Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

Wealth Management Fees

% Revenue

Other Revenue

% Revenue

Revenue

% Growth

HoldCo Compensation (excl. non-cash equity comp)

% Growth

% Revenue

Other Compensation (excl. non-cash equity comp)

% Growth

% Revenue

HoldCo SG&A

% Growth

% Revenue

Other SG&A

% Growth

% Revenue

Management Fees

% Growth

% Revenue

Total Expenses

% Revenue

Total Operating Income

Equity Method Earnings & Other Dividends

Adjusted EBITDA

% Revenue

Depreciation and Other Amortization

(Interest Income)

Interest Expense

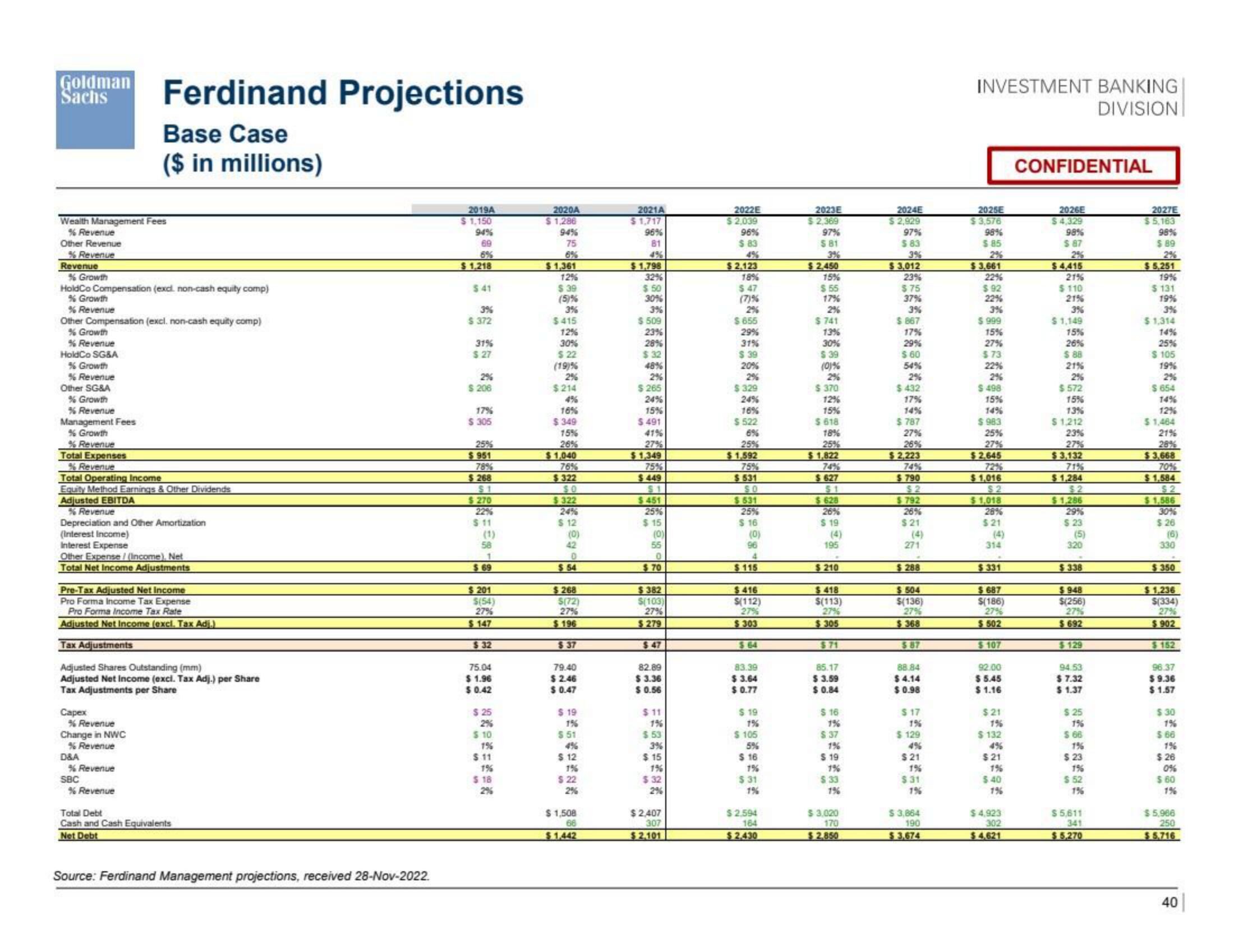

Ferdinand Projections

Base Case

($ in millions)

Other Expense/ (Income). Net

Total Net Income Adjustments

Pre-Tax Adjusted Net Income

Pro Forma Income Tax Expense

Pro Forma Income Tax Rate

Adjusted Net Income (excl. Tax Adj.)

