Engine No. 1 Activist Presentation Deck

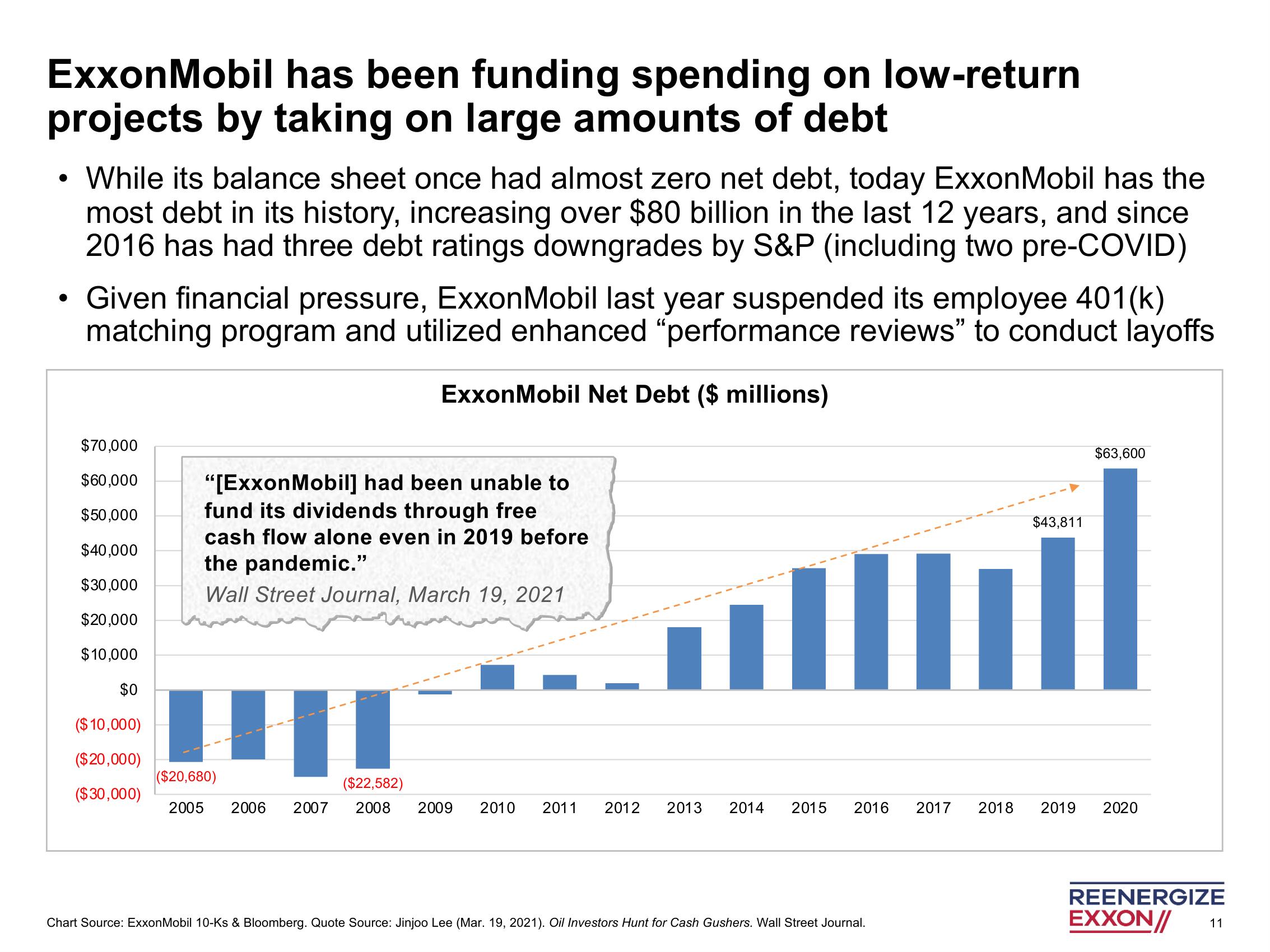

ExxonMobil has been funding spending on low-return

projects by taking on large amounts of debt

●

●

While its balance sheet once had almost zero net debt, today ExxonMobil has the

most debt in its history, increasing over $80 billion in the last 12 years, and since

2016 has had three debt ratings downgrades by S&P (including two pre-COVID)

Given financial pressure, ExxonMobil last year suspended its employee 401(k)

matching program and utilized enhanced "performance reviews" to conduct layoffs

ExxonMobil Net Debt ($ millions)

$70,000

$60,000

$50,000

$40,000

$30,000

$20,000

$10,000

$0

($10,000)

($20,000)

($30,000)

bill had be

"[ExxonMobil] had been unable to

fund its dividends through free

cash flow alone even in 2019 before

the pandemic."

Wall Street Journal, March 19, 2021

11

($20,680)

($22,582)

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Chart Source: ExxonMobil 10-Ks & Bloomberg. Quote Source: Jinjoo Lee (Mar. 19, 2021). Oil Investors Hunt for Cash Gushers. Wall Street Journal.

2017

$43,811

$63,600

2018 2019 2020

REENERGIZE

EXXON//

11View entire presentation