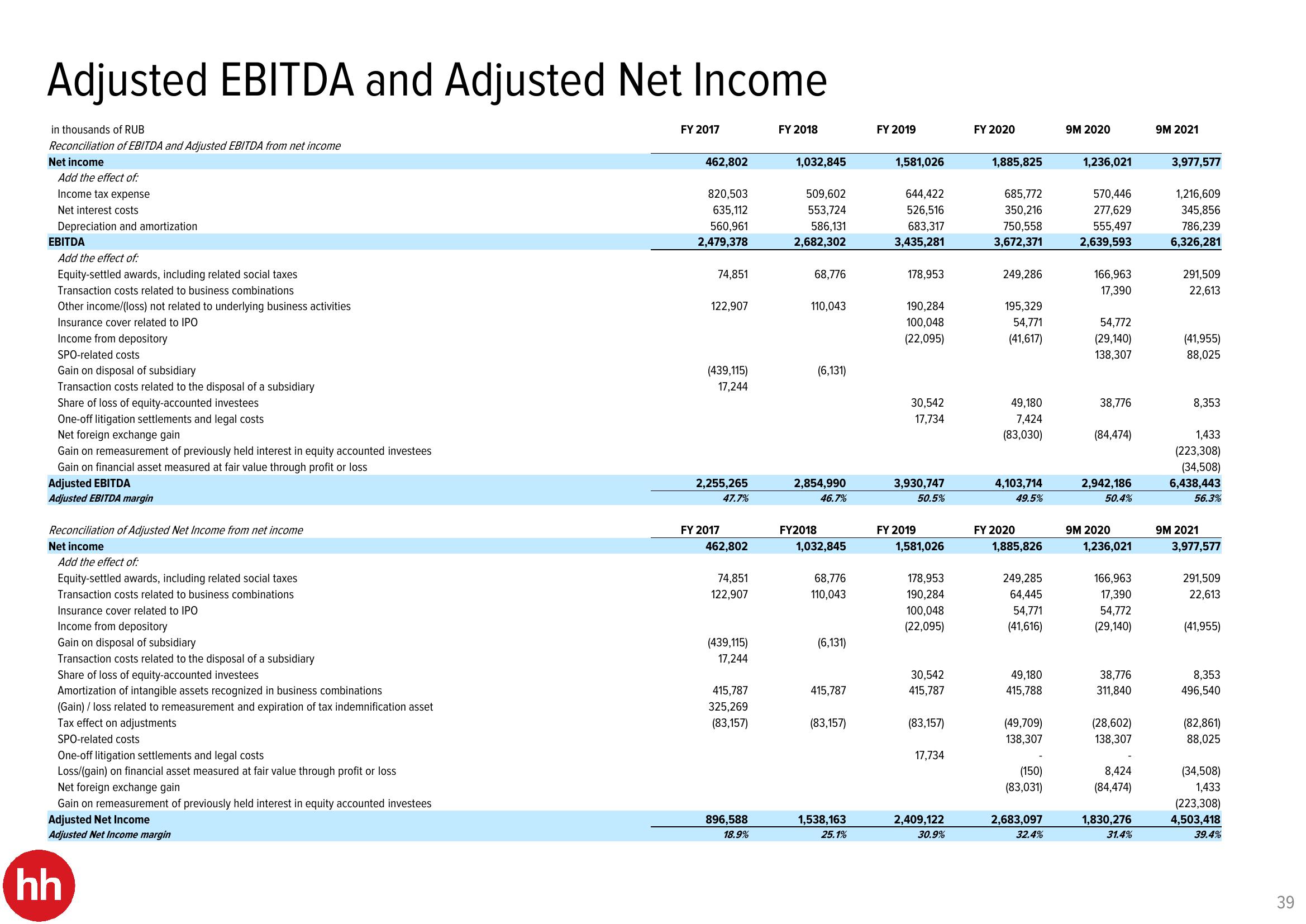

Adjusted EBITDA and Adjusted Net Income

in thousands of RUB

Reconciliation of EBITDA and Adjusted EBITDA from net income

Net income

Add the effect of:

Income tax expense

Net interest costs

Depreciation and amortization

EBITDA

Add the effect of:

Equity-settled awards, including related social taxes

Transaction costs related to business combinations

Other income/(loss) not related to underlying business activities

Insurance cover related to IPO

Income from depository

SPO-related costs

Gain on disposal of subsidiary

Transaction costs related to the disposal of a subsidiary

Share of loss of equity-accounted investees

One-off litigation settlements and legal costs

Net foreign exchange gain

Gain on remeasurement of previously held interest in equity accounted investees

Gain on financial asset measured at fair value through profit or loss

Adjusted EBITDA

Adjusted EBITDA margin

Reconciliation of Adjusted Net Income from net income

Net income

Add the effect of:

Equity-settled awards, including related social taxes

Transaction costs related to business combinations

Insurance cover related to IPO

Income from depository

Gain on disposal of subsidiary

Transaction costs related to the disposal of a subsidiary

Share of loss of equity-accounted investees

Amortization of intangible assets recognized in business combinations

(Gain) / loss related to remeasurement and expiration of tax indemnification asset

Tax effect on adjustments

SPO-related costs

One-off litigation settlements and legal costs

Loss/(gain) on financial asset measured at fair value through profit or loss

Net foreign exchange gain

Gain on remeasurement of previously held interest in equity accounted investees

Adjusted Net Income

Adjusted Net Income margin

hh

FY 2017

462,802

820,503

635,112

560,961

2,479,378

74,851

122,907

(439,115)

17,244

2,255,265

47.7%

FY 2017

462,802

74,851

122,907

(439,115)

17,244

415,787

325,269

(83,157)

896,588

18.9%

FY 2018

1,032,845

509,602

553,724

586,131

2,682,302

68,776

110,043

(6,131)

2,854,990

46.7%

FY2018

1,032,845

68,776

110,043

(6,131)

415,787

(83,157)

1,538,163

25.1%

FY 2019

1,581,026

644,422

526,516

683,317

3,435,281

178,953

190,284

100,048

(22,095)

30,542

17,734

3,930,747

50.5%

FY 2019

1,581,026

178,953

190,284

100,048

(22,095)

30,542

415,787

(83,157)

17,734

2,409,122

30.9%

FY 2020

1,885,825

685,772

350,216

750,558

3,672,371

249,286

195,329

54,771

(41,617)

49,180

7,424

(83,030)

4,103,714

49.5%

FY 2020

1,885,826

249,285

64,445

54,771

(41,616)

49,180

415,788

(49,709)

138,307

(150)

(83,031)

2,683,097

32.4%

9M 2020

1,236,021

570,446

277,629

555,497

2,639,593

166,963

17,390

54,772

(29,140)

138,307

38,776

(84,474)

2,942,186

50.4%

9M 2020

1,236,021

166,963

17,390

54,772

(29,140)

38,776

311,840

(28,602)

138,307

8,424

(84,474)

1,830,276

31.4%

9M 2021

3,977,577

1,216,609

345,856

786,239

6,326,281

291,509

22,613

(41,955)

88,025

8,353

1,433

(223,308)

(34,508)

6,438,443

56.3%

9M 2021

3,977,577

291,509

22,613

(41,955)

8,353

496,540

(82,861)

88,025

(34,508)

1,433

(223,308)

4,503,418

39.4%

39View entire presentation