Ready Capital Investor Presentation Deck

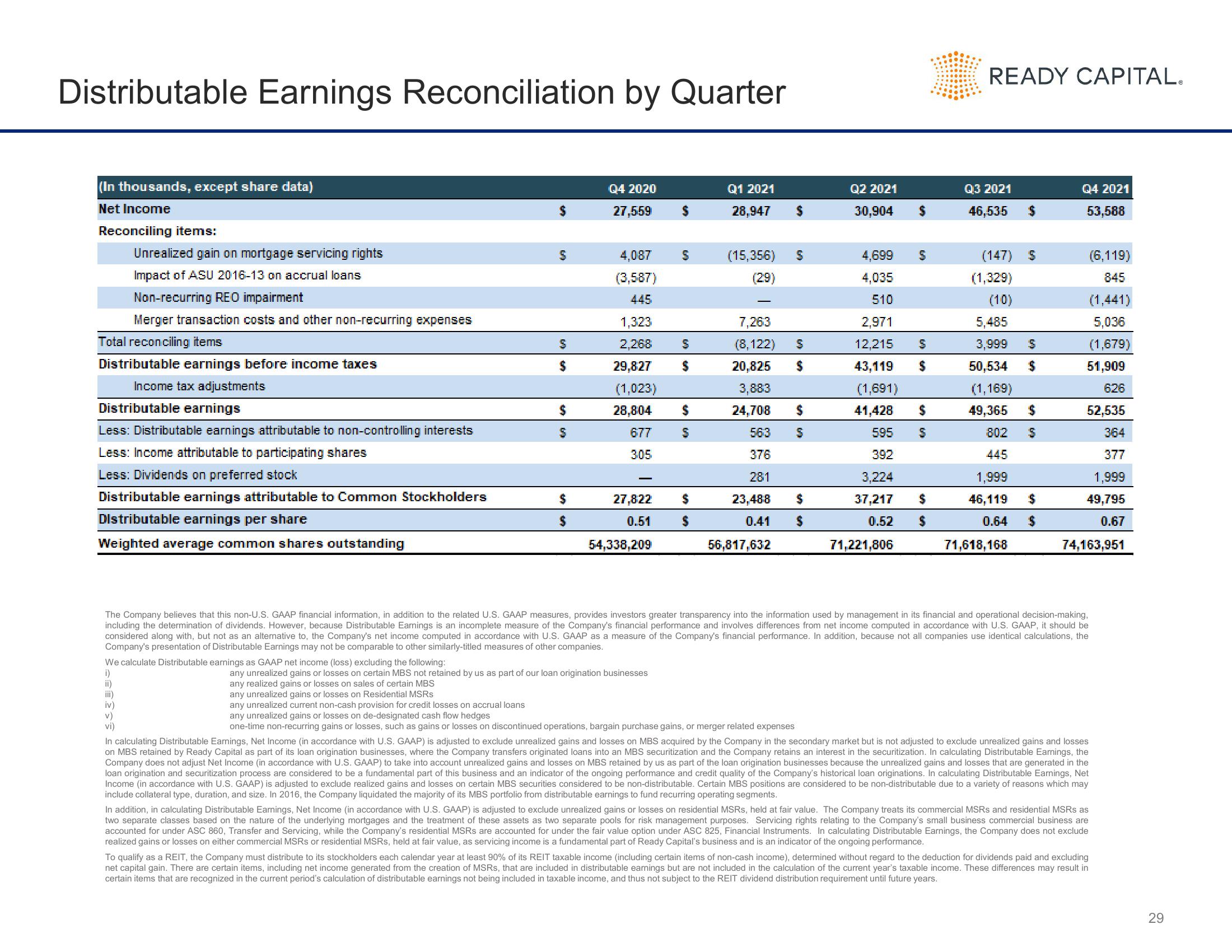

Distributable Earnings Reconciliation by Quarter

(In thousands, except share data)

Net Income

Reconciling items:

Unrealized gain on mortgage servicing rights

Impact of ASU 2016-13 on accrual loans

Non-recurring REO impairment

Merger transaction costs and other non-recurring expenses

Total reconciling items

Distributable earnings before income taxes

Income tax adjustments

Distributable earnings

Less: Distributable earnings attributable to non-controlling interests

Less: Income attributable to participating shares

Less: Dividends on preferred stock

Distributable earnings attributable to Common Stockholders

Distributable earnings per share

Weighted average common shares outstanding

iv)

v)

vi)

