Rent The Runway Results Presentation Deck

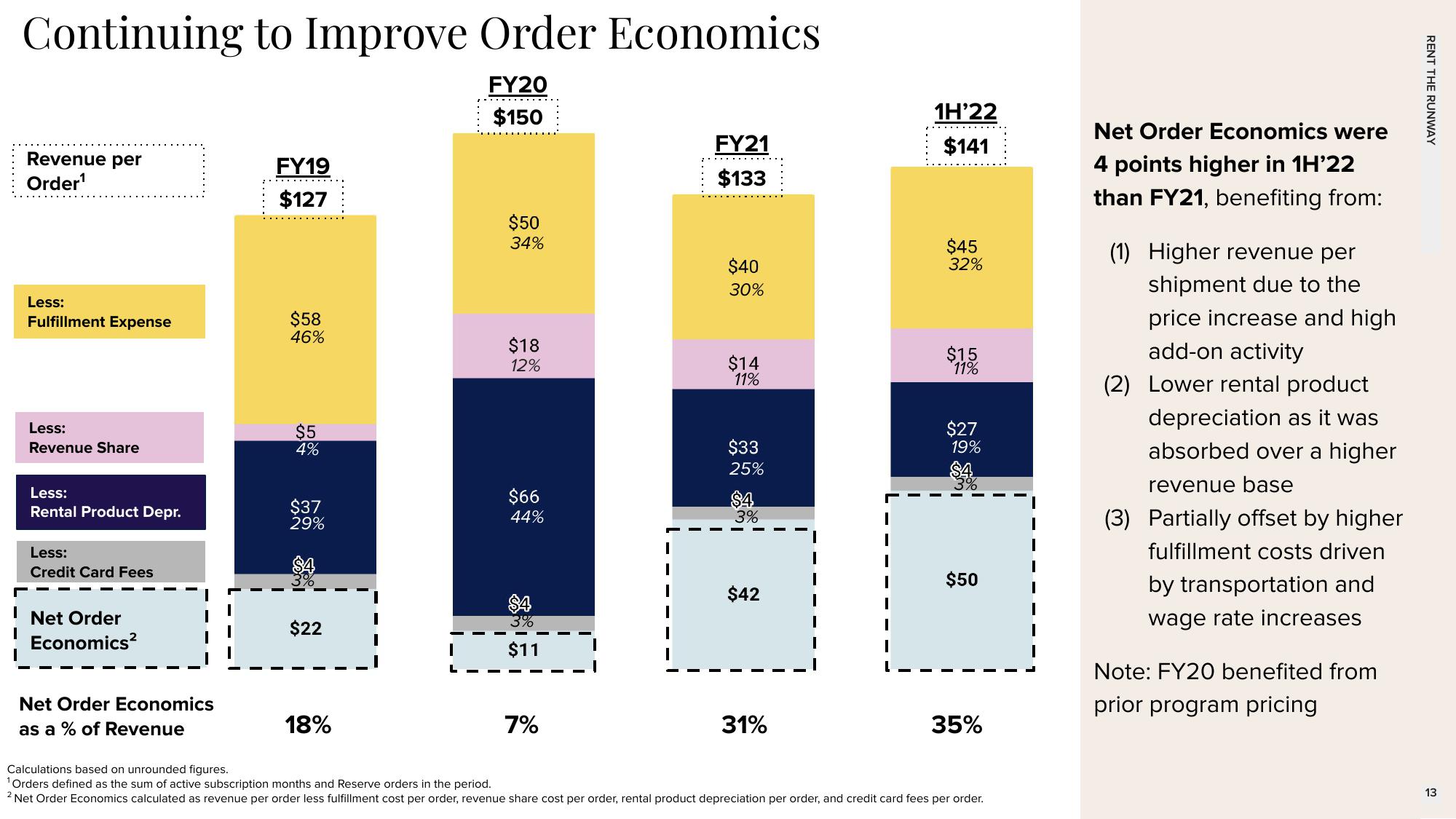

Continuing to Improve Order Economics

FY20

$150

Revenue per

Order¹

Less:

Fulfillment Expense

Less:

Revenue Share

Less:

Rental Product Depr.

Less:

Credit Card Fees

Net Order

Economics²

Net Order Economics

as a % of Revenue

FY19

$127

$58

46%

$5

4%

$37

29%

$22

18%

$50

34%

$18

12%

$66

44%

$11

7%

FY21

$133

$40

30%

$14

11%

$33

25%

$4

3%

$42

31%

1H'22

$141

$45

32%

$15

11%

$27

19%

$50

35%

Calculations based on unrounded figures.

¹Orders defined as the sum of active subscription months and Reserve orders in the period.

2 Net Order Economics calculated as revenue per order less fulfillment cost per order, revenue share cost per order, rental product depreciation per order, and credit card fees per order.

Net Order Economics were

4 points higher in 1H'22

than FY21, benefiting from:

(1) Higher revenue per

shipment due to the

price increase and high

add-on activity

(2) Lower rental product

depreciation as it was

absorbed over a higher

revenue base

(3) Partially offset by higher

fulfillment costs driven

by transportation and

wage rate increases

Note: FY20 benefited from

prior program pricing

RENT THE RUNWAY

13View entire presentation