J.P.Morgan ESG Presentation Deck

C Absolute Emissions

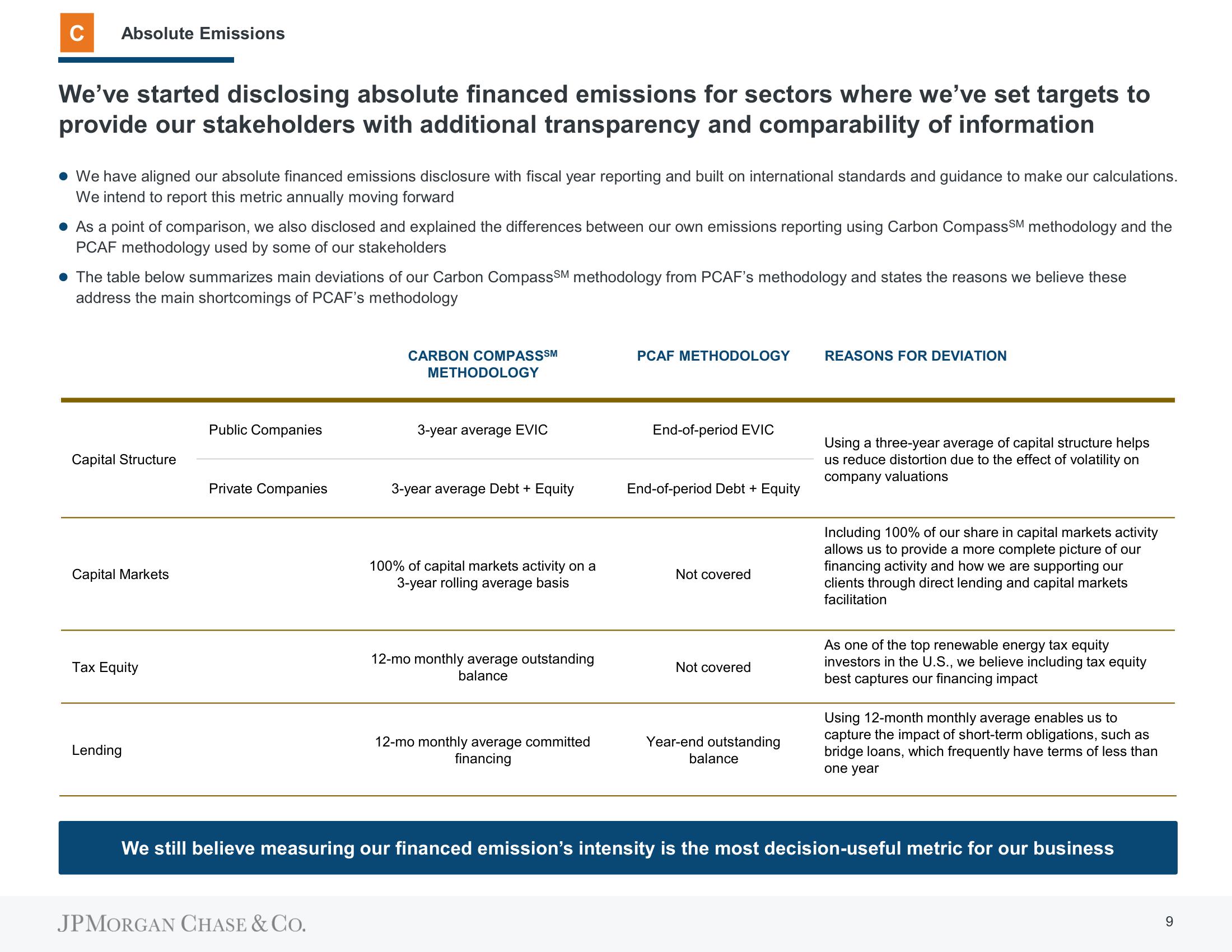

We've started disclosing absolute financed emissions for sectors where we've set targets to

provide our stakeholders with additional transparency and comparability of information

. We have aligned our absolute financed emissions disclosure with fiscal year reporting and built on international standards and guidance to make our calculations.

We intend to report this metric annually moving forward

As a point of comparison, we also disclosed and explained the differences between our own emissions reporting using Carbon Compass SM methodology and the

PCAF methodology used by some of our stakeholders

• The table below summarizes main deviations of our Carbon Compass SM methodology from PCAF's methodology and states the reasons we believe these

address the main shortcomings of PCAF's methodology

Capital Structure

Capital Markets

Tax Equity

Lending

Public Companies

Private Companies

CARBON COMPASSSM

JPMORGAN CHASE & CO.

METHODOLOGY

3-year average EVIC

3-year average Debt + Equity

100% of capital markets activity on a

3-year rolling average basis

12-mo monthly average outstanding

balance

12-mo monthly average committed

financing

PCAF METHODOLOGY

End-of-period EVIC

End-of-period Debt + Equity

Not covered

Not covered

Year-end outstanding

balance

REASONS FOR DEVIATION

Using a three-year average of capital structure helps

us reduce distortion due to the effect of volatility on

company valuations

Including 100% of our share in capital markets activity

allows us to provide a more complete picture of our

financing activity and how we are supporting our

clients through direct lending and capital markets

facilitation

As one of the top renewable energy tax equity

investors in the U.S., we believe including tax equity

best captures our financing impact

Using 12-month monthly average enables us to

capture the impact of short-term obligations, such as

bridge loans, which frequently have terms of less than

one year

We still believe measuring our financed emission's intensity is the most decision-useful metric for our business

9View entire presentation