Kinnevik Results Presentation Deck

OUR TELADOC EXIT REALIZES A >55% IRR INVESTMENT, WITH GAINS REALLOCATED

INTO NEW CARE DELIVERY MODELS AND OUR ENTRY INTO LIFE SCIENCES

I

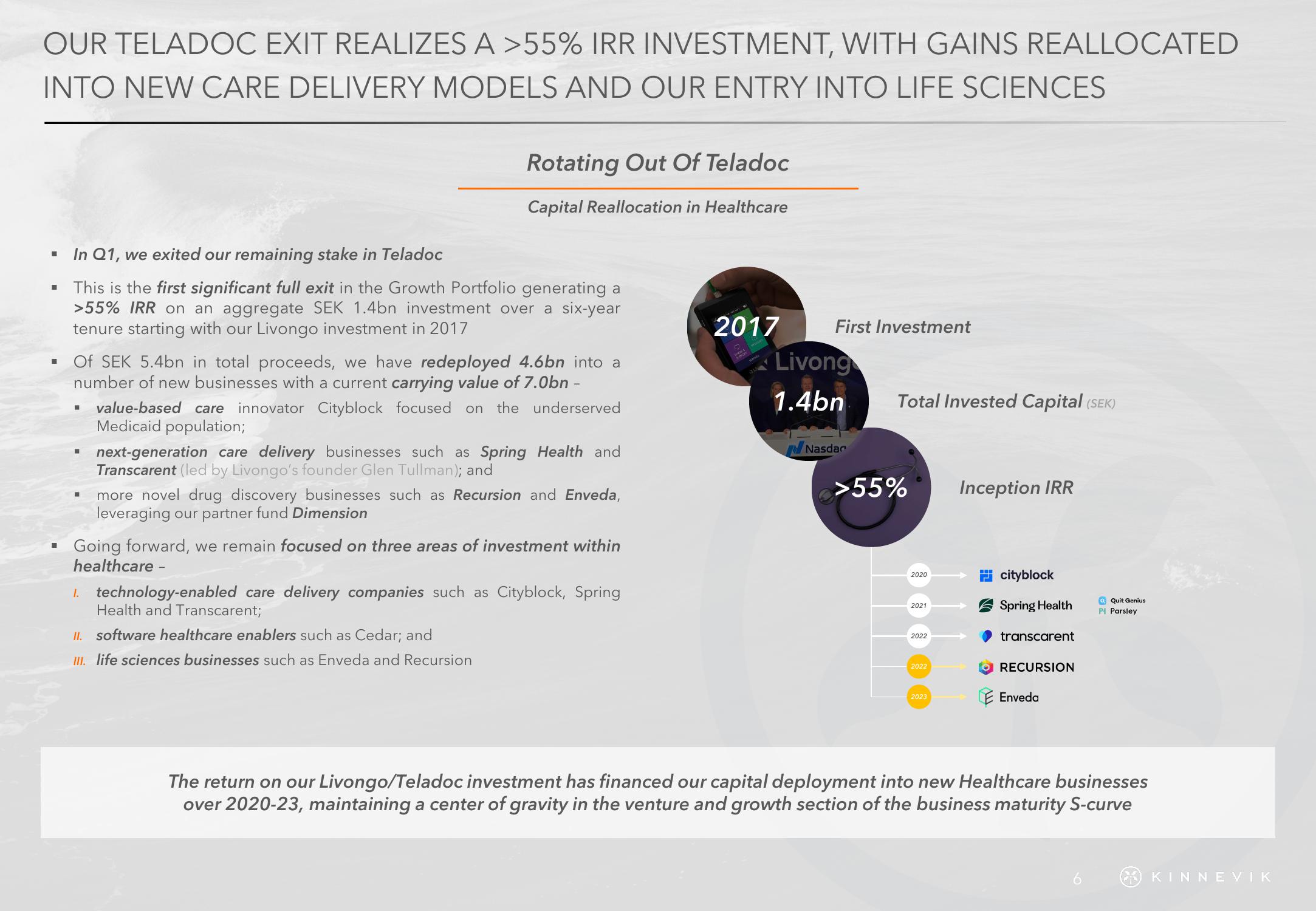

In Q1, we exited our remaining stake in Teladoc

This is the first significant full exit in the Growth Portfolio generating a

>55% IRR on an aggregate SEK 1.4bn investment over a six-year

tenure starting with our Livongo investment in 2017

Of SEK 5.4bn in total proceeds, we have redeployed 4.6bn into a

number of new businesses with a current carrying value of 7.0bn -

■

■

Rotating Out Of Teladoc

Capital Reallocation in Healthcare

"

value-based care innovator Cityblock focused on the underserved

Medicaid population;

next-generation care delivery businesses such as Spring Health and

Transcarent (led by Livongo's founder Glen Tullman); and

more novel drug discovery businesses such as Recursion and Enveda,

leveraging our partner fund Dimension

Going forward, we remain focused on three areas of investment within

healthcare -

1. technology-enabled care delivery companies such as Cityblock, Spring

Health and Transcarent;

II. software healthcare enablers such as Cedar; and

III. life sciences businesses such as Enveda and Recursion

2017 First Investment

: Livong

1.4bn

Nasdac

Total Invested Capital (SEK)

>55%

2020

2021

2022

2022

2023

Inception IRR

cityblock

Spring Health

transcarent

RECURSION

Enveda

o Quit Genius

P Parsley

The return on our Livongo/Teladoc investment has financed our capital deployment into new Healthcare businesses

over 2020-23, maintaining a center of gravity in the venture and growth section of the business maturity S-curve

KINNEVIKView entire presentation