Allwyn Investor Conference Presentation Deck

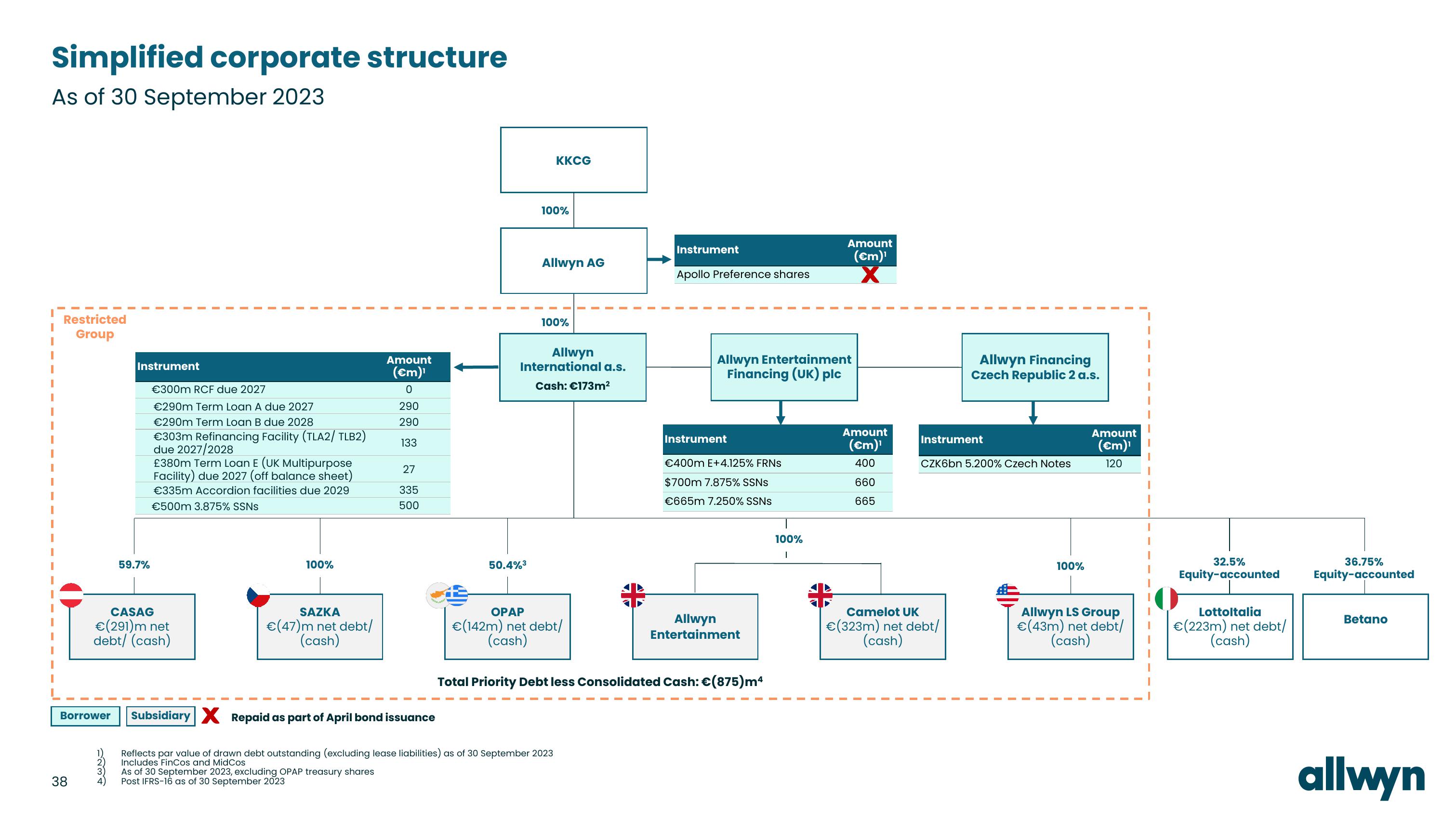

Simplified corporate structure

As of 30 September 2023

I

Restricted

Group

Instrument

38

59.7%

€300m RCF due 2027

€290m Term Loan A due 2027

€290m Term Loan B due 2028

€303m Refinancing Facility (TLA2/ TLB2)

due 2027/2028

£380m Term Loan E (UK Multipurpose

Facility) due 2027 (off balance sheet)

€335m Accordion facilities due 2029

€500m 3.875% SSNs

CASAG

€(291)m net

debt/ (cash)

100%

SAZKA

€(47)m net debt/

(cash)

Amount

(cm)¹

0

290

290

133

Borrower Subsidiary X Repaid as part of April bond issuance

27

335

500

As of 30 September 2023, excluding OPAP treasury shares

Post IFRS-16 as of 30 September 2023

50.4%³

KKCG

100%

Allwyn AG

100%

Allwyn

International a.s.

Cash: €173m²

OPAP

€(142m) net debt/

(cash)

Reflects par value of drawn debt outstanding (excluding lease liabilities) as of 30 September 2023

Includes FinCos and MidCos

Instrument

Apollo Preference shares

Allwyn Entertainment

Financing (UK) plc

Instrument

€400m E+4.125% FRNS

$700m 7.875% SSNs

€665m 7.250% SSNS

Allwyn

Entertainment

Total Priority Debt less Consolidated Cash: €(875)m4

Amount

(€m)¹

X

100%

I

Amount

(€m)¹

400

660

665

Allwyn Financing

Czech Republic 2 a.s.

Instrument

CZK6bn 5.200% Czech Notes

Camelot UK

€(323m) net debt/

(cash)

100%

Amount

(€m)¹

120

Allwyn LS Group

€(43m) net debt/

(cash)

32.5%

Equity-accounted

Lottoltalia

€(223m) net debt/

(cash)

36.75%

Equity-accounted

Betano

allwynView entire presentation