Investor Presentation

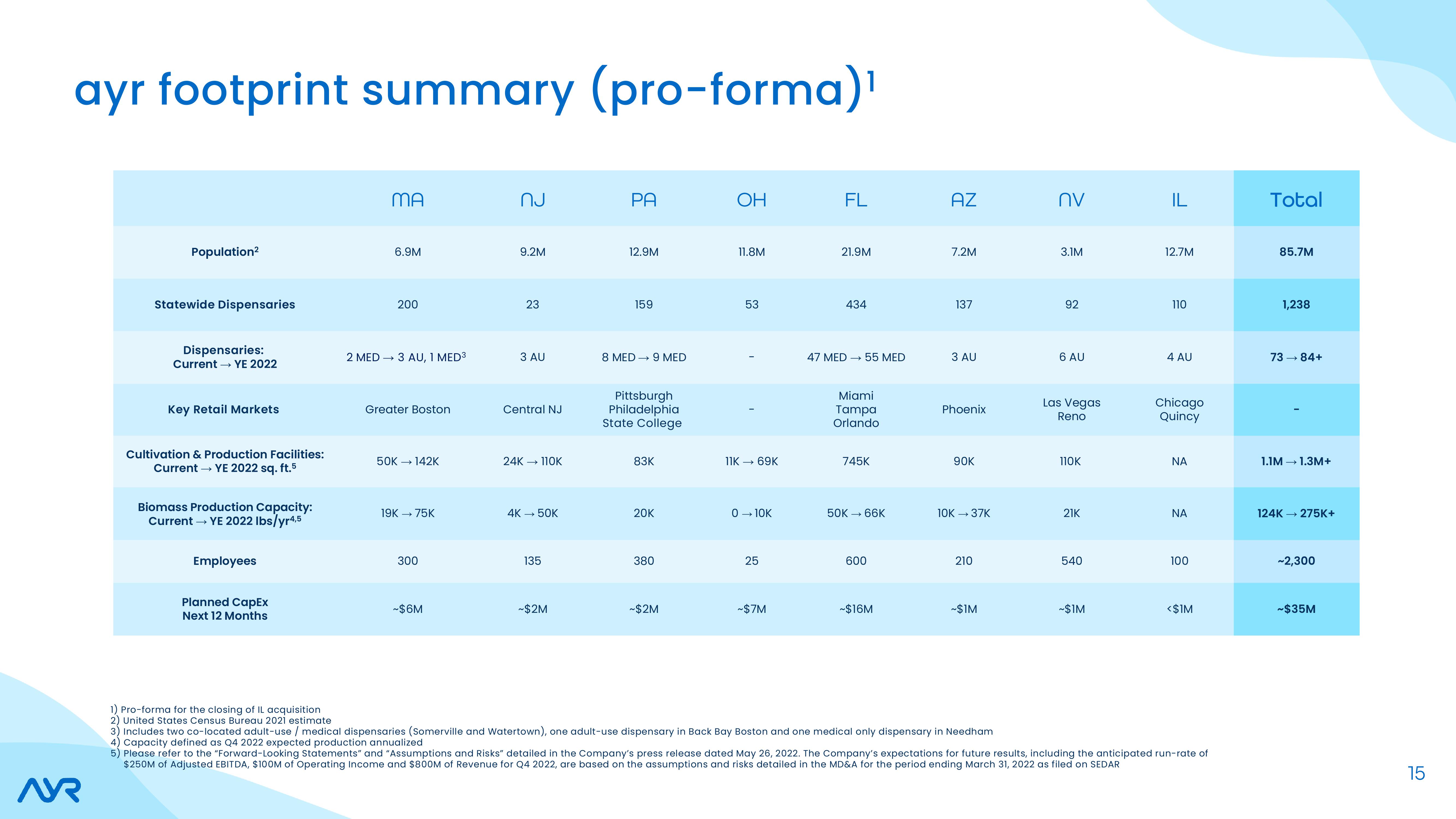

ayr footprint summary (pro-forma)¹

AR

Population²

Statewide Dispensaries

Dispensaries:

Current → YE 2022

Key Retail Markets

Cultivation & Production Facilities:

Current → YE 2022 sq. ft.5

Biomass Production Capacity:

Current → YE 2022 lbs/yr4,5

Employees

Planned CapEx

Next 12 Months

MA

6.9M

200

2 MED→3 AU, 1 MED³

Greater Boston

50K → 142K

19K → 75K

300

~$6M

nj

9.2M

23

3 AU

Central NJ

24K → 110K

4K →→ 50K

135

~$2M

PA

12.9M

159

8 MED → 9 MED

Pittsburgh

Philadelphia

State College

83K

20K

380

~$2M

OH

11.8M

53

11K →→ 69K

0 → 10K

25

~$7M

FL

21.9M

434

47 MED →→→ 55 MED

Miami

Tampa

Orlando

745K

50K → 66K

600

-$16M

AZ

7.2M

137

3 AU

Phoenix

90K

10K → 37K

210

~$1M

πν

3.1M

92

6 AU

Las Vegas

Reno

110K

21K

540

~$1M

IL

12.7M

110

4 AU

Chicago

Quincy

ΝΑ

ΝΑ

100

<$1M

1) Pro-forma for the closing of IL acquisition

2) United States Census Bureau 2021 estimate

3) Includes two co-located adult-use / medical dispensaries (Somerville and Watertown), one adult-use dispensary in Back Bay Boston and one medical only dispensary in Needham

4) Capacity defined as Q4 2022 expected production annualized

5) Please refer to the "Forward-Looking Statements" and "Assumptions and Risks" detailed in the Company's press release dated May 26, 2022. The Company's expectations for future results, including the anticipated run-rate of

$250M of Adjusted EBITDA, $100M of Operating Income and $800M of Revenue for Q4 2022, are based on the assumptions and risks detailed in the MD&A for the period ending March 31, 2022 as filed on SEDAR

Total

85.7M

1,238

73 → 84+

1.1M →→ 1.3M+

124K → 275K+

~2,300

~$35M

15View entire presentation