BuzzFeed SPAC Presentation Deck

BuzzFeed

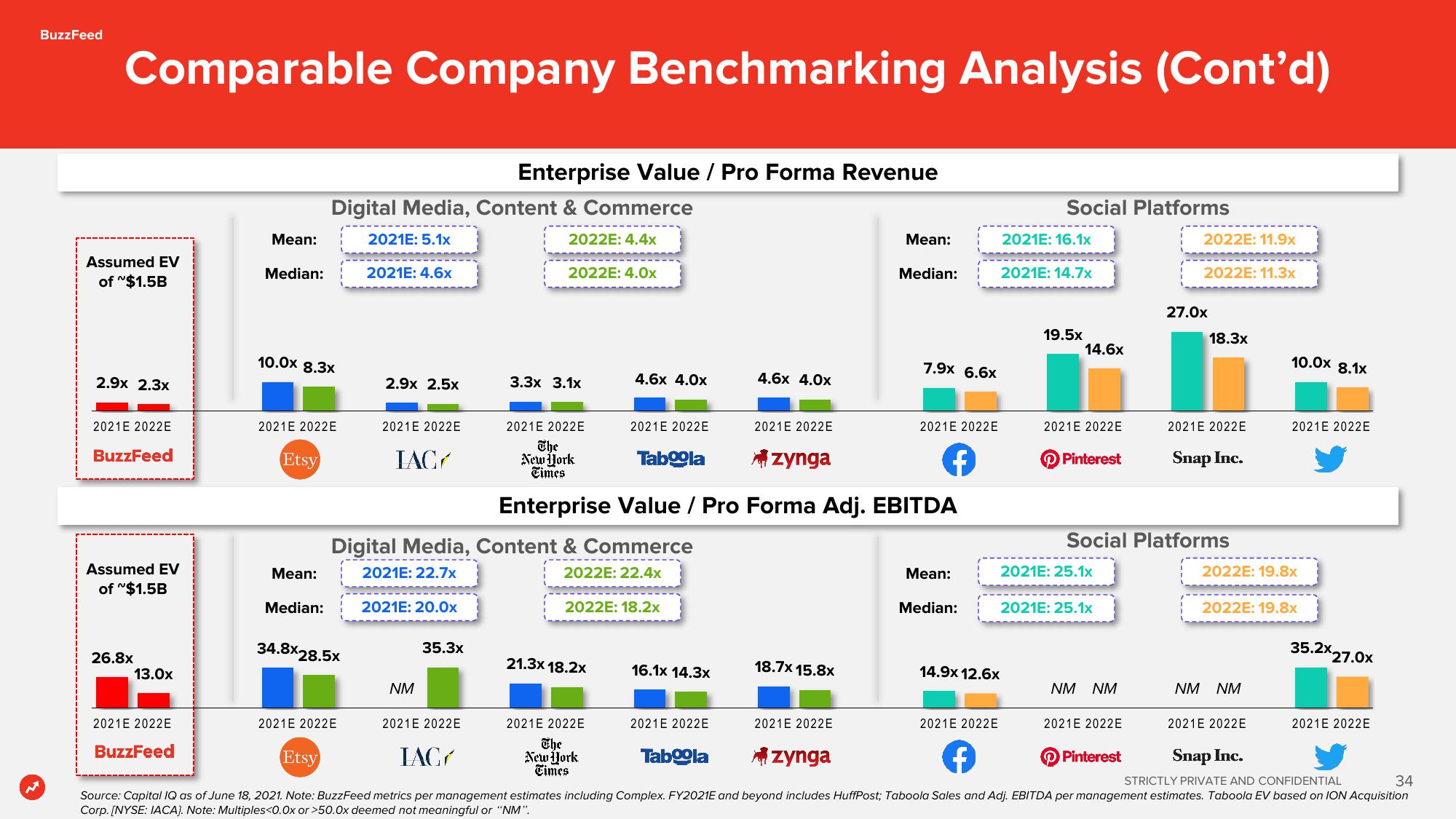

Comparable Company Benchmarking Analysis (Cont'd)

Assumed EV

of $1.5B

2.9x 2.3x

2021E 2022E

BuzzFeed

Assumed EV

of $1.5B

26.8x

13.0x

2021E 2022E

Mean:

BuzzFeed

Median:

10.0x 8.3x

2021E 2022E

Etsy

Mean:

Digital Media, Content & Commerce

2021E: 5.1x

2022E: 4.4x

Median:

34.8x28.5x

2021E: 4.6x

2021 2022E

2.9x 2.5x

2021 2022E

IAC

2021E: 20.0x

NM

Enterprise Value / Pro Forma Revenue

35.3x

2021 2022E

2022E: 4.0x

Digital Media, Content & Commerce

2021E: 22.7x

2022E: 22.4x

2022E: 18.2x

3.3x 3.1x

4.6x 4.0x

21.3x18.2x

2021 E 2022E

2021 2022E

The

New York

Times

2021E 2022E

The

New York

Times

Enterprise Value / Pro Forma Adj. EBITDA

Taboola

16.1x 14.3x

2021E 2022E

4.6x 4.0x

2021E 2022E

Taboola

zynga

18.7x 15.8x

2021E 2022E

Mean:

Median:

7.9x 6.6x

Azynga

2021E 2022E

f

Mean:

Median:

14.9x 12.6x

2021E 2022E

Social Platforms

2021E: 16.1x

2021E: 14.7x

19.5x

14.6x

2021E 2022E

Pinterest

2021E: 25.1x

2021E: 25.1x

NM NM

2021E 2022E

2022E: 11.9x

2022E: 11.3x

Social Platforms

Pinterest

27.0x

18.3x

2021E 2022E

Snap Inc.

2021E 2022E

Etsy

IAC

f

Snap Inc.

STRICTLY PRIVATE AND CONFIDENTIAL

34

Source: Capital IQ as of June 18, 2021. Note: BuzzFeed metrics per management estimates including Complex. FY2021E and beyond includes HuffPost; Taboola Sales and Adj. EBITDA per management estimates. Taboola EV based on ION Acquisition

Corp. [NYSE: IACA). Note: Multiples<0.0x or >50.0x deemed not meaningful or "NM".

10.0x 8.1x

2021E 2022E

2022E: 19.8x

NM NM

2022E: 19.8x

35.2x 27.0x

2021E 2022EView entire presentation