We calculate Distributable earnings as GAAP net income (loss) excluding the following:

i)

ii)

$

S

S

$

$

S

$

$

Q4 2020

27,559

4,087

(3,587)

445

1,323

2,268

29,827

(1,023)

28,804

677

305

27,822

0.51

54,338,209

S

S

600

$

$

S

$

Q1 2021

28,947

(15,356)

(29)

7,263

(8,122) S

20,825 $

3,883

24,708

563

376

281

23,488

0.41

56,817,632

$

S

any unrealized gains or losses on certain MBS not retained by us as part of our loan origination businesses

any realized gains or losses on sales of certain MBS

any unrealized gains or losses on Residential MSRS

any unrealized current non-cash provision for credit losses on accrual loans

any unrealized gains or losses on de-designated cash flow hedges

one-time non-recurring gains or losses, such as gains or losses on discontinued operations, bargain purchase gains, or merger related expenses

$

$

Q2 2021

30,904

4,699

4,035

510

2,971

12,215 S

43,119 $

(1,691)

41,428

595

392

$

S

3,224

37,217 $

0.52 S

71,221,806

READY CAPITAL.

Q3 2021

46,535

$

(147) S

(1,329)

(10)

5,485

3,999 S

50,534 $

(1,169)

49,365

802

445

1,999

46,119

0.64

71,618,168

$

S

$

$

The Company believes that this non-U.S. GAAP financial information, in addition to the related U.S. GAAP measures, provides investors greater transparency into the information used by management in its financial and operational decision-making,

including the determination of dividends. However, because Distributable Earnings is an incomplete measure of the Company's financial performance and involves differences from net income computed in accordance with U.S. GAAP, it should be

considered along with, but not as an alternative to, the Company's net income computed in accordance with U.S. GAAP as a measure of the Company's financial performance. In addition, because not all companies use identical calculations, the

Company's presentation of Distributable Earnings may not be comparable to other similarly-titled measures of other companies.

Q4 2021

53,588

(6,119)

845

(1,441)

5,036

(1,679)

51,909

626

52,535

364

377

1,999

49,795

0.67

74,163,951

In calculating Distributable Earnings, Net Income (in accordance with U.S. GAAP) is adjusted to exclude unrealized gains and losses on MBS acquired by the Company in the secondary market but is not adjusted to exclude unrealized gains and losses

on MBS retained by Ready Capital as part of its loan origination businesses, where the Company transfers originated loans into an MBS securitization and the Company retains an interest in the securitization. In calculating Distributable Earnings, the

Company does not adjust Net Income (in accordance with U.S. GAAP) to take into account unrealized gains and losses on MBS retained by us as part of the loan origination businesses because the unrealized gains and losses that are generated in the

loan origination and securitization process are considered to be a fundamental part of this business and an indicator of the ongoing performance and credit quality of the Company's historical loan originations. In calculating Distributable Earnings, Net

Income (in accordance with U.S. GAAP) is adjusted to exclude realized gains and losses on certain MBS securities considered to be non-distributable. Certain MBS positions are considered to be non-distributable due to a variety of reasons which may

include collateral type, duration, and size. In 2016, the Company liquidated the majority of its MBS portfolio from distributable earnings to fund recurring operating segments.

In addition, in calculating Distributable Earnings, Net Income (in accordance with U.S. GAAP) is adjusted to exclude unrealized gains or losses on residential MSRS, held at fair value. The Company treats its commercial MSRS and residential MSRs as

two separate classes based on the nature of the underlying mortgages and the treatment of these assets as two separate pools for risk management purposes. Servicing rights relating to the Company's small business commercial business are

accounted for under ASC 860, Transfer and Servicing, while the Company's residential MSRS are accounted for under the fair value option under ASC 825, Financial Instruments. In calculating Distributable Earnings, the Company does not exclude

realized gains or losses on either commercial MSRS or residential MSRS, held at fair value, as servicing income is a fundamental part of Ready Capital's business and is an indicator of the ongoing performance.

To qualify as a REIT, the Company must distribute to its stockholders each calendar year at least 90% of its REIT taxable income (including certain items of non-cash income), determined without regard to the deduction for dividends paid and excluding

net capital gain. There are certain items, including net income generated from the creation of MSRs, that are included in distributable earnings but are not included in the calculation of the current year's taxable income. These differences may result in

certain items that are recognized in the current period's calculation of distributable earnings not being included in taxable income, and thus not subject to the REIT dividend distribution requirement until future years.

29View entire presentation