Faraday Future Investor Presentation Deck

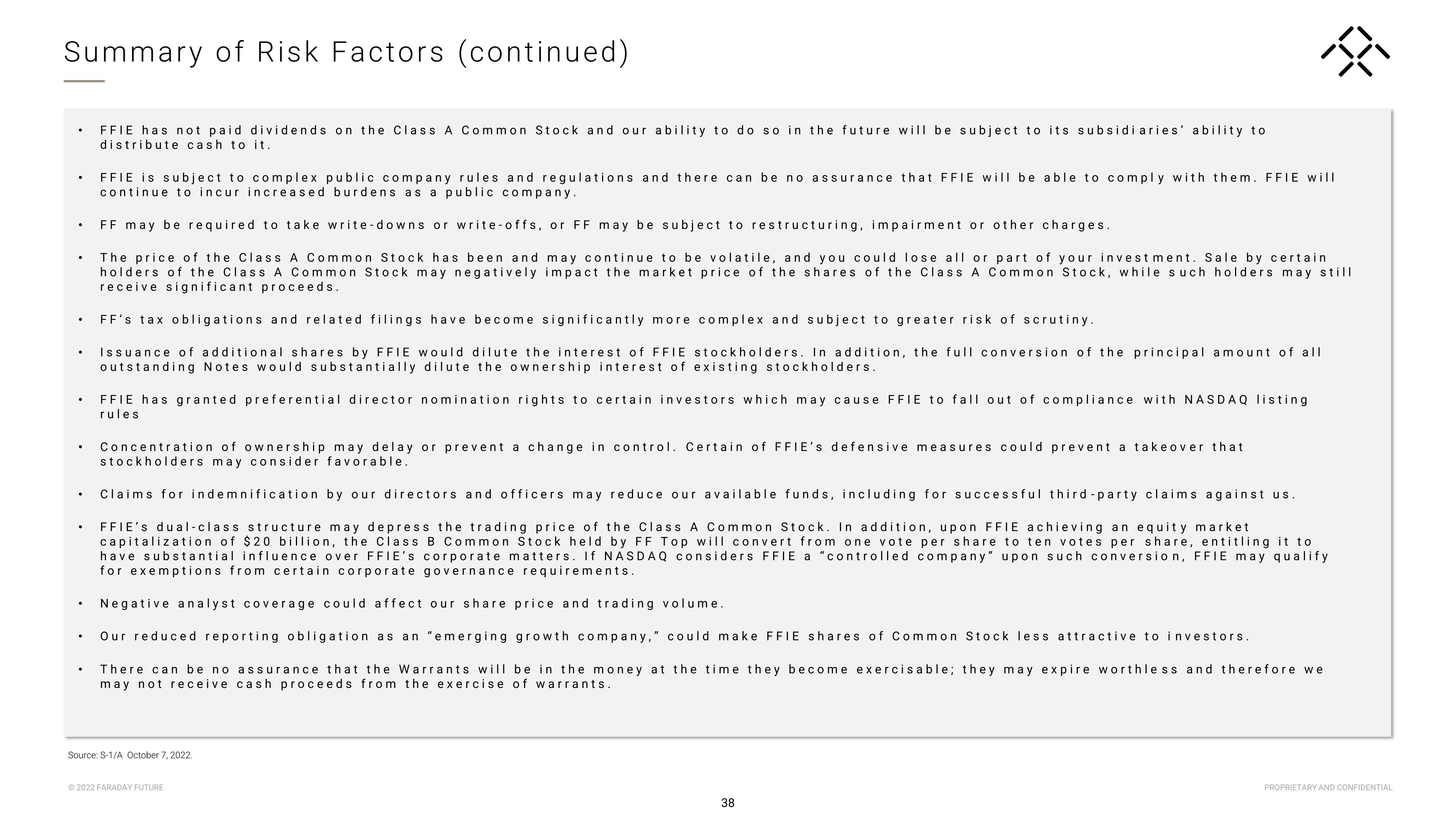

Summary of Risk Factors (continued)

.

.

.

.

FFIE has not paid dividends on the Class A Common Stock and our ability to do so in the future will be subject to its subsidiaries' ability to

distribute cash to it.

FFIE is subject to complex public company rules and regulations and there can be no assurance that FFIE will be able to comply with them. FFIE will

continue to incur increased burdens as a public company.

FF may be required to take write-downs or write-offs, or FF may be subject to restructuring, impairment or other charges.

The price of the Class A Common Stock has been and may continue to be volatile, and you could lose all or part of your investment. Sale by certain

holders of the Class A Common Stock may negatively impact the market price of the shares of the Class A Common Stock, while such holders may still

receive significant proceeds.

FF's tax obligations and related filings have become significantly more complex and subject to greater risk of scrutiny.

Issuance of additional shares by FFIE would dilute the interest of FFIE stockholders. In addition, the full conversion of the principal amount of all

outstanding Notes would substantially dilute the ownership interest of existing stockholders.

FFIE has granted preferential director nomination rights to certain investors which may cause FFIE to fall out of compliance with NASDAQ listing

rules

Concentration of ownership may delay or prevent a change in control. Certain of FFIE's defensive measures could prevent a takeover that

stockholders may consider favorable.

8

Claims for indemnification by our directors and officers may reduce our available funds, including for successful third-party claims against us.

FFIE's dual-class structure may depress the trading price of the Class A Common Stock. In addition, upon FFIE achieving an equity market

capitalization of $20 billion, the Class B Common Stock held by FF Top will convert from one vote per share to ten votes per share, entitling it to

have substantial influence over FFIE's corporate matters. If NASDAQ considers FFIE a "controlled company" upon such conversion, FFIE may qualify

for exemptions from certain corporate governance requirements.

Negative analyst coverage could affect our share price and trading volume.

Our reduced reporting obligation as an "emerging growth company," could make FFIE shares of Common Stock less attractive to inves rs.

There can be no assurance that the Warrants will be in the money at the time they become exercisable; they may expire worthless and therefore we

may not receive cash proceeds from the exercise of warrants.

Source: S-1/A October 7, 2022.

Ⓒ2022 FARADAY FUTURE

38

PROPRIETARY AND CONFIDENTIALView entire presentation