Lyft Results Presentation Deck

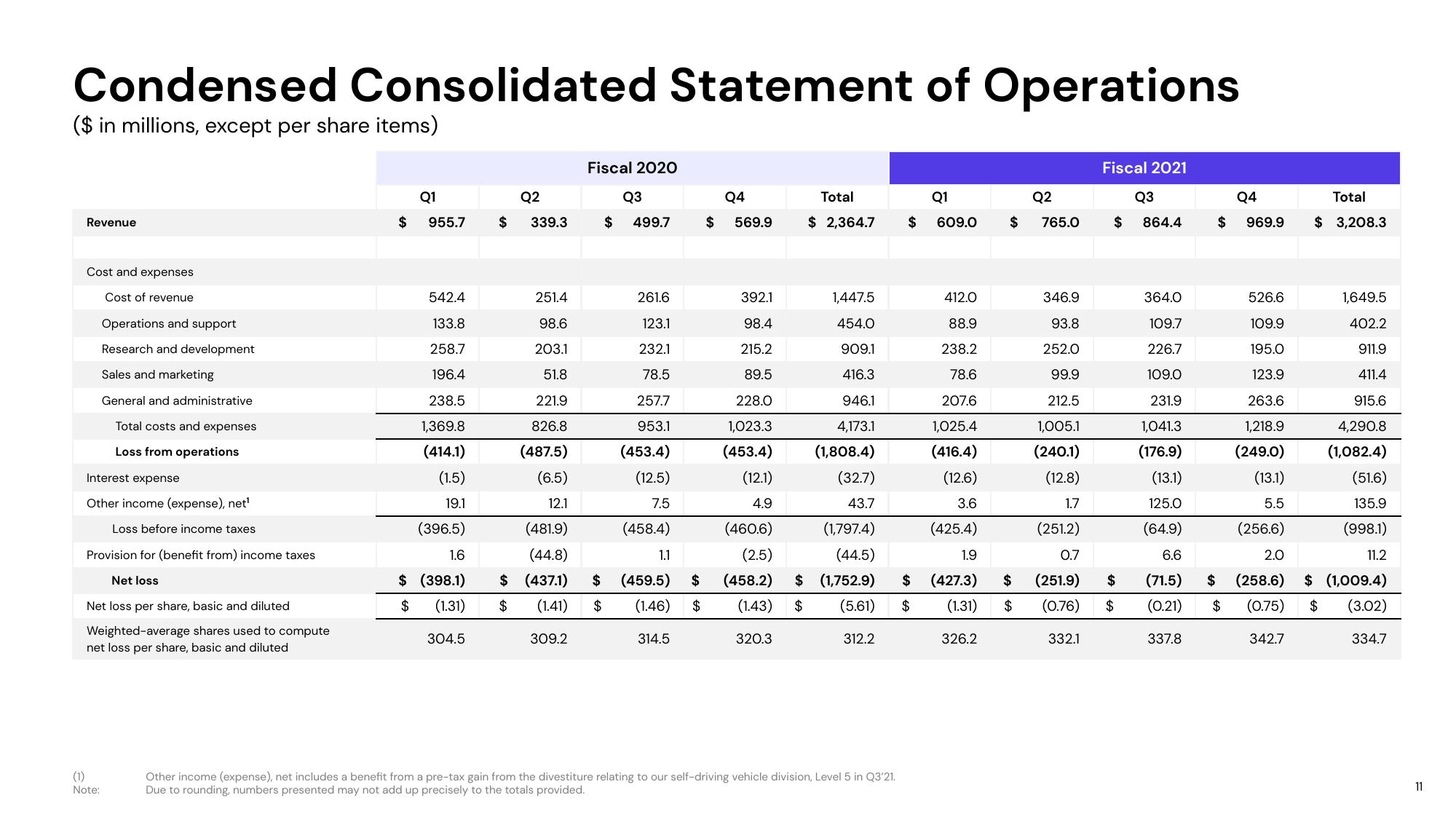

Condensed Consolidated Statement of Operations

($ in millions, except per share items)

Revenue

Cost and expenses

Cost of revenue

Operations and support

Research and development

Sales and marketing

General and administrative

Total costs and expenses

Loss from operations

Interest expense

Other income (expense), net¹

Loss before income taxes

Provision for (benefit from) income taxes

Net loss

Net loss per share, basic and diluted

Weighted-average shares used to compute

net loss per share, basic and diluted

(1)

Note:

$

Q1

955.7

542.4

133.8

258.7

196.4

238.5

1,369.8

(414.1)

(1.5)

19.1

(396.5)

1.6

(398.1)

$ (1.31)

$

304.5

Q2

$ 339.3

251.4

98.6

203.1

51.8

221.9

826.8

(487.5)

(6.5)

12.1

Fiscal 2020

309.2

(481.9)

(44.8)

$ (437.1)

(1.41) $

$

Q3

$ 499.7

261.6

123.1

232.1

78.5

257.7

953.1

(453.4)

(12.5)

7.5

(458.4)

1.1

$ (459.5) $

(1.46) $

314.5

Q4

$ 569.9

Total

Q1

$ 2,364.7 $ 609.0

392.1

98.4

215.2

89.5

228.0

1,023.3

(453.4)

(12.1)

4.9

(460.6) (1,797.4)

(2.5)

(44.5)

(458.2) $ (1,752.9)

(1.43) $ (5.61)

320.3

1,447.5

454.0

909.1

416.3

946.1

4,173.1

(1,808.4)

(32.7)

43.7

312.2

Other income (expense), net includes a benefit from a pre-tax gain from the divestiture relating to our self-driving vehicle division, Level 5 in Q3'21.

Due to rounding, numbers presented may not add up precisely to the totals provided.

Q2

$ 765.0

412.0

88.9

238.2

78.6

207.6

1,025.4

(416.4)

(12.6)

3.6

(425.4)

1.9

$ (427.3) $

(1.31) $

$

326.2

346.9

93.8

252.0

99.9

212.5

1,005.1

(240.1)

(12.8)

1.7

(251.2)

0.7

(251.9)

(0.76)

332.1

Fiscal 2021

Q3

$ 864.4

$

$

Q4

$ 969.9

337.8

364.0

109.7

226.7

109.0

231.9

1,041.3

(176.9)

(13.1)

125.0

(64.9)

6.6

(71.5) $ (258.6)

(0.21) $ (0.75) $

526.6

109.9

195.0

123.9

263.6

1,218.9

(249.0)

(13.1)

5.5

(256.6)

2.0

Total

$ 3,208.3

342.7

1,649.5

402.2

911.9

411.4

915.6

4,290.8

(1,082.4)

(51.6)

135.9

(998.1)

11.2

$ (1,009.4)

(3.02)

334.7

11View entire presentation