Tax Adjustments

Adjusted Shares Outstanding (mm)

Adjusted Net Income (excl. Tax Adj.) per Share

Tax Adjustments per Share

Capex

% Revenue

Change in NWC

% Revenue

D&A

% Revenue

SBC

% Revenue

Total Debt

Cash and Cash Equivalents

Net Debt

Source: Ferdinand Management projections, received 28-Nov-2022.

2019A

$1,150

94%

69

6%

$1,218

$41

3%

$372

31%

$ 27

2%

$ 206

17%

$ 305

25%

$951

78%

$268

$1

$270

22%

$11

(1)

58

1

$ 69

$ 201

$(54)

27%

$147

$32

75.04

$1.96

$0.42

$25

2%

$ 10

1%

$11

1%

$ 18

2020A

$1,286

94%

75

6%

$1,361

12%

$ 39

(5)%

3%

$415

12%

30%

$22

(19)%

2%

$214

4%

16%

$349

15%

26%

$1,040

76%

$322

$0

$322

24%

$ 12

(0)

42

0

$54

$268

$(72)

27%

$196

$ 37

79.40

$2.46

$ 0.47

$ 19

15

$ 51

4%

$ 12

1%

$ 22

2%

$1,508

66

$1,442

2021A

$1,717

96%

81

4%

$1,798

32%

$50

30%

3%

$ 509

23%

28%

$32

48%

2%

$265

24%

15%

$ 491

41%

27%

$1,349

75%

$449

$451

25%

$15

(0)

55

0

$70

$382

$(103)

27%

$279

$47

82.89

$3.36

$ 0.56

$11

1%

$53

3%

$15

1%

$32

2%

$2,407

307

$2,101

2022E

$2,039

96%

$83

$2.123

18%

$ 47

(7)%

2%

$655

29%

31%

$ 39

20%

2%

$ 329

24%

16%

$522

6%

25%

$1,592

75%

$531

SO

$531

25%

$ 16

(0)

96

4

$115

$416

$(112)

27%

$303

$64

83.39

$3.64

$ 0.77

$ 19

1%

$ 105

5%

$ 16

1%

$ 31

$2.594

164

$2.430

2023E

$2,369

97%

$ 81

3%

$2,450

15%

$55

17%

2%

$741

13%

30%

$39

(0)%

2%

$ 370

12%

15%

$ 618

18%

25%

$1,822

74%

$627

$1

$628

26%

$ 19

195

$210

$418

$(113)

27%

$305

$71

85.17

$ 3.59

$ 0.84

$ 16

1%

$ 37

1%

$ 19

1%

$.33

$3,020

170

$2,850

2024E

$2,929

97%

$ 83

3%

$3,012

23%

$75

37%

3%

$ 867

17%

29%

$ 60

54%

2%

$432

17%

14%

$787

27%

26%

$2,223

74%

$790

$2

$792

26%

$21

271

$288

$504

$(136)

27%

$368

$ 87

88.84

$4.14

$0.98

$17

1%

$129

$21

1%

$31

1%

$ 3,864

190

$3,674

INVESTMENT BANKING

DIVISION

2025E

$3,576

98%

$85

2%

$3.661

22%

$92

22%

3%

$ 999

15%

27%

$73

22%

2%

$ 498

15%

14%

$ 983

25%

27%

$2.645

72%

$1,016

$2

$1,018

28%

$21

314

$331

$687

$(186)

27%

$ 502

$107

92.00

$5.45

$ 1.16

$21

1%

$ 132

$21

$40

1%

$4,923

302

$4,621

CONFIDENTIAL

2026E

$4,329

98%

$ 87

2%

$4,415

21%

$ 110

21%

3%

$1,149

15%

26%

$ 88

21%

2%

$572

15%

13%

$1,212

23%

27%

$3,132

71%

$1,284

$2

$1,286

29%

$ 23

(5)

320

$338

$948

$(256)

27%

$692

$129

94.53

$ 7.32

$1.37

$ 25

1%

$ 66

1%

$ 23

1%

$ 52

1%

$5,611

341

$5,270

2027E

$5,163

98%

$ 89

2%

$5,251

19%

$ 131

19%

3%

$1,314

14%

25%

$ 105

19%

2%

$ 654

14%

12%

$1,464

21%

28%

$3,668

70%

$1,584

$2

$1,586

30%

$26

(6)

330

$350

$1,236

$(334)

27%

$902

$152

96.37

$9.36

$1.57

$30

$ 66

$26

0%

$ 60

1%

$5,966

250

$5,716

40View entire presentation