SoftBank Results Presentation Deck

●

●

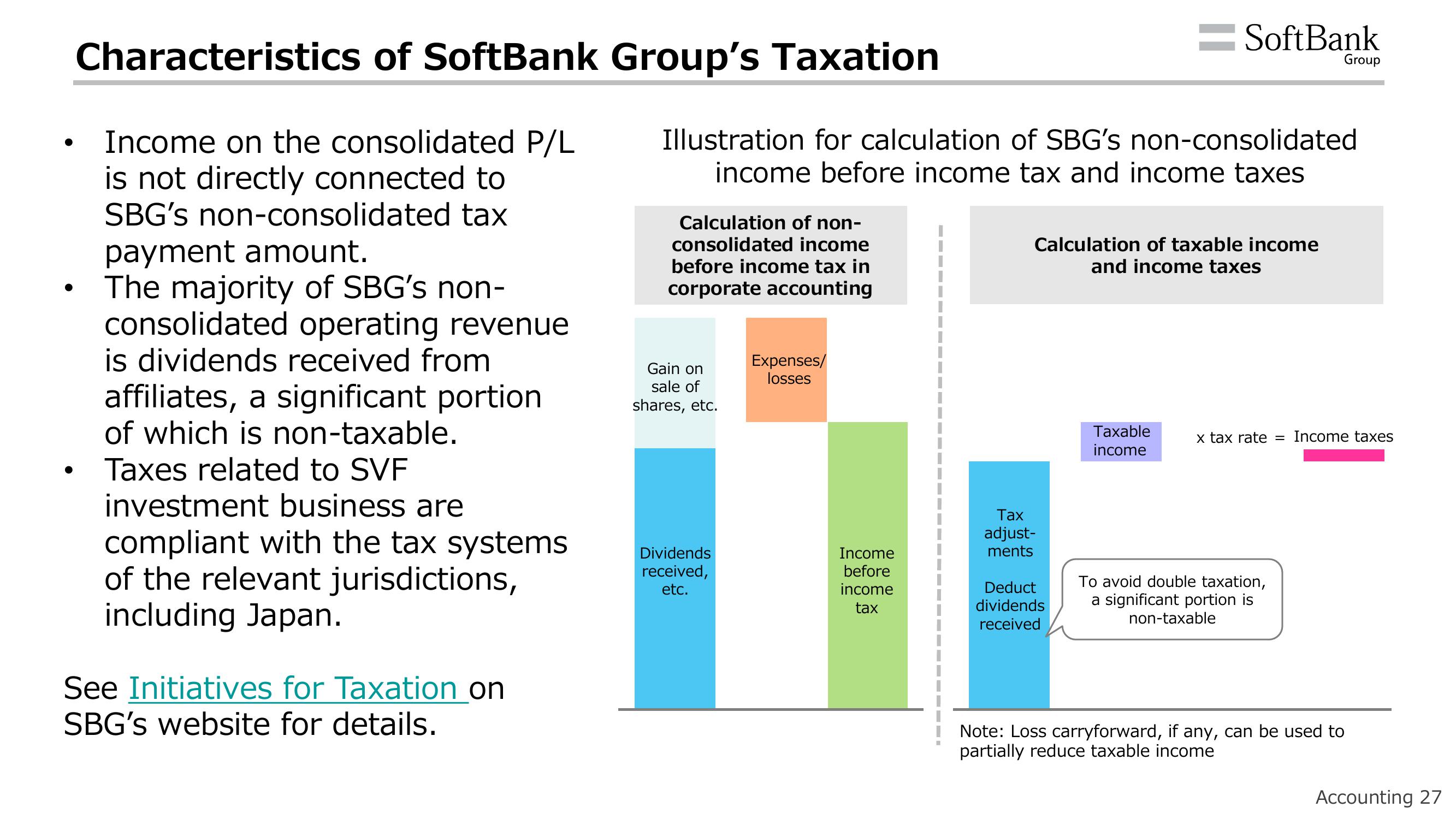

Characteristics of SoftBank Group's Taxation

Income on the consolidated P/L

is not directly connected to

SBG's non-consolidated tax

payment amount.

The majority of SBG's non-

consolidated operating revenue

is dividends received from

affiliates, a significant portion

of which is non-taxable.

Taxes related to SVF

investment business are

compliant with the tax systems

of the relevant jurisdictions,

including Japan.

See Initiatives for Taxation on

SBG's website for details.

Calculation of non-

consolidated income

before income tax in

corporate accounting

Illustration for calculation of SBG's non-consolidated

income before income tax and income taxes

Gain on

sale of

shares, etc.

Dividends

received,

etc.

Expenses/

losses

Income

before

income

tax

Calculation of taxable income

and income taxes

Tax

adjust-

ments

=SoftBank

Deduct

dividends

received

Taxable

income

Group

x tax rate = Income taxes

To avoid double taxation,

a significant portion is

non-taxable

Note: Loss carryforward, if any, can be used to

partially reduce taxable income

Accounting 27View entire presentation