SoftBank Results Presentation Deck

●

●

=SoftBank

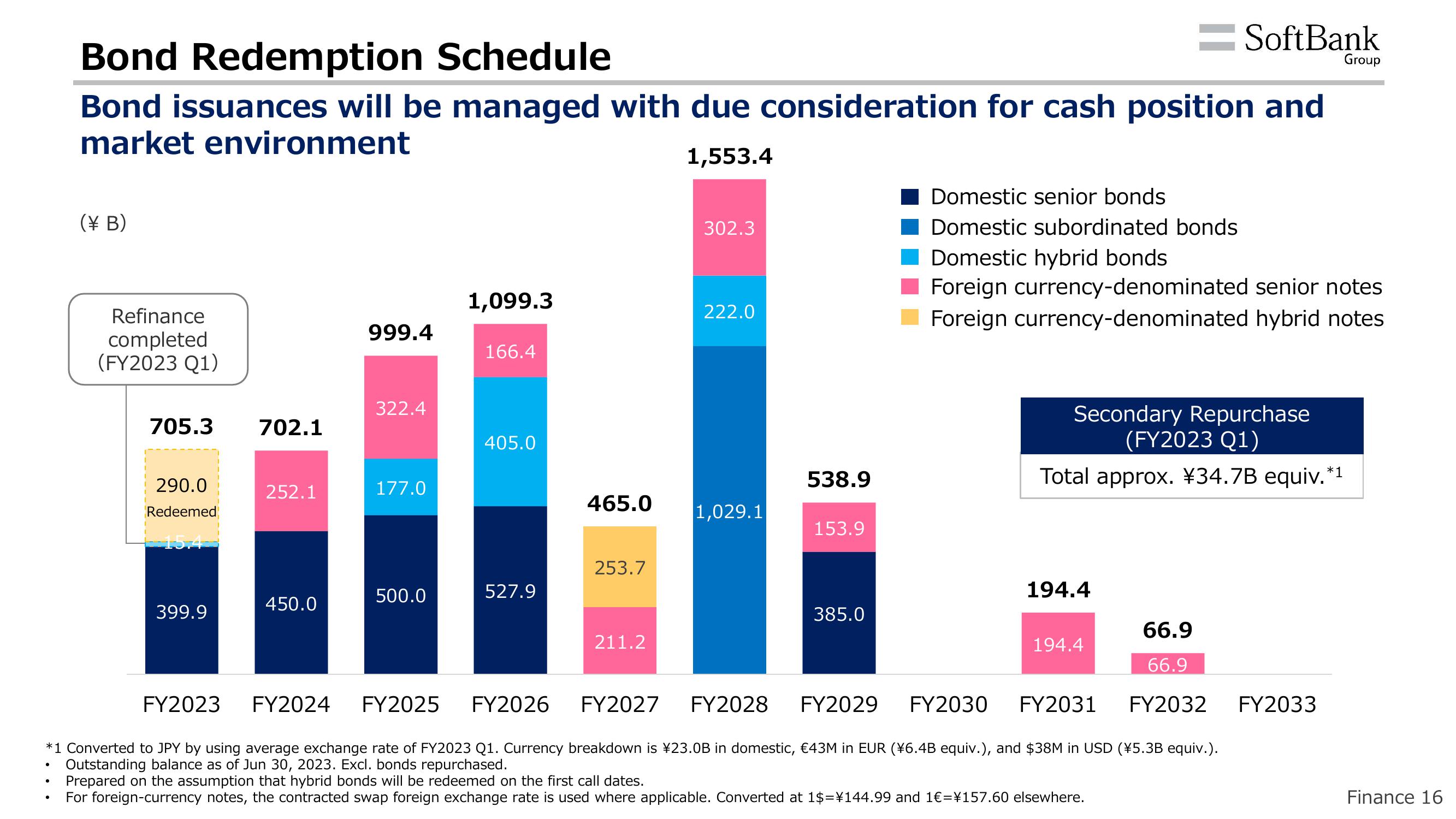

Bond Redemption Schedule

Bond issuances will be managed with due consideration for cash position and

market environment

1,553.4

●

(¥ B)

Refinance

completed

(FY2023 Q1)

705.3

290.0

Redeemed

-15.4-

399.9

702.1

252.1

450.0

999.4

322.4

177.0

500.0

1,099.3

166.4

405.0

527.9

465.0

253.7

211.2

302.3

222.0

1,029.1

538.9

153.9

385.0

Domestic senior bonds

Domestic subordinated bonds

Domestic hybrid bonds

Foreign currency-denominated senior notes

Foreign currency-denominated hybrid notes

Secondary Repurchase

(FY2023 Q1)

Total approx. ¥34.7B equiv.*1

194.4

FY2023

FY2024 FY2025 FY2026 FY2027 FY2028 FY2029

*1 Converted to JPY by using average exchange rate of FY2023 Q1. Currency breakdown is ¥23.0B in domestic, €43M in EUR (¥6.4B equiv.), and $38M in USD (¥5.3B equiv.).

Outstanding balance as of Jun 30, 2023. Excl. bonds repurchased.

Prepared on the assumption that hybrid bonds will be redeemed on the first call dates.

For foreign-currency notes, the contracted swap foreign exchange rate is used where applicable. Converted at 1$=¥144.99 and 1€ =¥157.60 elsewhere.

66.9

66.9

FY2030 FY2031 FY2032 FY2033

194.4

Group

Finance 16View entire presentation