Evercore Investment Banking Pitch Book

Confidential - Preliminary and Subject to Change

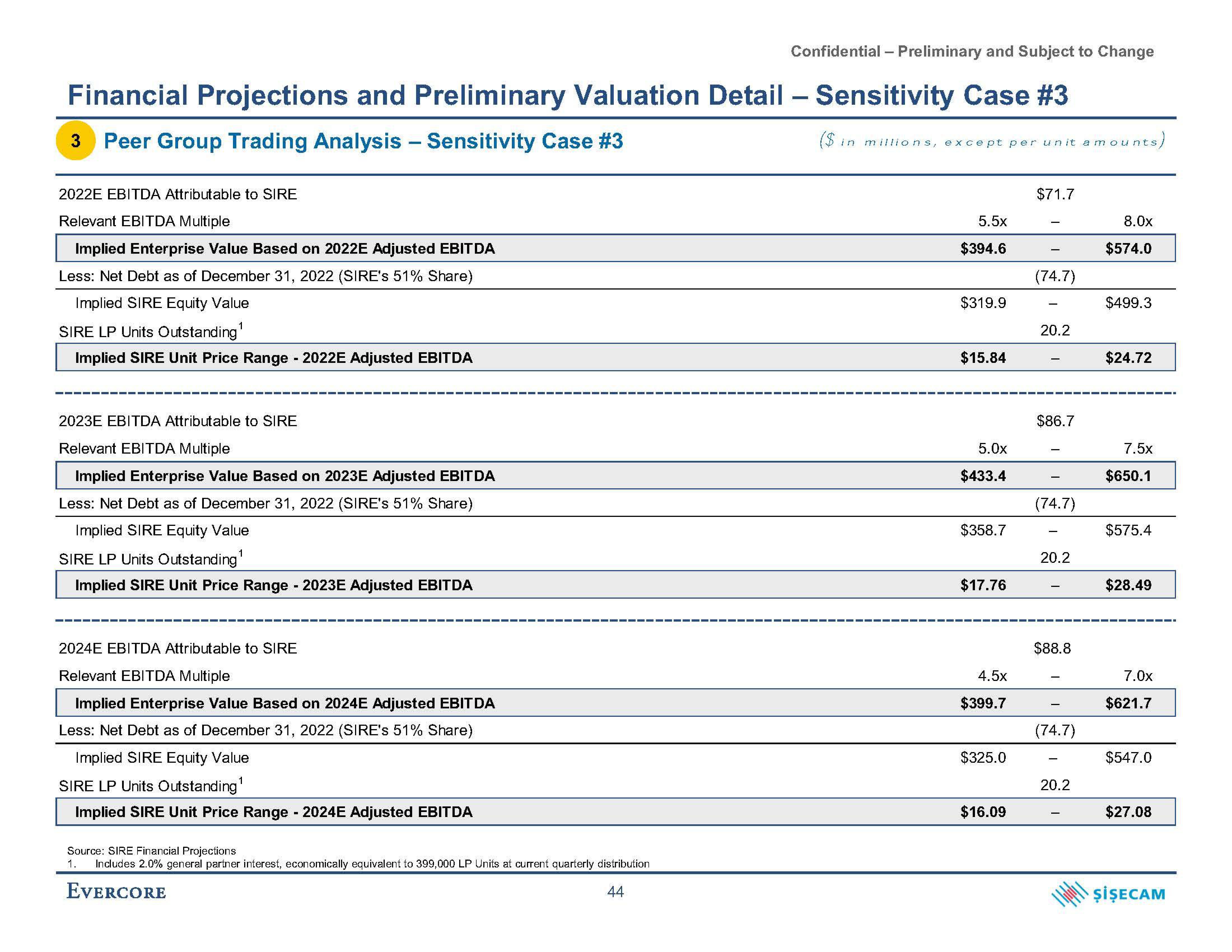

Financial Projections and Preliminary Valuation Detail - Sensitivity Case #3

3 Peer Group Trading Analysis - Sensitivity Case #3

2022E EBITDA Attributable to SIRE

Relevant EBITDA Multiple

Implied Enterprise Value Based on 2022E Adjusted EBITDA

Less: Net Debt as of December 31, 2022 (SIRE'S 51% Share)

Implied SIRE Equity Value

SIRE LP Units Outstanding¹

Implied SIRE Unit Price Range - 2022E Adjusted EBITDA

2023E EBITDA Attributable to SIRE

Relevant EBITDA Multiple

Implied Enterprise Value Based on 2023E Adjusted EBITDA

Less: Net Debt as of December 31, 2022 (SIRE's 51% Share)

Implied SIRE Equity Value

1

SIRE LP Units Outstanding'

Implied SIRE Unit Price Range - 2023E Adjusted EBITDA

2024E EBITDA Attributable to SIRE

Relevant EBITDA Multiple

Implied Enterprise Value Based on 2024E Adjusted EBITDA

Less: Net Debt as of December 31, 2022 (SIRE's 51% Share)

Implied SIRE Equity Value

SIRE LP Units Outstanding¹

Implied SIRE Unit Price Range - 2024E Adjusted EBITDA

Source: SIRE Financial Projections

1. Includes 2.0% general partner interest, economically equivalent to 399,000 LP Units at current quarterly distribution

EVERCORE

44

in millions, except per un it amounts

5.5x

$394.6

$319.9

$15.84

5.0x

$433.4

$358.7

$17.76

4.5x

$399.7

$325.0

$16.09

$71.7

(74.7)

20.2

$86.7

(74.7)

20.2

$88.8

(74.7)

ts)

20.2

8.0x

$574.0

$499.3

$24.72

7.5x

$650.1

$575.4

$28.49

7.0x

$621.7

$547.0

$27.08

ŞİŞECAMView entire presentation