Ford Investor Conference Presentation Deck

U.S LEASE SECURITIZATION

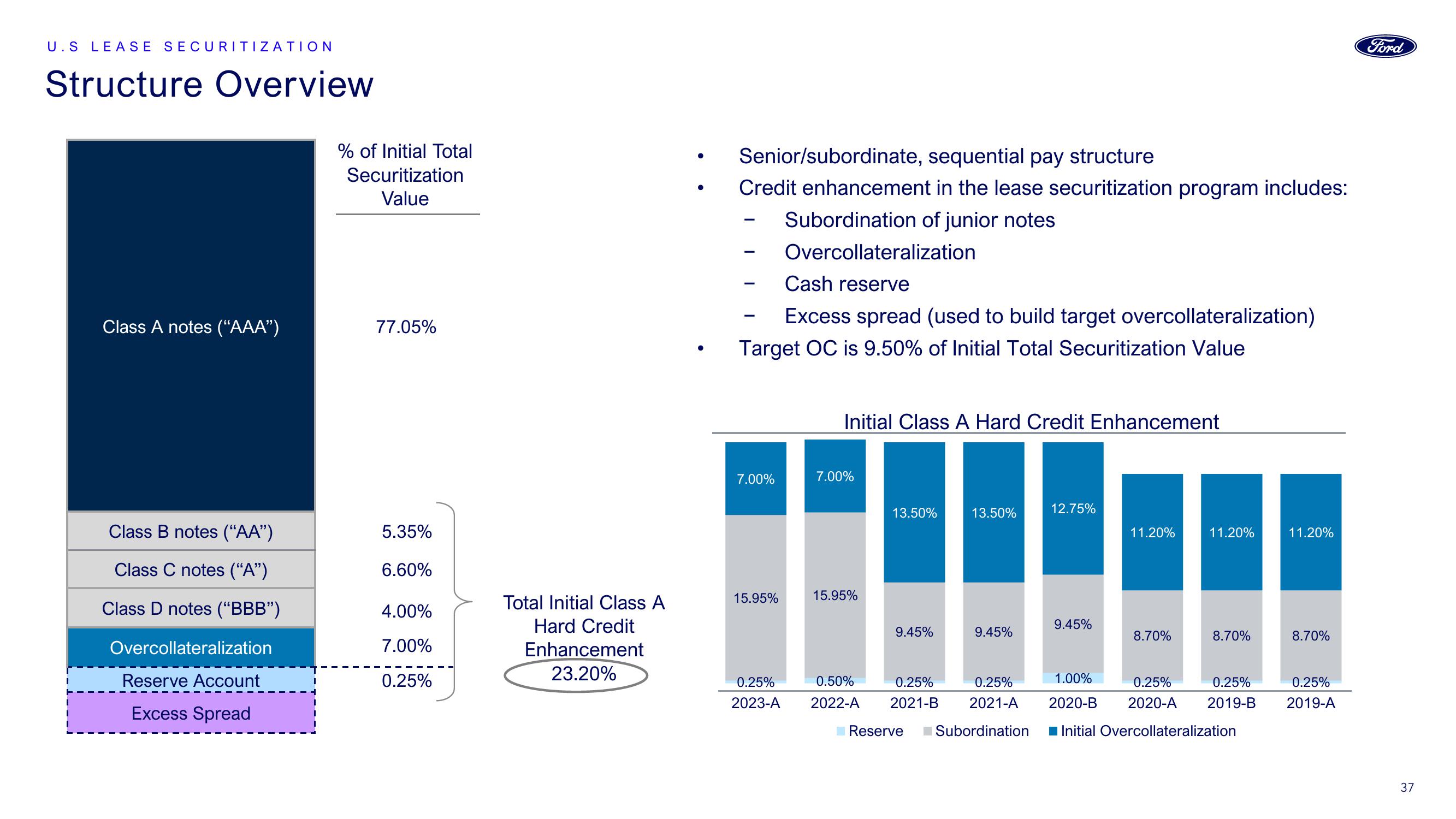

Structure Overview

Class A notes ("AAA")

Class B notes (“AA”)

Class C notes (“A”)

Class D notes ("BBB")

Overcollateralization

Reserve Account

Excess Spread

% of Initial Total

Securitization

Value

77.05%

5.35%

6.60%

4.00%

7.00%

0.25%

Total Initial Class A

Hard Credit

Enhancement

23.20%

Senior/subordinate, sequential pay structure

Credit enhancement in the lease securitization program includes:

Subordination of junior notes

-

Overcollateralization

Cash reserve

Excess spread (used to build target overcollateralization)

Target OC is 9.50% of Initial Total Securitization Value

-

-

7.00%

15.95%

Initial Class A Hard Credit Enhancement

7.00%

15.95%

13.50%

9.45%

13.50%

9.45%

0.25%

0.50%

0.25%

0.25%

2023-A 2022-A 2021-B 2021-A

Reserve Subordination

12.75%

9.45%

11.20%

8.70%

11.20%

8.70%

1.00%

0.25%

0.25%

2020-B 2020-A 2019-B

Initial Overcollateralization

11.20%

8.70%

0.25%

2019-A

Ford

37View entire presentation