Main Street Capital Investor Day Presentation Deck

MAIN continues to execute

on the key aspects of its

long-term plans as

discussed in prior years

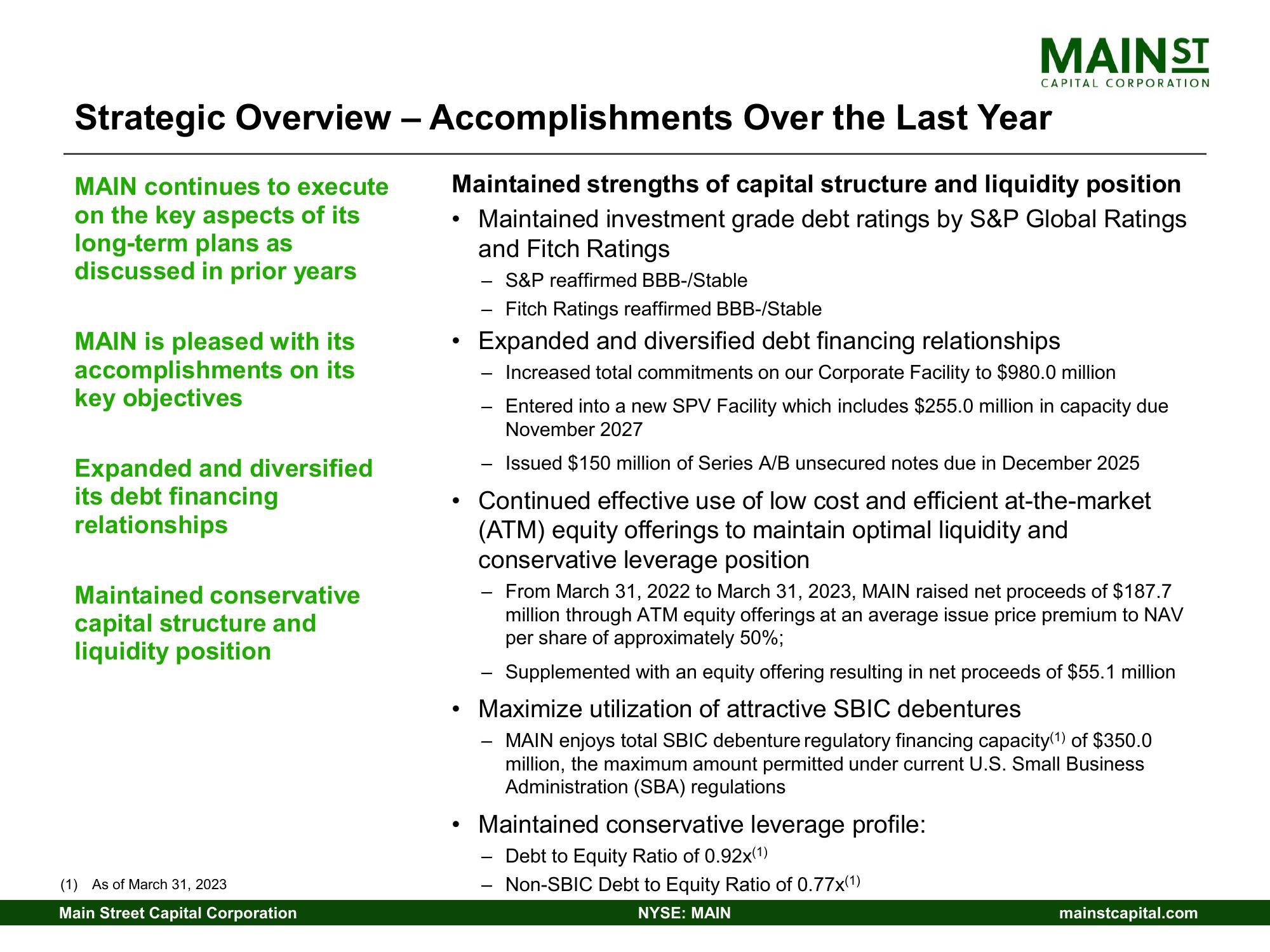

Strategic Overview - Accomplishments Over the Last Year

MAIN is pleased with its

accomplishments on its

key objectives

Expanded and diversified

its debt financing

relationships

Maintained conservative

capital structure and

liquidity position

(1) As of March 31, 2023

Main Street Capital Corporation

●

Maintained strengths of capital structure and liquidity position

Maintained investment grade debt ratings by S&P Global Ratings

and Fitch Ratings

●

MAINST

●

CAPITAL CORPORATION

- S&P reaffirmed BBB-/Stable

Fitch Ratings reaffirmed BBB-/Stable

Expanded and diversified debt financing relationships

Increased total commitments on our Corporate Facility to $980.0 million

Entered into a new SPV Facility which includes $255.0 million in capacity due

November 2027

- Issued $150 million of Series A/B unsecured notes due in December 2025

Continued effective use of low cost and efficient at-the-market

(ATM) equity offerings to maintain optimal liquidity and

conservative leverage position

Maintained conservative leverage profile:

Debt to Equity Ratio of 0.92x(1)

Non-SBIC Debt to Equity Ratio of 0.77x(1)

NYSE: MAIN

From March 31, 2022 to March 31, 2023, MAIN raised net proceeds of $187.7

million through ATM equity offerings at an average issue price premium to NAV

per share of approximately 50%;

Supplemented with an equity offering resulting in net proceeds of $55.1 million

Maximize utilization of attractive SBIC debentures

MAIN enjoys total SBIC debenture regulatory financing capacity(¹) of $350.0

million, the maximum amount permitted under current U.S. Small Business

Administration (SBA) regulations

mainstcapital.comView entire presentation