Tradeweb Results Presentation Deck

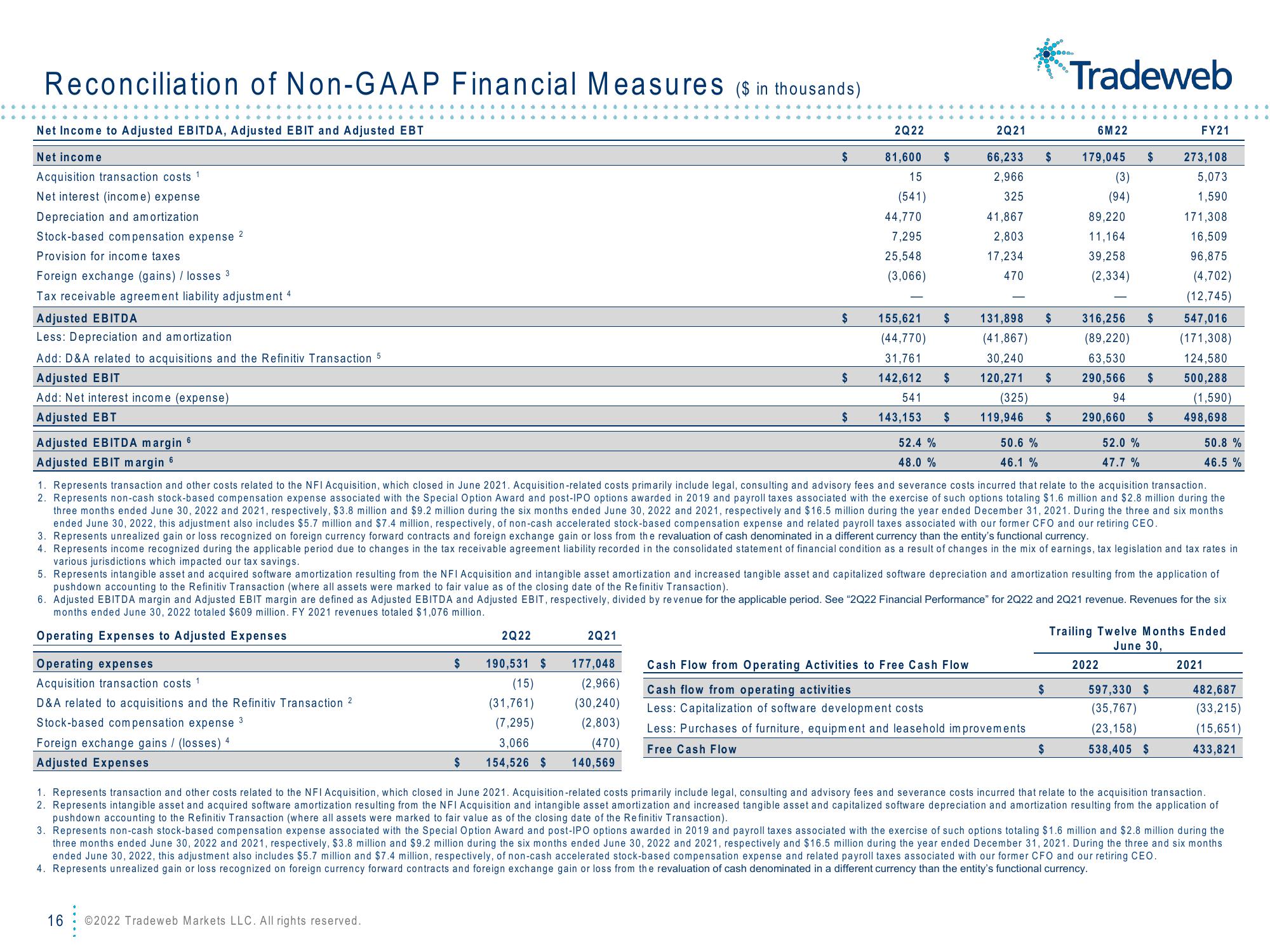

Reconciliation of Non-GAAP Financial Measures ($ in thousands)

Net Income to Adjusted EBITDA, Adjusted EBIT and Adjusted EBT

Net income

Acquisition transaction costs 1

Net interest (income) expense

Depreciation and amortization

Stock-based compensation expense 2

Provision for income taxes

Foreign exchange (gains) / losses 3

Tax receivable agreement liability adjustment 4

Adjusted EBITDA

Less: Depreciation and amortization

Add: D&A related to acquisitions and the Refinitiv Transaction 5

Adjusted EBIT

Add: Net interest income (expense)

Adjusted EBT

Adjusted EBITDA margin 6

Adjusted EBIT margin 6

Operating expenses

Acquisition transaction costs 1

D&A related to acquisitions and the Refinitiv Transaction 2

Stock-based compensation expense 3

Foreign exchange gains / (losses)

Adjusted Expenses

4

16

$

©2022 Tradeweb Markets LLC. All rights reserved.

