BuzzFeed Investor Presentation Deck

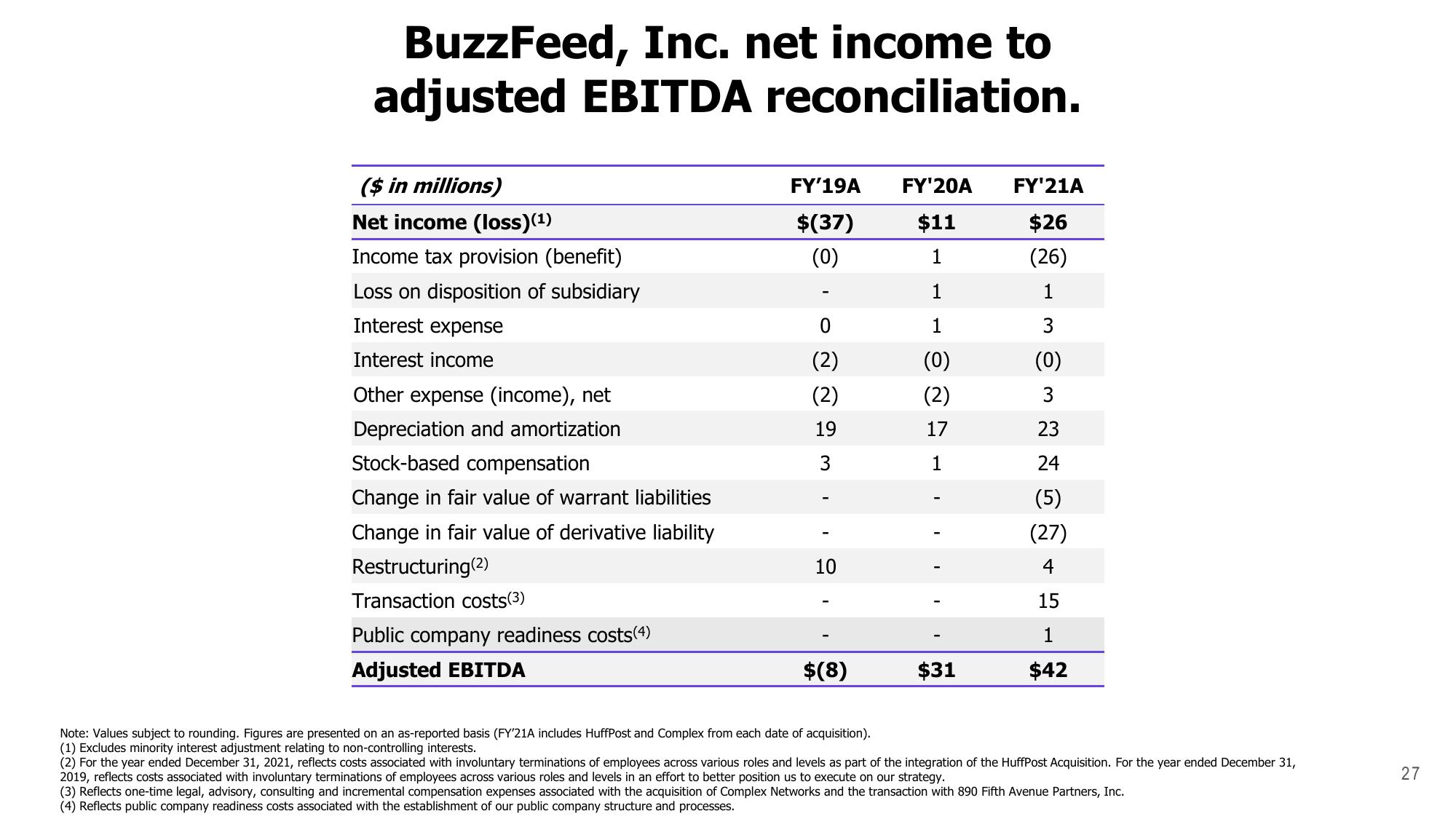

BuzzFeed, Inc. net income to

adjusted EBITDA reconciliation.

($ in millions)

Net income (loss)(¹)

Income tax provision (benefit)

Loss on disposition of subsidiary

Interest expense

Interest income

Other expense (income), net

Depreciation and amortization

Stock-based compensation

Change in fair value of warrant liabilities

Change in fair value of derivative liability

Restructuring (2)

Transaction costs(3)

Public company readiness costs(4)

Adjusted EBITDA

FY'19A FY'20A FY'21A

$(37)

$11

$26

(0)

1

(26)

1

3

(0)

3

23

24

(5)

(27)

4

15

1

$42

0

(2)

(2)

19

3

10

$(8)

(0)

(2)

17

$31

Note: Values subject to rounding. Figures are presented on an as-reported basis (FY'21A includes HuffPost and Complex from each date of acquisition).

(1) Excludes minority interest adjustment relating to non-controlling interests.

(2) For the year ended December 31, 2021, reflects costs associated with involuntary terminations of employees across various roles and levels as part of the integration of the HuffPost Acquisition. For the year ended December 31,

2019, reflects costs associated with involuntary terminations of employees across various roles and levels in an effort to better position us to execute on our strategy.

(3) Reflects one-time legal, advisory, consulting and incremental compensation expenses associated with the acquisition of Complex Networks and the transaction with 890 Fifth Avenue Partners, Inc.

(4) Reflects public company readiness costs associated with the establishment of our public company structure and processes.

27View entire presentation