Antero Midstream Partners Mergers and Acquisitions Presentation Deck

AR Peer Benchmarking Cont'd

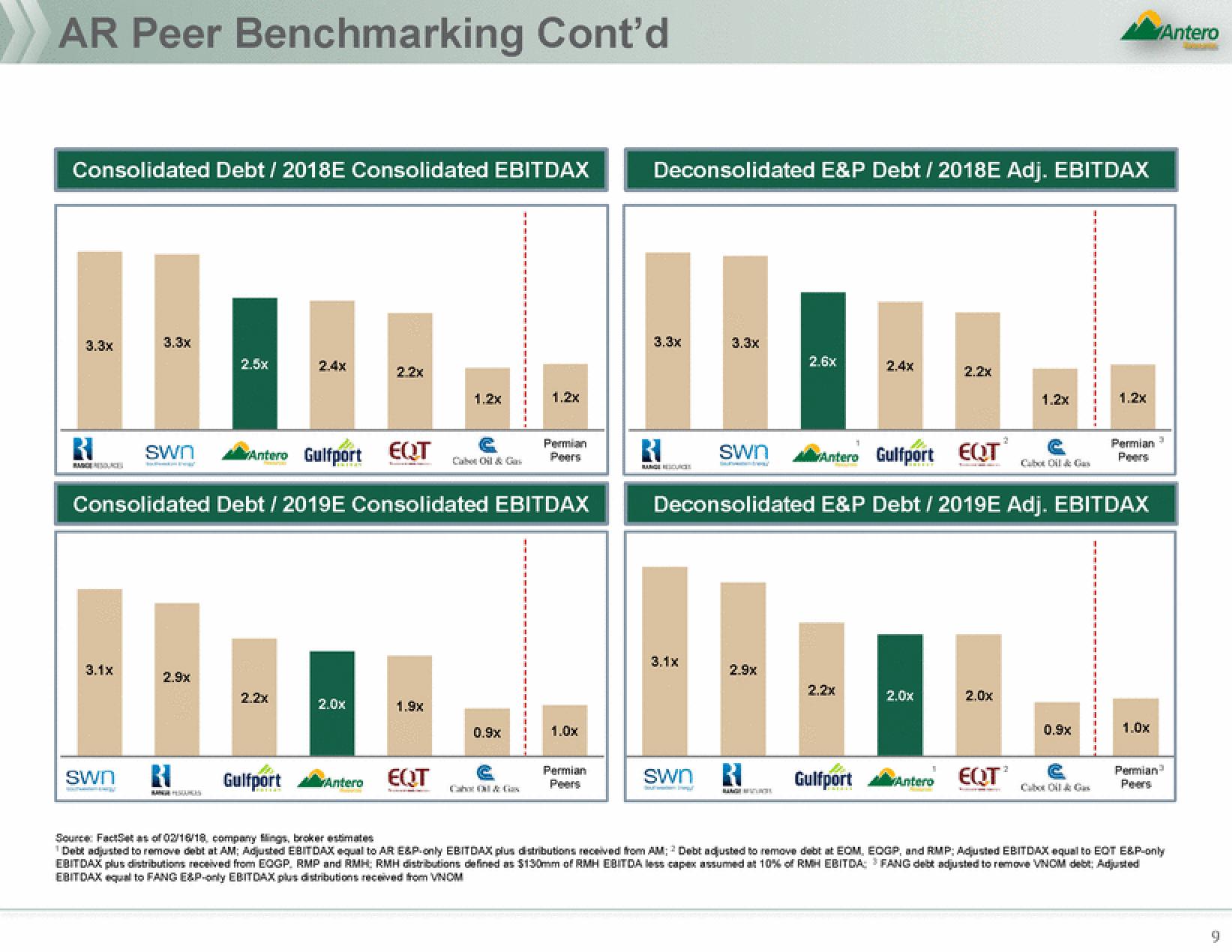

Consolidated Debt / 2018E Consolidated EBITDAX

3.3x

RI

BAC

3.3x

Swn

SWn

H

3.1x

2.9x

2.5x

2.2x

2.4x

Antero Gulfport EQT

Consolidated Debt / 2019E Consolidated EBITDAX

Gulfport

2.0x

2.2x

Antero

1.9x

1.2x

EQT

1.2x

0.9x

Permian

Peers

1.0x

Permian

Peers

Deconsolidated E&P Debt/2018E Adj. EBITDAX

3.3x

RANGE RESOURCES

3.3x

Swn

SWn

2.6x

11

3.1x

2.9x

2.2x

BLAGE ENTS

1

Gulfport

2.4x

Antero Gulfport EQT

Deconsolidated E&P Debt / 2019E Adj. EBITDAX

2.0x

2.2x

Antero

2.0x

1.2x

EQT

Cabo Oil & Gas

1.2x

0.9x

Permian 3

Peers

Antero

1.0x

Permian³

Peers

Source: FactSet as of 02/16/18, company flings, broker estimates

Debt adjusted to remove debt at AM; Adjusted EBITDAX equal to AR E&P-only EBITDAX plus distributions received from AM; Debt adjusted to remove debt at EOM, EDGP, and RMP: Adjusted EBITDAX equal to EQT E&P-only

EBITDAX plus distributions received from EQGP, RMP and RMH: RMH distributions defined as $130mm of RMH EBITDA less capex assumed at 10% of RMH EBITDAFANG debt adjusted to remove VNOM debt; Adjusted

EBITDAX equal to FANG E&P-only EBITDAX plus distributions received from VNOMView entire presentation