$

2Q22

$

2Q21

$

190,531 $ 177,048

(15)

(2,966)

(31,761) (30,240)

(7,295)

(2,803)

3,066

(470)

154,526 $ 140,569

$

$

2Q22

81,600

15

(541)

44,770

7,295

25,548

(3,066)

$

52.4 %

48.0 %

155,621

(44,770)

31,761

142,612 $

541

143,153

2Q21

$ 131,898

(41,867)

30,240

120,271

(325)

119,946

$

66,233

2,966

325

41,867

2,803

17,234

470

50.6 %

46.1 %

Cash Flow from Operating Activities to Free Cash Flow

Cash flow from operating activities

Less: Capitalization of software development costs

Less: Purchases of furniture, equipment and leasehold improvements

Free Cash Flow

0000

$

$

1. Represents transaction and other costs related to the NFI Acquisition, which closed in June 2021. Acquisition-related costs primarily include legal, consulting and advisory fees and severance costs incurred that relate to the acquisition transaction.

2. Represents non-cash stock-based compensation expense associated with the Special Option Award and post-IPO options awarded in 2019 and payroll taxes associated with the exercise of such options totaling $1.6 million and $2.8 million during the

three months ended June 30, 2022 and 2021, respectively, $3.8 million and $9.2 million during the six months ended June 30, 2022 and 2021, respectively and $16.5 million during the year ended December 31, 2021. During the three and six months

ended June 30, 2022, this adjustment also includes $5.7 million and $7.4 million, respectively, of non-cash accelerated stock-based compensation expense and related payroll taxes associated with our former CFO and our retiring CEO.

$

$

3. Represents unrealized gain or loss recognized on foreign currency forward contracts and foreign exchange gain or loss from the revaluation of cash denominated in a different currency than the entity's functional currency.

4. Represents income recognized during the applicable period due to changes in the tax receivable agreement liability recorded in the consolidated statement of financial condition as a result of changes in the mix of earnings, tax legislation and tax rates in

various jurisdictions which impacted our tax savings.

5. Represents intangible asset and acquired software amortization resulting from the NFI Acquisition and intangible asset amortization and increased tangible asset and capitalized software depreciation and amortization resulting from the application of

pushdown accounting to the Refinitiv Transaction (where all assets were marked to fair value as of the closing date of the Refinitiv Transaction).

6. Adjusted EBITDA margin and Adjusted EBIT margin are defined as Adjusted EBITDA and Adjusted EBIT, respectively, divided by revenue for the applicable period. See "2Q22 Financial Performance" for 2Q22 and 2Q21 revenue. Revenues for the six

months ended June 30, 2022 totaled $609 million. FY 2021 revenues totaled $1,076 million.

Operating Expenses to Adjusted Expenses

Tradeweb

$ 316,256 $

(89,220)

63,530

290,566 $

94

290,660 $

$

6M 22

179,045

(3)

(94)

89,220

11,164

39,258

(2,334)

$

52.0 %

47.7 %

2022

FY21

273,108

5,073

1,590

171,308

16,509

96,875

(4,702)

(12,745)

547,016

(171,308)

124,580

500,288

(1,590)

498,698

597,330 $

(35,767)

(23,158)

538,405 $

50.8 %

46.5 %

Trailing Twelve Months Ended

June 30,

2021

1. Represents transaction and other costs related to the NFI Acquisition, which closed in June 2021. Acquisition-related costs primarily include legal, consulting and advisory fees and severance costs incurred that relate to the acquisition transaction.

2. Represents intangible asset and acquired software amortization resulting from the NFI Acquisition and intangible asset amortization and increased tangible asset and capitalized software depreciation and amortization resulting from the application of

pushdown accounting to the Refinitiv Transaction (where all assets were marked to fair value as of the closing date of the Refinitiv Transaction).

3. Represents non-cash stock-based compensation expense associated with the Special Option Award and post-IPO options awarded in 2019 and payroll taxes associated with the exercise of such options totaling $1.6 million and $2.8 million during the

three months ended June 30, 2022 and 2021, respectively, $3.8 million and $9.2 million during the six months ended June 30, 2022 and 2021, respectively and $16.5 million during the year ended December 31, 2021. During the three and six months

ended June 30, 2022, this adjustment also includes $5.7 million and $7.4 million, respectively, of non-cash accelerated stock-based compensation expense and related payroll taxes associated with our former CFO and our retiring CEO.

4. Represents unrealized gain or loss recognized on foreign currency forward contracts and foreign exchange gain or loss from the revaluation of cash denominated in a different currency than the entity's functional currency.

482,687

(33,215)

(15,651)

433,821View entire presentation